BETA Technologies IPO: $7.4B Valuation Analysis | Low-Altitude Economy

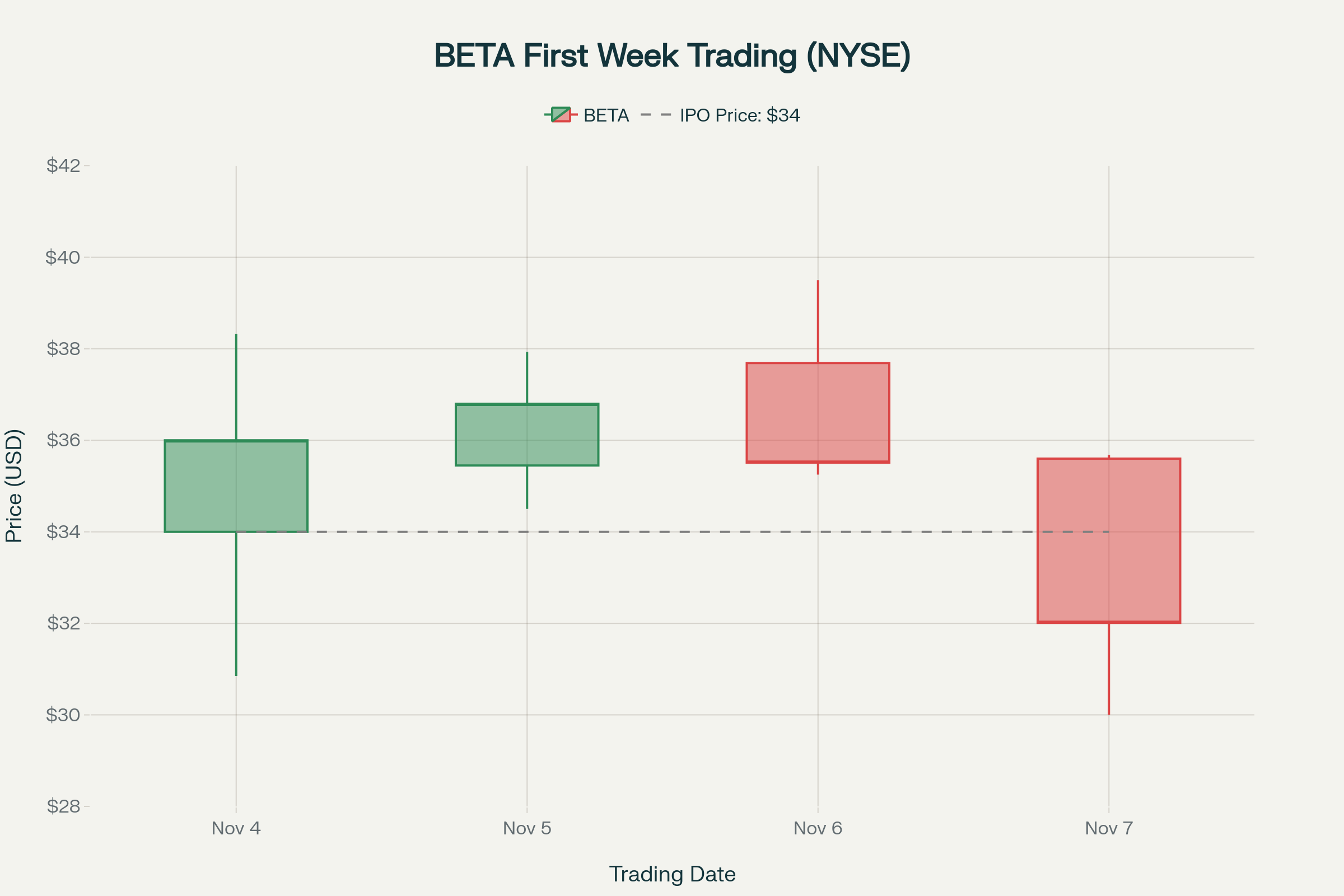

BETA Technologies rang the opening bell on the New York Stock Exchange on Tuesday morning, marking the first major electric aircraft manufacturer to pursue a traditional IPO rather than a SPAC merger. Kyle Clark, the company’s founder and CEO, stood on the balcony overlooking the trading floor as shares began trading under the ticker symbol BETA at $34 per share, pricing above the anticipated range and raising over $1 billion.

The stock closed its first day at $36, up nearly 6% from its IPO price, valuing the Vermont-based electric aircraft manufacturer at roughly $7.4 billion.

For those who’ve spent their careers watching aviation evolve, BETA’s public debut carries genuine weight. The company isn’t just another tech startup promising disruption. BETA already has metal in the air and contracts with customers who matter. Certification timelines look achievable rather than aspirational.

| Company | Market Cap (USD) | Stock Price (Nov 2025) | Public Method | Major Investors |

| BETA Technologies | $7.4 billion | $36 (IPO) | Traditional IPO | Amazon, GE Aerospace |

| Joby Aviation | $13.3 billion | $14.44 | SPAC Merger 2021 | Toyota, Uber |

| Archer Aviation | $5.3 billion | $8.00 | SPAC Merger 2021 | United Airlines |

| Eve Air Mobility | $1.2 billion | $4.80 | SPAC Merger | Embraer |

| Vertical Aerospace | $0.43 billion | $5.33 | SPAC Merger | American Airlines |

Stock prices as of November 4, 2025; companies reflect mixed public data from 2021-2025

Why BETA Chose Vermont Over Silicon Valley

Clark founded BETA in 2017 after recognizing that electric propulsion would reshape cargo and passenger movement through low-altitude airspace. An unconventional founder, Harvard engineer, former professional hockey player, and now pilot, Clark stayed in Vermont, learned to fly helicopters personally to test BETA’s designs, and secured institutional backing from Fidelity and Qatar Investment Authority rather than chasing venture capital’s burn-fast cycles.

The company’s first customer was United Therapeutics, which needed efficient transport for human organs intended for transplant. That $48 million contract gave BETA its initial focus: cargo missions with tight time windows where electric propulsion’s reliability and lower operating costs would create genuine value. From there, BETA methodically expanded, building relationships with UPS (which ordered up to 150 aircraft), the U.S. Air Force through the Agility Prime program, and operators like Bristow Group.

BETA now employs roughly 1,600 people, mostly working at its headquarters at Burlington International Airport. The company raised more than $1.5 billion in private investment before going public, including a recent $300 million investment from GE Aerospace. GE’s partnership provides BETA direct access to turbine certification expertise and manufacturing infrastructure, potentially accelerating hybrid-electric development for longer-range military and cargo applications.

The 50-Foot Wing: How BETA Bridges Regional and Urban Missions

BETA develops two models of its Alia aircraft, both leveraging the same 50-foot arched wing inspired by the Arctic tern, a migratory bird known for endurance flight. The wing design creates the aerodynamic efficiency needed to maximize battery range while keeping the aircraft small enough to operate from constrained locations.

The Conventional Play: BETA’s Path to Faster Certification

The Alia CX300 conventional takeoff and landing model uses a single rear-mounted pusher propeller for propulsion and relies on the wing for lift. With a maximum speed of 176 mph and a range of 387 miles, the CX300 targets regional cargo and passenger routes where conventional airports already exist. BETA expects FAA certification for the CX300 by late 2026 or early 2027.

The A250: Unlocking Vertiports and Urban Operations

BETA Alia A250 eVTOL

BETA Alia A250 eVTOL

The Alia A250 eVTOL features four top-mounted rotors, enabling vertical takeoff and landing. These rotors provide lift during takeoff and landing, then lock into their lowest-drag position during cruise while the rear propeller handles forward thrust. The A250 can carry five passengers or cargo up to 250 nautical miles at speeds up to 170 mph. Certification for the eVTOL variant will follow the CX300, likely in 2027 or early 2028.

Both aircraft charge in under an hour using BETA’s proprietary charging systems. The company has built a network of 46 charging locations across 22 states, with 23 more sites under development. BETA’s chargers support both its own aircraft and competitors’ machines, positioning the company as an infrastructure provider across the electric aviation industry rather than focusing solely on airframe sales. Archer Aviation, one of BETA’s eVTOL competitors, already uses BETA charging equipment.

BETA’s stepwise certification approach methodically sequences electric aircraft certification, reducing development risk at each stage. The company first achieved FAA type certification for its Hartzell propeller, designed explicitly for advanced air mobility aircraft. Next comes certification of BETA’s electric motor as a standalone product, followed by the CX300 aircraft, and finally the A250 eVTOL. This methodical progression validates critical processes and technologies before moving to more complex configurations.

The FAA’s “powered lift” category covers aircraft that generate lift from rotating blades (like helicopters) for vertical flight but transition to fixed-wing propulsion for cruise (like airplanes), requiring aviation certification standards distinct from either category alone. BETA’s A250 falls into this classification, representing one of the first manned aircraft seeking approval under these evolving regulatory frameworks.

The SPAC That Wasn’t: Why BETA’s Competitors Are Racing, While BETA Planned

BETA enters the public markets positioned between two established competitors in the electric aviation space: Joby Aviation (valued at $13.3 billion as of November 2025) and Archer Aviation (valued at $5.3 billion). Both went public via SPAC mergers in 2021 and focus primarily on urban air mobility with four-passenger eVTOL designs.

Joby, the market leader, holds significant contracts with NASA, Toyota, and the U.S. Air Force. The company’s S4 aircraft targets 100-mile routes at speeds up to 200 mph and aims for commercial certification in late 2025 or early 2026. Joby’s market capitalization reflects investor confidence in its execution, though the stock has seen volatility typical of pre-revenue aerospace companies.

Archer develops the Midnight eVTOL, a 12-rotor design also focused on a four-passenger urban air taxi service. The company secured partnerships with United Airlines and Southwest Airlines, with plans to launch commercial services by 2026. Archer’s market cap of $5.3 billion places it roughly midway between BETA and Joby in terms of investor valuation.

Other competitors face steeper challenges. Vertical Aerospace, valued at just $430 million as of November 2025, recently completed critical transition flight testing for its VX4 aircraft but posted a net loss exceeding $235 million over 12 months. Eve Air Mobility, backed by Embraer and valued at $1.2 billion, reported a $64.7 million net loss in Q2 2025 while advancing eVTOL development. Lilium’s market cap collapsed to roughly $33 million after the German company entered insolvency proceedings.

BETA differentiates itself through several factors. The company’s five-passenger capacity exceeds most competitors’ four-passenger designs. The dual-model strategy (eCTOL and eVTOL) provides the optionality competitors lack, allowing BETA to serve both regional routes at conventional airports and urban air mobility missions requiring vertical flight. The charging network provides recurring revenue opportunities beyond aircraft sales. BETA’s focus on cargo before passengers reduces aviation certification complexity while building operational experience with customers who value reliability over passenger comfort.

While Joby and Archer target urban air mobility operations beginning in late 2025 through 2026, meaning initial commercial passenger service launches during that timeframe pending final FAA approval, BETA’s certification timeline extends to late 2026 for its simpler CX300 model and 2027-2028 for the A250 eVTOL. This later timing reflects BETA’s choice to pursue conventional IPO funding rather than accelerating development timelines to meet SPAC investor expectations.

| Company | Aircraft Model | Aircraft Type | Passenger Capacity | Cargo Capacity | Range (miles) | Max Speed (mph) | Wingspan (feet) | Charge Time | Certification Target |

| BETA Technologies | Alia CX300 (eCTOL) | Conventional Takeoff | 5 passengers | 200 cu ft | 387 | 176 | 50 | <1 hour | 2026-2027 |

| BETA Technologies | Alia A250 (eVTOL) | Vertical Takeoff | 5 passengers | 200 cu ft | 250 | 170 | 50 | <1 hour | 2027-2028 |

| Joby Aviation | S4 (eVTOL) | Vertical Takeoff | 4 passengers + pilot | N/A | 100 | 200 | N/A | N/A | 2025 |

| Archer Aviation | Midnight (eVTOL) | Vertical Takeoff | 4 passengers + pilot | N/A | 100 | 150 | N/A | Fast charge | 2025 |

| Vertical Aerospace | VX4 (eVTOL) | Vertical Takeoff | 4 passengers + pilot | N/A | 100 | 200 | N/A | N/A | 2026 |

| Eve Air Mobility | eVTOL | Vertical Takeoff | 4 passengers + pilot | N/A | 60 | 150 | N/A | N/A | 2026 |

Cargo capacity shown for BETA reflects internal volume; competitors’ cargo specifications are not publicly disclosed in comparable metrics.

A Low-Altitude Economist’s Perspective

From an economic standpoint, BETA’s public offering represents more than capital formation. The company validates the thesis that electric propulsion enables entirely new operating models in airspace below 3,000 feet.

Traditional aviation economics constrain operations to airports with sufficient infrastructure to support large turbine aircraft. Operating costs, noise restrictions, and range limitations make most routes under 250 miles uneconomical for conventional aircraft. This creates connectivity gaps that ground transportation struggles to fill efficiently, particularly for time-sensitive cargo or routes between smaller communities.

Electric aircraft flip these constraints. Lower operating costs (BETA estimates 74% reduction versus conventional helicopters) make shorter routes viable. Quiet electric propulsion reduces noise concerns that limit airport operations. Vertical takeoff capability eliminates the need for runways. Distributed infrastructure, from BETA’s charging network to future vertiports, creates new nodes for commerce rather than funneling everything through hub airports.

The low-altitude economy encompasses urban air mobility, drone delivery services, agricultural applications including precision crop monitoring and spray optimization, emergency medical transport expansion to rural hospitals, and tourism, all operating below traditional controlled airspace. Bank of America Institute estimates the global civil adoption of eVTOL aircraft could grow by 62% annually from 2025 to 2030. The broader commercial electric aircraft market could reach $984 billion by 2035, expanding from $113 billion in 2025 at a 21.67% compound annual growth rate.

But market size projections mean nothing without addressing fundamental challenges. Battery energy density constrains operations most severely. Current lithium-ion aviation batteries deliver 300-400 Wh/kg, enough for regional routes but insufficient for longer distances. Infrastructure deployment lags aircraft development, with only 46 BETA charging sites operational, while industry analyst projections exceed 1,000 vertiports globally by 2028. Regulatory frameworks continue evolving as the FAA establishes aviation certification pathways for powered lift aircraft and air traffic management systems for low-altitude operations.

Building vertiport infrastructure at scale requires capital investment, industry analysts estimate, exceeding $2-3 billion across North America alone, creating partnership opportunities with airports, real estate developers, and energy providers, rather than individual manufacturers funding construction independently.

Public acceptance hurdles mount as operators must convince users to trust aircraft designs that most people have never seen, much less flown. While market research suggests that urban commuters would consider air taxis if safety and reliability match those of traditional aviation, range anxiety and trust in new technologies remain concerns. BETA’s focus on piloted operations rather than fully autonomous flight helps address these concerns, though it increases operating costs compared to eventual autonomous operations.

BETA’s strategic approach aligns well with these realities. The conventional takeoff CX300, requiring simpler aviation certification than the eVTOL variant, establishes operational credibility while leveraging existing airport infrastructure. Cargo missions for customers like UPS provide revenue before navigating the more complex regulatory and public acceptance challenges of passenger operations. The charging network creates a platform that supports both BETA’s aircraft and competitors, positioning the company as an infrastructure provider across the electric aviation industry rather than a pure airframe manufacturer.

$310 Million in Losses, $7.4 Billion in Valuation: Does the Math Work?

BETA’s $7.4 billion valuation deserves scrutiny. The company reported revenue of $15.6 million in the first half of 2025, up from $7.6 million in the same period in 2024. Net losses widened to $183.2 million from $137.1 million. For the 12 months ending June 30, 2025, BETA posted a net loss of $310.2 million on revenue of just $23.1 million.

These numbers reflect pre-revenue aerospace economics. BETA operates in the development phase, with most revenue coming from early deliveries of charging equipment and engineering services rather than aircraft sales. Full commercial certification still sits 18-30 months away. Until BETA achieves FAA approval and begins delivering production aircraft at scale, losses will continue mounting as development, aviation certification, and infrastructure costs accelerate.

Investors betting on BETA wager that the company can navigate certification faster than competitors, convert its order book into delivered aircraft, and scale production without the cost overruns that plague aerospace startups. The $1 billion raised through the IPO, combined with $300 million from GE Aerospace, provides runway. Capital intensity in aerospace means this money will burn faster than software company cash piles.

The decision to pursue a traditional IPO rather than a SPAC merger distinguishes BETA from Joby, Archer, and others. Clark told reporters that as competitors pursued SPACs in 2021, BETA chose to stay private until it had real aircraft, real customers, and a clear path to certification. That patience may prove wise. SPAC-backed competitors face public market scrutiny, including shareholder lawsuits over missed timelines, analyst criticism of pre-revenue valuations, and pressure to accelerate certification timelines before capital runs dry, a burden BETA avoided by staying private until 2025.

Clock Ticking: Can BETA Stay Ahead of the Competition?

BETA now faces the challenge every newly public aerospace company confronts: delivering on promises to investors while executing the most complex engineering and aviation certification programs the industry has undertaken in a decade.

The company must achieve FAA certification for the CX300 by late 2026, a timeline that requires flawless execution as the agency establishes precedent for electric aircraft certification. The U.S. Air Force awarded BETA the first airworthiness approval for manned electric aircraft in 2021, providing early validation. Full commercial certification carries higher scrutiny. Recent FAA approval (granted in October 2025) for pilot training on the A250 eVTOL represents a formal milestone in the certification process, authorizing BETA to begin training pilots on eVTOL-specific flight characteristics under FAA oversight, a prerequisite for eventual type certification. This suggests the agency views BETA’s approach favorably, though aviation certification timelines rarely compress and frequently extend.

Production scaling presents another risk. BETA operates manufacturing facilities at Burlington International Airport, but moving from prototype production to rates that satisfy customers like UPS (which ordered up to 150 aircraft) requires capital investment, supply chain development, and quality control systems that aerospace startups often struggle to implement. The partnership with GE Aerospace helps here, providing access to manufacturing expertise and potential production capacity.

Market timing adds uncertainty. BETA aims to certify its aircraft as the broader electric aviation industry reaches inflection points in battery technology, charging infrastructure, and regulatory frameworks. If the market develops faster than expected, BETA’s early mover advantage compounds. If technical or regulatory hurdles slow adoption, the company burns through capital while waiting for the market to materialize.

Competition will intensify. Joby and Archer race toward late 2025 and 2026 certification targets for urban air mobility operations. Traditional aerospace manufacturers, including Boeing and Airbus, are observing and may enter the market once pioneers like BETA prove viability. Chinese manufacturers, backed by substantial government investment in low-altitude economy development, could become formidable competitors in international markets.

You’re Watching Aviation’s Transformation Happen in Real Time the moment when Beta Technologies, an electric aviation startup, rang the opening bell at the New York Stock Exchange (NYSE) to celebrate its initial public offering (IPO) on November 4

the moment when Beta Technologies, an electric aviation startup, rang the opening bell at the New York Stock Exchange (NYSE) to celebrate its initial public offering (IPO) on November 4

Kyle Clark stood on that NYSE balcony Tuesday morning after BETA accomplished what many electric aircraft startups target but few achieve: building aircraft that complete test flights, securing production orders from major operators, and raising capital without requiring multiple extensions to certification timelines.

The company still faces years of hard work before reaching profitability. There are plenty of ways this story could end badly for investors who bought at a $7.4 billion valuation.

But for the low-altitude economy, BETA’s IPO matters because it validates the viability of electric propulsion in commercial aviation operations, demonstrating that electric powerplants can serve beyond experimental flight into genuine cargo and passenger service. The company’s charging network provides infrastructure for the entire electric aviation industry. The stepwise aviation certification approach de-risks technology development while maintaining aggressive timelines. The customer base spans logistics, defense, medical, and passenger operations, demonstrating demand across use cases. You’re watching the foundation of a new transportation layer being built, one that operates in airspace traditionally reserved for helicopters, general aviation, and drones. Whether BETA becomes the dominant platform or just another company that helped establish the market, the low-altitude economy continues to expand. Electric aircraft will move cargo between distribution centers, transport medical supplies to rural hospitals, carry passengers between regional airports, and enable services we haven’t yet imagined.

You're watching the foundation of a new transportation layer being built, one that operates in airspace traditionally reserved for helicopters, general aviation, and drones. Whether BETA becomes the dominant platform or just another company that helped establish the market, the low-altitude economy continues to expand. Electric aircraft will move cargo between distribution centers, transport medical supplies to rural hospitals, carry passengers between regional airports, and enable services we haven’t yet imagined.