The infrastructure backbone supporting the emerging low-altitude economy is taking shape at a remarkable speed. Industry analysis reveals that 1,504 vertiports are planned for development worldwide as of February 2025. This represents a dramatic surge of 500 additional sites since September 2024, signaling growing confidence in electric vertical takeoff and landing aircraft technology and the commercial viability of urban air mobility services operating below 1,000 meters.

The total investment required reaches $1.55 billion. However, industry experts predict approximately 980 vertiports will actually be constructed between 2025 and 2029 due to program failures and regulatory delays. This realistic assessment acknowledges the gap between ambitious planning and practical execution that characterizes emerging aviation industries. Even this conservative estimate

China and the United States Lead Different Approaches to Global Vertiport Development

While the United States has assembled an impressive vertiport development pipeline with 92 cities and airports drafting advanced air mobility plans, China leads in operational scale and systematic deployment. China operates over 750 planned vertiports, more than 50% of the global total, with Shenzhen alone planning 1,200 platforms by 2026. This acceleration in the US followed the "Unleashing American Drone Dominance" executive order in June 2025, but state-level action provided the real momentum for American development.

Vertiport hub in Hefei China

Vertiport hub in Hefei China

China clearly leads in operational scale, financial commitment, systematic deployment, and commercial operations. The US leads primarily in private-sector engagement and distributed planning, which are different but not necessarily superior metrics.

Florida Sets the Standard for State Support

Florida leads with 24 sites in various stages of development, backed by legislation signed at the Paris Air Show. This law allows the state transportation department to cover up to 100 percent of construction costs for projects that boost tourism and emerging aviation technology. The legislation redefines airports to include vertiports and channels aviation fuel tax revenues toward these new facilities, creating a funding pipeline that other states lack.

Corporate partnerships drive most American development rather than government planning. UrbanV signed a joint venture with Signature Aviation in June 2025 to build networks across Florida, New York, California, and Texas. This partnership combines Signature’s extensive FBO terminals with purpose-built eVTOL infrastructure.

Ferrovial Vertiports, backed by Spanish infrastructure expertise, targets more than 10 sites in Florida while studying additional markets where urban air transport could reduce commute times. Eve Air Mobility’s collaboration with Ferrovial addresses air traffic management integration, addressing one of the critical gaps between aircraft operations and ground systems.

New York City Demonstrates Urban Integration

New York City established the urban integration standard when its Economic Development Corporation announced that “Downtown Skyport” would operate the Downtown Manhattan Heliport starting in early 2025. This joint venture between Skyports Infrastructure and Groupe ADP demonstrates how existing heliport infrastructure can be retrofitted for eVTOL operations, rather than building entirely new facilities.

This approach provides a faster path to commercial service in densely populated urban areas, where land acquisition and permitting often hinder greenfield projects. The strategy offers valuable lessons for other major metropolitan regions facing similar development challenges.

Regional Development Patterns Reflect Local Advantages

Regional patterns reflect geography and business climate considerations. Florida’s flat terrain, year-round favorable weather conditions, and thriving tourism economy create natural conditions for air taxi routes that connect beaches, theme parks, and urban centers.

California emphasizes integration with existing transit networks and environmental goals. Texas leverages pro-business regulations and abundant land to attract developers. The state’s major metros offer multiple route options within typical eVTOL range limits, although securing sites, utility connections, and local approvals remains complex across diverse jurisdictions.

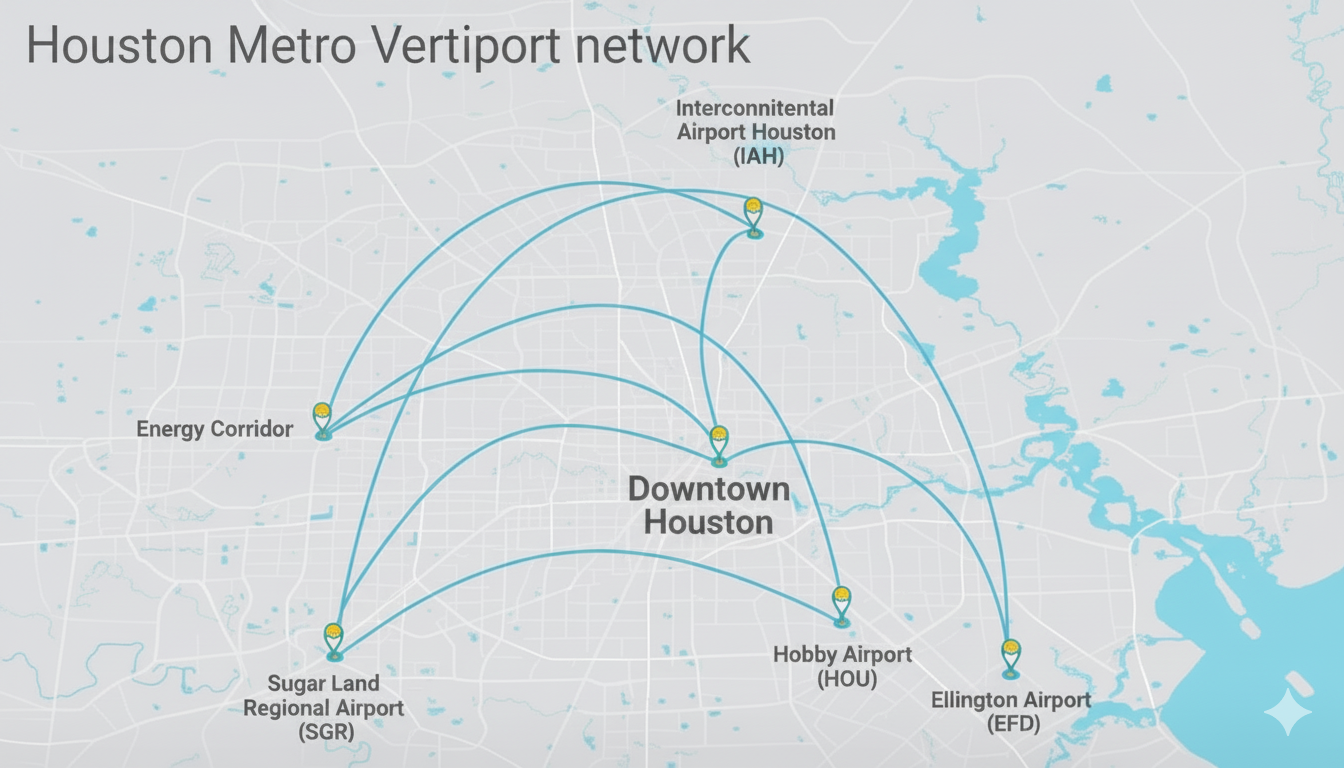

Proposed Houston Metro area Vertiport Network

Proposed Houston Metro area Vertiport Network

This private-sector approach differs markedly from Asia’s government-led development or Europe’s regulatory-first strategies. Companies can move quickly when barriers fall, but success ultimately depends on access to real estate and cooperation with local government. With 92 active programs and major corporate partnerships now in place, the United States appears well-positioned to lead global eVTOL infrastructure deployment once the aircraft certification programs are completed.

The diversity of state regulations creates complexity, yet it also allows successful models, such as Florida’s, to spread rapidly to other markets seeking similar economic benefits.

Asia-Pacific Drives Government-Led Infrastructure Expansion

The Far East, particularly China, drives much of the global expansion through government-managed low-altitude economy initiatives. Regional transport organizations plan over 100 vertiports across Guangdong Province by 2027 alone. This concentrated development approach contrasts sharply with the more distributed, private-sector-led growth patterns emerging in Europe and North America.

China's Systematic Approach to Low-Altitude Economy Development

China has established the world's most comprehensive low-altitude economy development framework, with 30 provinces integrating low-altitude initiatives into their development plans and six cities, Shenzhen, Hangzhou, Hefei, Suzhou, Chengdu, and Chongqing, designated as pilot zones for airspace operations below 600 meters. This systematic approach ensures that physical and regulatory infrastructure develops in parallel with aircraft technology and certification programs.

The scale of investment reflects serious government commitment. China's low-altitude economy reached 505.95 billion yuan ($69.8 billion) in 2023, representing 33.8% growth year-over-year. Projections suggest the industry will exceed 3 trillion yuan by 2035, representing a seven-fold increase from previous estimates. This acceleration demonstrates how coordinated government support can drive rapid industry development.

Regional development approaches reveal fundamentally different economic models:

| Region | Planned Facilities | Development Model | Investment Approach | Key Advantage |

| United States | 92 cities/airports planning | Private-sector led | Corporate partnerships | State support (Florida 100%) |

| China (Shenzhen) | 1,200 platforms by 2026 | Government-managed | $1.7 billion in government funding | Industrial scale deployment |

| Europe | Testing-focused approach | Regulatory-first | Safety validation priority | Regulatory compliance |

| Japan | EXPO & OSAKAKO operational | Demonstration-focused | World Expo showcase | Operational validation |

| Australasia | Airport-based modular designs | Low-cost rapid deployment | Modular, cost-efficient | Quick market entry |

| Turkey | Lower land costs offset | European integration | Land cost arbitrage | Lower infrastructure costs |

Japan Showcases Advanced Urban Air Mobility Infrastructure

SkyDrive demonstration flights at Expo 2025 in Osaka

SkyDrive demonstration flights at Expo 2025 in Osaka

Japan has emerged as another significant player with several high-profile completions. The EXPO Vertiport in Osaka reached completion on March 28, 2025, featuring 7,944 square meters of facilities, including an apron, hangar, and charging equipment. This facility serves as a showcase for the World Expo 2025, demonstrating Japan’s commitment to positioning itself at the forefront of advanced air mobility.

Complementing the EXPO facility, Osaka Metro Co., Ltd. completed the OSAKAKO Vertiport specifically to support SkyDrive demonstration flights. Located at 1-105-5 Kaigan-dori, Minato-ku, this 12,000-square-meter facility features passenger facilities, hangars, charging infrastructure, and a mobility hub that connects to on-demand buses and shared bicycles.

The vertiport opened to the public in mid-April 2025, offering visitors the opportunity to experience boarding a mock-up eVTOL aircraft through facial recognition-enabled processes. SkyDrive has successfully conducted multiple demonstration flights using its flagship aircraft above Expo 2025, marking a significant milestone in the operational deployment of eVTOLs.

These flights represent some of the first commercial-scale eVTOL operations in Asia, providing valuable real-world data on aircraft performance, passenger acceptance, and operational procedures. The success of these demonstrations influences development strategies across the region.

European vertiport development takes a cautious approach

European vertiport development takes a more cautious, testing-focused approach compared to the rapid expansion seen in Asia and North America. The continent prioritizes safety validation and regulatory compliance over speed to market.

United Kingdom Establishes Testing Infrastructure

The UK achieved a significant milestone with the completion of its first vertiport testbed at Bicester Motion in Oxfordshire. Initially breaking ground in December 2024, the facility reached operational completion by June 2025.

Skyports vertiport and terminal at Bicester Motion

Skyports vertiport and terminal at Bicester Motion

The Bicester Motion vertiport spans 0.42 acres and includes a compact 160-square-meter passenger terminal. Built adjacent to existing general aviation grass runways, the facility serves as a critical testing ground for eVTOL flight operations, ground infrastructure, and air traffic management.

Skyports Infrastructure developed the facility as part of the Advanced Mobility Ecosystem Consortium, an Innovate UK Future Flight Challenge project. The facility features sophisticated systems designed to evolve in tandem with emerging eVTOL technologies.

These systems include passenger processing capabilities with weight balance optimization, identity validation, and screening functions. A dedicated passenger lounge enhances customer comfort, while an operations room houses Skyports’ Vertiport Automation System, optimizing scheduling and aircraft throughput. A situational awareness module provides integrated airspace monitoring and weather tracking capabilities.

Vertical Aerospace plans to use the Bicester facility for VX4 flight testing beginning in 2026, making it a launchpad for one of Europe’s most promising eVTOL programs. The controlled environment allows for systematic refinement of infrastructure, safety systems, and passenger processes before commercial deployment.

Mediterranean Markets Show Growing Interest

Italy is emerging as another focal point for European vertiport development. UrbanV, a leading vertiport infrastructure company, launched a partnership with Future Flight Global in May 2025 to develop advanced air mobility services starting in Rome.

This collaboration will focus on designing, constructing, and operating vertiports across the Italian capital, potentially creating a template for other major European cities. The partnership represents a significant commitment to establishing urban air mobility networks in one of Europe’s most complex urban environments.

Design specification differences create dramatic cost variations:

The Middle East continues to expand its vertiport network, with the Dubai Road and Transport Authority collaborating with Skyports on a new facility at Dubai International Airport. This development reinforces Dubai’s strategy of integrating advanced air mobility into its existing transportation ecosystem.

Dubai’s approach focuses on leveraging existing airport infrastructure while creating dedicated eVTOL facilities that can support both tourism and business travel applications. The city’s flat terrain and favorable weather conditions provide ideal operating environments for electric aircraft.

No Standard Design Playbook Yet

The global vertiport market exhibits significant variations in design approaches and construction costs, influenced by regional priorities and market conditions.

In Australasia, first-generation vertiports primarily utilize airport-based, modular, and low-cost designs. This approach prioritizes rapid deployment and cost efficiency over elaborate passenger amenities. The strategy enables rapid market entry while minimizing initial capital requirements.

European developments face higher average construction costs due to expensive urban land values, though this is partially offset by planned developments in Turkey, where land costs remain more reasonable. The European approach emphasizes integration with existing transportation networks and compliance with stricter regulatory frameworks.

Construction costs and equipment specifications vary dramatically based on location, intended use, and local regulatory requirements. Basic vertiports can be established for relatively modest investments, while full-service facilities with comprehensive passenger amenities, maintenance capabilities, and charging infrastructure require substantially higher capital commitments.

Design specification differences create dramatic cost variations:

| Standard/Specification | TLOF Dimension | FATO Dimension | Safety Area | Total Area Required | Key Differences |

| ICAO Annex 14 (Heliports) | 0.83 × wingspan | 11.5m (Lilium example) | 3.5m (Lilium example) | 772.8 m² | Based on helicopter standards |

| FAA EB 105A (Vertiports) | 1 RD (Rotor Diameter) | 2 RD | 2.5 D | 1,739 m² | Specific to eVTOL operations |

| EASA Design Specifications | 12m design parameter D | Based on D parameter | Edge placement for TLOFs | Varies by topology | Considers multiple topologies |

| Lilium Jet Requirements (ICAO) | 11.5m | 11.5m + 3.5m safety = 15m | 15m minimum | 772.8 m² | Smaller total area |

| Lilium Jet Requirements (FAA) | Not specified | Not specified | Not specified | 1,739 m² | Doubled area requirement vs ICAO |

Standardization Challenges and Opportunities

The industry faces ongoing challenges in standardizing vertiport design specifications while accommodating diverse regional requirements and aircraft types. Early facilities provide valuable learning opportunities that inform future development standards.

Different eVTOL manufacturers have varying infrastructure requirements for charging, maintenance, and passenger loading. This diversity complicates standardization efforts but also drives innovation in flexible facility design.

Regulators Scramble to Keep Pace

The regulatory landscape continues evolving as aviation authorities worldwide develop specific guidance for vertiport design, operation, and integration with existing airspace management systems. These regulatory frameworks must address unique challenges posed by low-altitude operations.

Safety certification requirements for vertiport infrastructure parallel those for traditional airports, but must account for eVTOL-specific operational characteristics. Noise management, visual flight rules integration, and emergency procedures require specialized attention and expertise.

Charging infrastructure presents particular challenges, requiring coordination between aviation authorities, electrical safety regulators, and local building codes. The integration of high-power charging systems into aviation facilities creates new safety considerations that traditional airports have never faced.

Air traffic management integration remains one of the most complex regulatory challenges. Vertiports must coordinate with existing air traffic control systems while managing multiple aircraft movements in confined urban airspace.

Plans vs. Reality

AIR’s new facility in central Israel is designed to scale production, accommodating the assembly of up to six aircraft simultaneously to meet growing demand for its multi-domain eVTOL solutions

AIR’s new facility in central Israel is designed to scale production, accommodating the assembly of up to six aircraft simultaneously to meet growing demand for its multi-domain eVTOL solutions

Industry analysts acknowledge the gap between planned and probable vertiport construction. The realistic expectation of 980 completed vertiports by 2029, compared to 1,504 planned facilities, reflects typical challenges in emerging industries. Program failures often result from insufficient funding, regulatory delays, or changes in the plans of eVTOL manufacturers. The global market value of $1.093 billion for construction costs and aviation system equipment represents substantial economic activity.

This figure encompasses everything from basic landing pads to sophisticated passenger terminals with full ground support capabilities. Market forecasts suggest continued growth throughout the decade, with the vertiport industry projected to expand from $0.4 billion in 2023 to $10.7 billion by 2030.

Construction costs reveal the true complexity of vertiport economics. The range spans from $100,000 modular suburban facilities to $20 million metropolitan vertihubs with comprehensive passenger terminals and maintenance capabilities.

| Vertiport Type | Cost Range (USD Million) | Features | Annual Operating Cost |

| Modular (Suburban) | $0.1 - $0.275 | Rapid deployment, minimal amenities | $0.05 |

| Modular (Low-traffic) | $0.1 - $0.275 | Basic maintenance, limited staffing | $0.05 |

| Metropolitan Vertihub | $3.5 - $12 | Multiple landing pads, passenger terminals, maintenance bays | $17 |

| Metropolitan Vertihub (High-end) | $10 - $20 | Advanced features, full ground support | Not specified |

| Network (6 facilities) | $29.6 (annual operating) | Basic network operations | $29.6 |

| Network (20 facilities) | $90.3 (annual labor income) | Full-scale network with comprehensive services | $173.3 (economic output) |

This growth trajectory depends heavily on the success of eVTOL certification programs and regulatory approval for commercial operations. The timing of aircraft certification will largely determine when infrastructure investments begin generating revenue.

Manufacturing Capacity Defines Market Timing

While infrastructure planning accelerates, manufacturing capacity provides the ultimate constraint on market timing. This growth trajectory depends heavily on the success of eVTOL certification programs and regulatory approval for commercial operations. The timing of aircraft certification will largely determine when infrastructure investments begin generating revenue. While planners draw circles on maps, manufacturers face the hard mathematics of production lines. The manufacturing capacity comparison reveals the physical constraints determining market entry timing.

Manufacturing capacity constraints will determine market entry timing:

| Company | Facility Size (sq ft) | Production Capacity (Aircraft/Year) | Key Features | Timeline |

| Joby Aviation (Marina) | 435,500 | 24 | Doubled capacity, pilot training simulators | Operational 2025 |

| Joby Aviation (Dayton) | Not specified | 500 | Component manufacturing, test capabilities | Equipment installation underway |

| AIR (Israel) | 32,000 | 6 simultaneous assembly | Assembly lines, engineering labs, composite workshops | Opened July 2025 |

| TCab Tech (Wuhu) | 11.5 acres | 200 | Digital manufacturing, two complete assembly lines | Construction started 2025 |

| Archer Aviation | Not specified | Not specified | High-volume facility with Stellantis partnership | Construction complete |

| Stellantis-Archer (Georgia) | Not specified | 2,300 | Joint venture targeting high-volume production | Planned |

| AutoFlight | Not specified | Delivered first certified | World's first certified one-ton eVTOL | Certified August 2025 |

Operational Considerations Drive Network Success

Successful vertiport networks require careful consideration of location selection, passenger flow optimization, and integration with existing transportation systems. The most effective facilities serve as mobility hubs, connecting eVTOL services with ground transportation, parking, and other amenities.

Charging infrastructure represents a critical component of vertiport design, requiring careful planning for power supply, charging protocols, and access for maintenance. Battery technology limitations currently constrain the range and payload capacity of eVTOLs, making efficient charging systems essential for viable operations.

Weather monitoring and management capabilities become increasingly crucial as operations scale up. Unlike traditional airports, which often have extensive weather monitoring systems, many vertiports must develop these capabilities from scratch while ensuring seamless integration with regional air traffic management systems.

Ground support equipment for eVTOL aircraft differs significantly from that required for traditional aviation. The unique characteristics of electric aircraft create new demands for specialized maintenance facilities, battery handling systems, and emergency response procedures.

Network Effects and Route Planning

The success of individual vertiports largely depends on the development of comprehensive networks that offer meaningful transportation alternatives. Single facilities have limited utility compared to interconnected systems that enable point-to-point travel across metropolitan areas.

Route planning must consider aircraft performance limitations, passenger demand patterns, and integration with existing transportation networks. The most successful vertiport networks will likely emerge in markets with natural travel corridors that align with eVTOL operational capabilities.

| Aircraft/Company | Payload Capacity | Flight Time/Range | Operational Status | Route Implications | Infrastructure Impact |

| AIR eVTOL | 550 lbs | 1 hour at 155 mph | FAA Experimental Certification | Constrains operational radius | Affects vertiport placement |

| SkyDrive SD-05 | Not specified | Demonstration flights | Active demonstrations Osaka | Urban demonstration validation | Passenger processing validation |

| Lilium Jet | Not specified | 13.9m wingspan | Under development | Regional network focus | Network design considerations |

| AutoFlight CarryAll | 1 ton (2,200 lbs) | Heavy cargo operations | First certified one-ton eVTOL | Industrial/cargo applications | Heavy-duty charging requirements |

| Joby Aviation | Not specified | Commercial launch 2026 | Dubai service planned | Tourism and business travel | Hub connectivity important |

| Archer Midnight | Not specified | Production starting 2025 | High-volume production | Metropolitan network focus | High-frequency operations |

What This All Means

The surge in infrastructure development reflects growing confidence in the commercial potential of the low-altitude economy. While not every planned vertiport will reach completion, the current construction pace suggests that essential infrastructure will be available when eVTOL aircraft achieve full commercial certification.

This coordination between aircraft development and ground infrastructure represents a critical success factor for the emerging urban air mobility industry. The companies and regions that successfully align these development timelines will likely capture early market advantages.

As the industry matures, standardization of vertiport design, operations, and safety protocols will become increasingly important. Early facilities, such as those in Osaka and Bicester, provide valuable learning opportunities that will inform future developments worldwide, helping establish best practices for this new category of aviation infrastructure.