Beyond the Hype: What MOSIAC/eIPP Really Means for the US Low Altitude Economy

The Federal Aviation Administration just unleashed the most significant regulatory changes aviation has seen since the Sport Pilot rule in 2004. The eVTOL and Advanced Air Mobility Integration Pilot Program, working alongside the new MOSAIC rule and updated Advisory Circular 21.17-4, will reshape America's low-altitude economy and ripple through global markets.

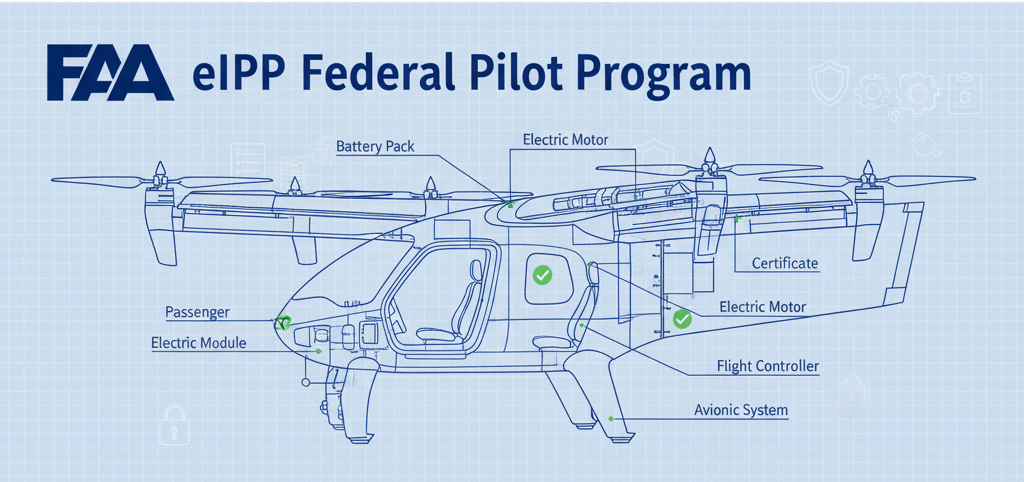

How the eIPP Actually Works

The program structure allows multiple companies to participate through government-led consortia, not just five companies total. The FAA will select at least five pilot projects, each led by a state, local, tribal, or territorial government partnering with one or more private companies. This consortium approach means dozens of companies could participate across selected projects.

Consider a single pilot project with an eVTOL manufacturer, charging infrastructure provider, traffic management system developer, and ground transportation company all working together under government leadership. Major eVTOL developers including Joby Aviation, Archer Aviation, Beta Technologies, and Wisk Aero have announced participation intentions.

The program encompasses air taxis, cargo logistics, medical services, regional passenger transportation, and emergency response. Each pilot project will test different operational concepts across various geographic and economic conditions.

Economic Impact: Jobs, Investment, and Market Scale

Advanced air mobility development expects to generate over 11,000 new full-time aerospace jobs and $8 billion in new business activity across participating regions by 2045. Southern California alone could see 2,133 jobs created during vertiport construction phases, plus another 943 permanent operational positions generating an average annual wage of $95,800.

The employment ripple effects extend beyond direct hiring. For every $1 million in direct AAM spending, about 11.2 jobs are created across the broader economy. These positions span multiple skill levels, from aerospace engineers and advanced technicians to pilots, air traffic controllers, and vertiport management personnel.

Global AAM market projections show explosive growth, ranging from $65.91 billion by 2032 to $114.5 billion by 2034, with the US market alone projected to reach $115 billion annually by 2035. Utah's economic impact assessment projects 31.6 million passengers using AAM services by 2045, with average ticket costs dropping to under $90 through automation and scale efficiencies.

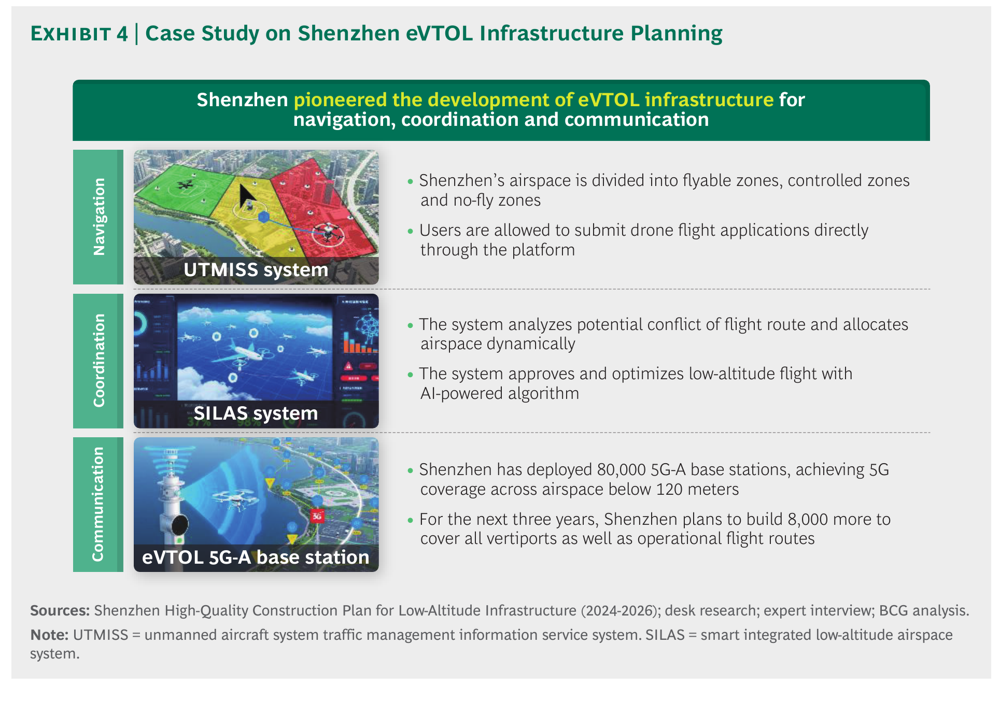

Infrastructure Development

The regulatory framework changes will trigger substantial infrastructure investment. Vertiport development requires specialized facilities with safety-critical geometry, high-voltage charging systems, advanced lighting and marking standards, and integration with existing transportation networks. Florida's Senate Bill 1662 shows state response, authorizing the Florida Department of Transportation to fund up to 100 percent of vertiport project costs.

Modern vertiports need sophisticated air traffic management systems, passenger processing facilities, maintenance capabilities, and ground transportation integration. This complexity creates opportunities across construction, electrical systems, software development, and telecommunications industries.

Regulatory Innovation: Performance Over Prescription

The performance-based framework established through MOSAIC and AC 21.17-4 marks a fundamental shift from prescriptive regulations toward outcome-focused standards. This approach allows manufacturers to propose innovative compliance methods while maintaining safety requirements, potentially reducing certification costs and timeframes.

The stall speed-based performance standard, replacing rigid weight limits under MOSAIC, enables development of larger, more capable aircraft. Four-seat aircraft with retractable landing gear and controllable-pitch propellers can now qualify for streamlined certification, directly competing with traditional general aviation while offering electric propulsion advantages.

International Competition

These regulatory advances position the United States to maintain leadership in a global market where China and European nations pursue aggressive AAM development strategies. Chinese manufacturers benefit from integrated supply chains with 70-80 percent component overlap with electric vehicle production, providing cost advantages and production scalability.

The FAA's collaboration with international partners through the National Aviation Authorities Network shows recognition of AAM markets' global nature. The Roadmap for Advanced Air Mobility Aircraft Type Certification aims to harmonize standards across the United States, Australia, Canada, New Zealand, and the United Kingdom.

European markets experience rapid growth, with the region expected to achieve compound annual growth rates exceeding 25 percent from 2025 to 2035. European Union Aviation Safety Agency's proactive regulatory approach creates competitive pressure on US market positioning.

Supply Chain Vulnerabilities

Rapid AAM operations scaling will test existing aerospace supply chains in unprecedented ways. Existing aerospace supply chains differ significantly from traditional aviation due to stringent quality standards, limited suppliers for specialized components, and skilled labor shortages.

eVTOL manufacturers face unique operational challenges. Battery logistics governed by UN dangerous goods regulations create shipping and handling complexities. Coordination across geographically dispersed component suppliers becomes complex with high-voltage electrical systems and advanced composite materials.

China controls approximately 60 percent of global rare earth production and over 80 percent of refined output, creating strategic vulnerabilities. Recent Chinese export permit requirements for graphite products highlight these dependencies. Lithium, rare earth elements, and graphite form the foundation of electric aircraft propulsion systems.

Safety Standards and Public Trust

Despite regulatory progress, public acceptance remains critical. Moving from traditional aviation safety frameworks to autonomous operations requires demonstrating unprecedented reliability levels. The eIPP's emphasis on generating safety data through real-world operations addresses this directly, but success depends on maintaining exemplary safety records during early deployments.

Air traffic management integration presents complex technical challenges extending beyond individual aircraft performance. The current FAA approach of pushing detect-and-avoid responsibilities to individual aircraft creates economic inefficiencies and technical complexities requiring coordination between aircraft manufacturers, air traffic control systems, and ground-based infrastructure providers.

Technology Transfer and National Security

The AAM industry's dual-use potential for national security applications adds strategic importance beyond commercial considerations. Technologies developed for civilian AAM operations have direct applications in defense scenarios, including troop transport, cargo delivery, and surveillance operations.

Maintaining US technological leadership ensures access to these capabilities while preventing dependence on foreign suppliers for critical defense applications, influencing both regulatory priorities and investment decisions across government agencies.

The Path Forward

The convergence of regulatory enablement, technological maturity, and market demand suggests AAM will shift from experimental operations to mainstream transportation within the current decade. This transition will reshape urban planning, logistics networks, and regional connectivity patterns.

Rural areas may gain improved access to medical services, emergency response, and economic opportunities through AAM connectivity. Urban areas will need to integrate vertiport infrastructure with existing transportation networks, potentially changing how cities approach zoning and development planning.

The integration of autonomous systems promises additional efficiency gains and cost reductions, although this requires resolving complex technical and regulatory challenges related to unmanned operations in populated areas.

The FAA's regulatory innovations represent critical enablers for US leadership in the emerging low-altitude economy. Success in capturing projected economic benefits depends on continued government-industry collaboration, sustained infrastructure and workforce development investment, and maintaining technological advantages in an increasingly competitive global market. The following 18 to 36 months will likely determine whether the United States can translate regulatory leadership into sustained commercial dominance.