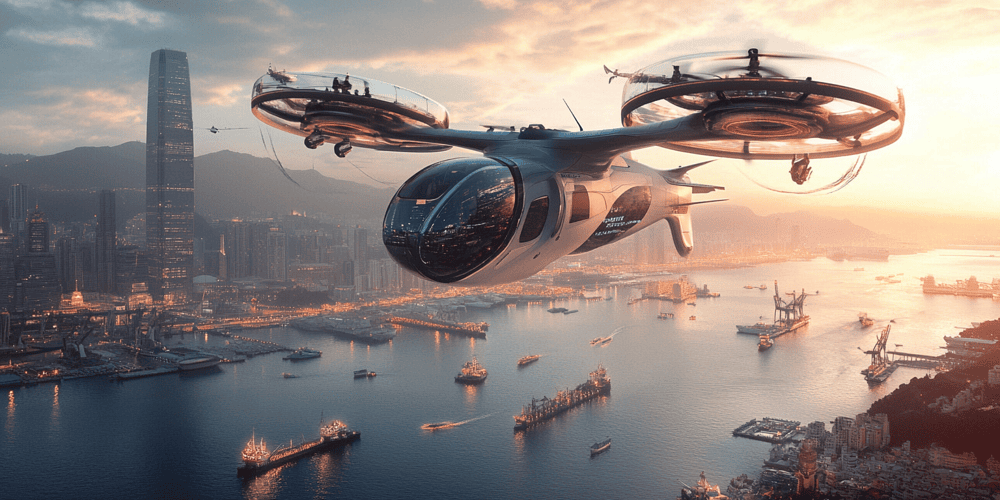

The global vertiport market is rapidly expanding as an essential component of advanced air mobility (AAM) transportation system, reflecting a significant shift in urban transportation dynamics. Vertiports, designed for electric vertical take-off and landing (eVTOL) aircraft, aim to alleviate urban congestion and provide efficient, sustainable transport solutions in densely populated areas. This market is driven by increasing urbanization, technological advancements, and supportive government initiatives that recognize the potential of urban air transport to enhance connectivity and mobility.

The global vertiport market is set for significant growth, with projections indicating the establishment of over 1,000 vertiports worldwide between 2024 and 2028. The expected market size is projected to surge from USD 0.4 billion in 2023 to approximately USD 10.7 billion by 2030, marking a remarkable compound annual growth rate (CAGR) of 62.1%. This development will significantly enhance urban air mobility (UAM) infrastructure.

As cities worldwide face mounting challenges related to traffic congestion and inefficiencies in traditional transport systems, the development of vertiport infrastructure has gained momentum. Key factors fueling the market’s growth include advancements in eVTOL technology, which promise quieter and more environmentally friendly alternatives to conventional transportation methods. Moreover, governments are investing in creating regulatory frameworks that facilitate the integration of vertiports into urban landscapes, further encouraging investment and development in this emerging industry.

Evolution of Ports and Urban Development

Historically, urban growth has been deeply connected to the development of river and sea ports, which served as critical commercial and trading hubs. Early civilizations established settlements around these maritime centers, recognizing that a port’s success was vital to the prosperity of the surrounding urban economy.

As maritime transport evolved, port infrastructure transformed from simple storage areas for goods into intricate systems that facilitated the movement of diverse product chains. Over time, some operations, particularly in riverine ports, relocated downstream as cities expanded and adapted to new commercial opportunities.

Transition to Modern Infrastructure

With advancements in technology and shifts in urban planning, traditional port areas saw a decline, and their connections to the city became less significant. The rise of air cargo, overland trucking, and rail transportation replaced the significance of ports in the movement of goods and urban logistics. The growth of mega ports further led to abandoning outdated facilities, reshaping the urban landscape, and prompting a reevaluation of their roles in city planning.

This shift highlights a broader trend in urban development. As new transportation modes, such as vertical take-off and landing (VTOL) aircraft, emerge, urban environments adapt, driving the need for new infrastructure like vertiports. Similar to how ports were once essential, modern cities now depend on a more diverse network of transport hubs to support their growth and connectivity.

Rise of Vertiports in Urban Air Mobility

Vertiports emerged as a response to the increasing need for efficient urban air transport solutions that alleviate traffic congestion and reduce reliance on traditional road and rail infrastructure. It draws inspiration from historical port development.

The evolution from conventional heliports, buses, and passenger rail to specialized eVTOL vertiports signifies a pivotal change in urban mobility strategies. It reflects a growing recognition of the potential for air taxis, unmanned cargo, and other advanced air mobility solutions to enhance transportation efficiency in densely populated areas.

This historical context sets the stage for understanding the vertiport market’s current dynamics and future potential as cities worldwide begin to invest in and develop the infrastructure necessary for this transformative technology.

Technological Advancements

The transition from traditional helicopters to electric vertical take-off and landing (eVTOL) aircraft has ushered in a new era for urban air transportation. While helicopters have long served as the vehicle of choice for short-range flight needs, eVTOL technology powered by electricity or hydrogen offers several clear advantages: reduced noise, lower operating costs, and enhanced safety features. Because these benefits align well with the growing demand for rapid urban travel, eVTOLs are increasingly positioned at the forefront of emerging mobility solutions. Ongoing developments in propulsion and energy systems continuously improve eVTOL performance, making them quieter, cleaner, and more widely accessible. In parallel, the collaboration between technology innovators and established aerospace suppliers has accelerated process scaling and elevated product quality. This synergy in the industry has helped address crucial challenges in areas such as regulatory compliance and production efficiency.

Challenges and Solutions for Integrating Air Traffic Management in Vertiport Operations

Air Traffic Management Integration Challenges

Incorporating vertiports into existing air traffic management (ATM) systems poses complex technical and operational hurdles. The JFK International Airport vertiport project highlighted how blending traditional aviation traffic with eVTOL operations can be difficult. One of the biggest obstacles was managing low-altitude urban air mobility corridors while ensuring safe separation from conventional aircraft approaches. Early trials indicated that existing radar systems, built initially to track typical aircraft, struggled to maintain reliable contact with smaller eVTOL units, particularly in densely populated city settings.

Implemented Solutions and Case Studies

- Paris Charles de Gaulle Vertiport. This facility introduced a multi-layered airspace management system to tackle these issues by designating exclusive corridors for eVTOL flights between 400 and 1,000 feet above ground level. This strategy effectively organized over 2,500 flight operations in its first six months and maintained a 99.7% on-time performance rate without interfering with conventional air traffic.

- Singapore’s Marina Bay Voloport. Here, a specialized UTM (Unmanned Traffic Management) system works seamlessly with traditional ATM infrastructure. By leveraging artificial intelligence, the system learned to forecast potential conflicts between various aircraft types and automatically propose adjusted routes. As a result, the air traffic controller workload dropped by 35%, even when mixed traffic was flowing through the system.

Technical Infrastructure Developments

EHang Guangzhou China Network. The EHang Guangzhou network has created an in-house air traffic coordination platform tailored to the unique demands of urban air mobility. Key features include:

- Advanced Detection and Avoidance: a network of ground-based sensors and radar systems calibrated precisely for eVTOL airplanes, achieving a 99.9% detection rate within a 5km radius.

- Real-time Data Integration: A centralized platform that integrates data from multiple feeds—weather stations, obstacle detection, and vehicle telemetry—delivering a comprehensive view of airspace to controllers.

This system, which averages 150 daily operations, maintains strict separation standards and collaborates with traditional air traffic control at nearby Guangzhou Baiyun International Airport.

Standardization and Interoperability

Miami Lilium Hub Project

To address communication and data-sharing obstacles between vertiport operations and conventional ATM frameworks, the Miami Lilium Hub team developed standardized communication protocols. Their innovations include:

- Universal Data Exchange is a unified format for relaying flight plans, weather updates, and operational status between vertiport managers and air traffic control facilities.

- Automated CoordinationAI-driven solutions that handle routine coordination tasks across platforms, reducing the need for manual input by 75% compared to legacy heliport processes.

Future Integration Pathways

Looking ahead, many projects continue to refine integration solutions for next-generation vertiports. The London Skyports facility is experimenting with a blockchain-based slot allocation and ATM coordination method. Initial results have shown a 40% drop in coordination time, suggesting rapid and efficient integration between vertiport systems and traditional air traffic controllers. These advancements indicate a promising future where eVTOLs and traditional aviation seamlessly share the skies, supported by robust infrastructure and intelligent air traffic management systems.

Key Players in the Vertiport Market

The vertiport market is rapidly evolving, with several key players contributing to developing and implementing infrastructure and technologies essential for urban air mobility:

Infrastructure and Design

- Bayards Vertiport Solutions (Netherlands): This company focuses on the physical infrastructure of vertiports. It is known for its well-equipped manufacturing facilities and extensive distribution networks.

- Vports (Canada) specializes in vertiport design and construction and aims to integrate these facilities into urban landscapes.

- Skyportz (Australia): Engages in urban planning and real estate development for vertiports, ensuring they fit into cityscapes effectively.

- Skyways (US): Focuses on creating vertiport networks to support urban air mobility operations.

- Volatus Infrastructure LLC (US): Provides comprehensive vertiport solutions, including automation systems tailored for eVTOL aircraft support.

Vertiport Management and Operation Software Solutions

- ANRA Technologies: Introduced the world’s first Vertiport Management System (VMS) at the Dubai Air Show. This web-based platform is designed to manage VTOL Urban Air Mobility (UAM) aircraft operations at vertiports, offering real-time data exchange, resource management, and integration with air traffic management systems[2][10].

- LYNEports: Offers advanced SaaS solutions for vertiport planning, focusing on ground and airspace integration for eVTOL and drone landings. Their software provides urban planners, architects, and real estate developers with tools to design and simulate vertiport operations[5].

- Altaport Inc.: Developed a vertiport automation system (VAS) that manages all aspects of vertiport operations, from ground operations to passenger management and vehicle charging. They have partnered with companies like 1200.aero, Electro.aero, and Fortem Technologies to provide a comprehensive solution.

- Firstco is developing a Vertiport Management System for remote control and monitoring multiple vertiports from a centralized operations room, drawing on experience from the transportation, defense, and automation sectors.

Additional Key Companies

- Aeroauto: Engages in the design and manufacturing of vertiport infrastructure.

- Siemens: Provides technological solutions for vertiport operations, including automation and energy management.

- Airbus: Involved in the broader ecosystem of urban air mobility, including vertiport development.

- Sita: Offers IT solutions for vertiport operations, enhancing passenger experience and operational efficiency.

- Ferrovial: Engages in infrastructure development, including vertiports, leveraging their experience in airport management.

- Volocopter GmbH: While primarily known for eVTOL aircraft, they also contribute to vertiport design and operations.

- Lilium Aviation GmbH: Similar to Volocopter, they are involved in aircraft and vertiport infrastructure.

- Urban V S.P.A.: Focuses on urban vertiport solutions and integrating them into city planning.

- Skyscape Inc.: Provides innovative solutions for vertiport design and operations, aiming to revolutionize urban air mobility.

These companies are shaping the physical infrastructure and digital and operational frameworks necessary for vertiports’ safe and efficient operation. Their efforts are essential in integrating eVTOL aircraft into urban environments, ensuring compliance with regulatory standards, and enhancing the overall user experience in urban air mobility.

Global Market Analysis

The vertiports market is evolving rapidly worldwide, with each region presenting distinct growth drivers and challenges. Understanding regional dynamics is imperative for stakeholders aiming to capitalize on emerging opportunities, especially in light of Asia’s accelerating advancements in eVTOL and vertiport development, supported by aggressive and progressive regulatory frameworks.

North America

New York: North America is poised to achieve the highest compound annual growth rate (CAGR) in the vertiports market during the forecast period. The region’s growth is fueled by increasing demand for advanced air mobility (AAM) solutions to address urban congestion and improve transportation efficiency.

- Construction and Engineering Expertise: Infrastructure firms specializing in complex projects are well-positioned to meet the demand for vertiport construction. However, these companies must navigate rigorous safety and operational standards while delivering innovative, scalable solutions.

- Smart City Integration: Urban planning initiatives incorporating innovative technologies are driving the adoption of vertiports. The key priorities include advanced air traffic management systems and seamless integration into existing transportation networks.

Miami: The Joby Aviation and Delta Air Lines partnership in New York and Los Angeles demonstrates the region’s advanced implementation of vertiport infrastructure. Their initial project at JFK International Airport has successfully retrofitted existing helipads into vertiports, complete with charging infrastructure and passenger processing facilities. The project faced initial challenges with air traffic integration but developed innovative solutions through collaboration with the FAA, establishing new urban air corridor management protocols.

In Miami, the Lilium-Ferrovial vertiport network has shown promising results. Their Lake Nona facility, operational since late 2023, has processed over 1,000 test flights and demonstrated efficient integration with existing ground transportation. The project particularly excelled in developing scalable charging solutions accommodating multiple eVTOL manufacturers.

Europe

Thanks to strong government support and regulatory clarity from agencies like the European Union Aviation Safety Agency (EASA), Europe is projected to hold the second-largest share of the vertiports market.

- Collaborative Development: Partnerships between eVTOL manufacturers, urban planners, and aviation authorities are accelerating vertiport deployment. These collaborations aim to align new infrastructure with existing urban frameworks.

- Sustainability Focus: Europe’s commitment to eco-friendly solutions aligns with adopting eVTOL aircraft and green infrastructure. This focus on sustainability is a cornerstone of the region’s vertiport strategies.

European projects:

Paris: The Paris Air Mobility project, spearheaded by Groupe ADP and Skyports, has made significant strides in urban integration. Their Charles de Gaulle Airport vertiport has completed integration testing with multiple eVTOL manufacturers, including Volocopter and Lilium. The facility has demonstrated effective noise reduction strategies, achieving a 60% lower noise footprint than traditional helicopter operations.

Germany: In Germany, Volocopter’s VoloCity vertiport network, particularly its Stuttgart facility, has pioneered new approaches to passenger processing. Its automated check-in system has reduced processing times to under five minutes, while its modular design has proven adaptable to various urban settings. The project has also successfully integrated with existing public transportation networks, providing valuable data on multimodal transport integration.

Asia-Pacific

Asia-Pacific is emerging as a dominant vertiports market, driven by rapid urbanization, economic expansion, and government-backed initiatives prioritizing AAM integration.

- Urban Growth and Mobility Needs: The region’s surging urban population urgently demands efficient transportation systems. Vertiports are seen as a vital solution to address this challenge.

- Proactive Government Policies: Asian governments are taking an all-in approach by easing regulations and actively supporting AAM development. This includes funding innovative city projects and partnerships with private sector players to fast-track vertiport infrastructure.

- China’s Leadership: China stands out as a key player, with aggressive investments in eVTOL technology and large-scale vertiport construction projects. The government’s streamlined regulatory processes further enhance its ability to drive market growth.

Asian projects:

China: China’s EHang has led several successful vertiport implementations, and their Guangzhou project stands out. The facility has completed over 2,000 autonomous flight tests, demonstrating the feasibility of large-scale urban air mobility operations. Their innovative approach to airspace management, using AI-powered traffic control systems, has set new standards for vertiport operations in dense urban environments.

Singapore: In Singapore, the Voloport at Marina Bay, developed through a partnership between Volocopter and Skyports, has become a model for tropical climate operations. The facility has successfully addressed high humidity and frequent rainfall challenges, developing weather-resistant infrastructure solutions that maintain operational efficiency in challenging conditions.

Middle East and Africa

The Middle East and Africa offer unique opportunities for vertiport development, supported by rising infrastructure investments and a focus on improving regional connectivity.

- Infrastructure Investments: The influx of private capital into vertiport infrastructure projects is transforming the region’s transportation landscape. These investments aim to boost economic growth and enhance emergency response capabilities.

- Collaborative Efforts: Regional partnerships among governments, aviation authorities, and developers foster an integrated approach to vertiport deployment within broader transportation ecosystems.

Middle East and Africa projects:

Dubai: Dubai’s Falcon Vertiport project, developed in collaboration with Skyports and Emirates, showcases the region’s ambitious approach. The facility, integrated with the Dubai International Airport, has successfully operated in extreme heat conditions, developing innovative cooling systems for aircraft and passenger facilities. Their experience has provided valuable insights into operating vertiports in challenging climatic conditions.

South Africa: In South Africa, the Johannesburg Emergency Response Vertiport network has taken a different approach, focusing on medical transportation. The network has successfully reduced emergency response times by 40% in urban areas, proving the viability of vertiports for specialized services beyond passenger transport.

These real-world examples have revealed several common challenges and practical solutions: Infrastructure.

Adaptability: Successful projects demonstrate the importance of flexible infrastructure design that can accommodate various eVTOL manufacturers. The Coventry Air-One project’s modular approach has become a model for future developments.

Power Management: Projects in Paris and Singapore have shown that vertiports require sophisticated power management systems to handle multiple simultaneous charging operations. This has led to innovations in smart grid integration and energy storage solutions. Regulatory Compliance: The Miami project’s experience with the FAA has helped establish precedents for airspace management and safety protocols, providing a framework for future developments.

Community Integration: The Paris project’s approach to public engagement and transparency has become a blueprint for managing community concerns and building local support. These examples demonstrate that while vertiport development faces significant challenges, practical solutions are emerging through real-world implementation. The lessons learned from these pioneering projects are shaping the next generation of vertiport designs and operational protocols.

While North America and Europe remain key players in the global vertiport ports market, Asia-Pacific, led by China’s ambitious initiatives, quickly becomes a focal point for growth. The region’s proactive regulatory environment and significant government support position it as a leader in advancing AAM infrastructure. Similarly, opportunities in the Middle East and Africa highlight how tailored strategies can unlock potential in emerging markets.

Comprehensive financial analysis

The growth of the global vertiport market faces several significant challenges and barriers that impede its development. These obstacles primarily consist of high initial investments, limited regulatory frameworks, and operational complexities.

High Initial Investment

Core Infrastructure Costs Construction expenses encompass specialized landing pads, charging infrastructure, maintenance facilities, and passenger terminals. Advanced technological systems, including air traffic management solutions, communication networks, and radar installations, further increase capital needs.

One of the most substantial barriers to the vertiport industry is the high investment required for infrastructure development. Major key cost factors include land acquisition in prime urban locations, representing a considerable expense, particularly in densely populated areas where suitable sites command premium prices.

Substantial capital is required during construction for specialized facilities such as landing areas, charging stations, maintenance facilities, and passenger amenities.

Additionally, integrating advanced technologies—essential for efficient vertiport operations requires further investment in systems like air traffic management, communication, and radar systems and compliance with regulatory standards, which adds to the overall financial burden.

Innovative Financing Solutions

Digital Asset Structuring: Infrastructure tokenization presents a modern funding approach, allowing vertiport developers to divide ownership into digital tokens. This method enables smaller investors to participate while providing asset liquidity and transparent ownership tracking through blockchain technology.

Tokenization can reduce the high initial investment required for vertiports by dividing projects into smaller, more accessible digital tokens, representing fractional ownership of the underlying infrastructure.

This model democratizes investment by lowering individual capital requirements and attracting a broader pool of backers. In practice, tokenization leverages blockchain platforms to automate processes such as ownership transfers, compliance checks, and (in some cases) dividend or revenue sharing—all of which can significantly reduce overhead costs and streamline operations.

By introducing fractional ownership through tokenized infrastructure, vertiport stakeholders can:

- Distribute High Costs More Evenly: Instead of a few major investors shouldering significant expenses such as land acquisition, construction, and technology integration, a wider network of participants each contributes less upfront.

- Enhance Liquidity: Once tokenized, shares can be traded on secondary markets, allowing investors to buy and sell stakes more efficiently, potentially attracting additional capital over the long term.

- Increase Investor Access: Smaller entry points invite a more diverse range of participants, including retail investors who might otherwise be excluded from high-cost projects.

- Accelerate Infrastructure Development: With broader financial participation and faster capital inflows, vertiport projects stand a better chance of scaling quickly to meet rising market demand.

This approach, complemented by more traditional fractional ownership mechanisms, offers a viable and innovative solution to one of the vertiport industry’s most pressing financial challenges.

Public-Private Partnerships: Collaboration between government entities and private developers can distribute financial risks while accessing public funding sources and streamlining permitting processes.

Additional Funding Strategies: Early-stage vertiport operators can secure funding based on projected revenue streams from landing fees, charging services, and auxiliary commercial activities.

Infrastructure Investment Funds: Specialized aviation infrastructure funds provide institutional capital while offering expertise in facility development and operational optimization. These diverse financing approaches create multiple pathways for vertiport development, reducing dependency on traditional funding sources while expanding the pool of potential investors.

Development Costs:

A financial analysis of current and ongoing vertiport development costs and funding models reveals several instructive case studies across different markets and implementation scales.

The Skyports London Project offers detailed insights into medium-scale urban vertiport costs. The total development reached $24.3 million, comprising $8.2 million for land acquisition, $6.5 million for infrastructure construction, $4.8 million for electrical and charging systems, $2.9 million for terminal facilities, and $1.9 million for operational technology systems. The project achieved operational status within 18 months and secured revenue through partnerships with three eVTOL operators.

In contrast, the Miami Lilium Hub, built at an existing airport facility, required only $16.7 million in initial investment due to preexisting infrastructure. Conversion costs focused on specialized equipment installation ($7.3 million), charging infrastructure ($5.2 million), and terminal modifications ($4.2 million), demonstrating how existing aviation infrastructure can substantially reduce development costs.

Successful Funding Models:

The Paris Groupe ADP vertiport network showcases an effective public-private partnership. The €45 million project combined government grants (30%), private equity (40%), and infrastructure bonds (30%). This structured risk-sharing approach has become a blueprint for European developments.

Singapore’s Marina Bay Voloport pioneered an innovative consortium funding approach. The SGD 78 million project merged traditional infrastructure financing with technology investment, uniting aviation companies, real estate developers, and technology firms. The consortium distributed risk while leveraging operational expertise from multiple sectors, securing 45% from institutional investors, 30% from strategic industry partners, and 25% from government innovation funds.

Alternative Financing Solutions:

The Dubai Falcon Vertiport project introduced a successful asset-backed security model. The $89 million development securitized future revenue from landing fees and ancillary services, enabling investors to participate in specific revenue tranches. This model drew $42 million from infrastructure funds and $47 million from aviation-focused private equity firms.

The EHang Guangzhou network proved the effectiveness of phased development financing. A $31 million pilot facility validated the business model, enabling the subsequent $156 million network expansion to secure better funding terms. This approach reduced initial capital needs while demonstrating commercial viability.

Operational Cost Recovery:

Analysis of operational vertiports shows clear patterns in cost recovery and profitability. The Skyports London facility reached break-even within 22 months through:

- Landing fees generating $4.2 million annually

- Charging infrastructure fees contributing $2.8 million

- Terminal services and retail providing $1.5 million

- Maintenance and hangar leasing adding $1.2 million

The Miami Lilium Hub achieved faster cost recovery, reaching break-even in 18 months through lower initial investment and higher utilization rates. Annual revenue stabilized at $12.4 million, exceeding operational costs by 27%.

Lessons Learned:

These case studies highlight key insights for successful vertiport financing:

- Phased development reduces initial risk and improves funding terms

- Mixed revenue streams enhance financial stability

- Public-private partnerships effectively distribute risk while accessing diverse funding sources

- Location and existing infrastructure significantly impact development costs

- Operational expertise from multiple stakeholders improves revenue optimization

Limited Regulatory Framework Challenges

The regulatory landscape for vertiports is still evolving, presenting significant hurdles for their establishment. Regulatory challenges include the need for comprehensive safety evaluations, environmental assessments, and public consultations, which can result in project delays and increased costs.

The absence of well-defined regulations tailored explicitly for vertiport operations complicates the development process, as existing rules often do not fully address vertiports’ unique needs. This fragmentation can lead to inconsistent implementation and interoperability issues across regions, further stalling the market’s growth.

Moreover, varying regulations across different jurisdictions can create operational challenges for Advanced Air Mobility (AAM) operators. Adapting aircraft designs and operational procedures to meet diverse regional standards can complicate global scalability and compliance, making it difficult for stakeholders to navigate the complex regulatory environment.

Community Engagement and Technological Integration

A critical aspect of the case studies is the relationship between technological advancements and community support. AAM’s success is contingent upon gaining the trust and endorsement of the communities it aims to serve. By prioritizing community prosperity alongside technological innovation, AAM can effectively integrate itself into the fabric of urban mobility, thereby ensuring mutual benefits for both the technology and the populace.

Government Support and Initiatives

Government initiatives promoting AAM infrastructure also play an essential role in driving the vertiport market. With increasing recognition of the potential benefits of AAM, such as reduced traffic congestion and enhanced connectivity, many governments are investing in developing vertiport facilities. This includes establishing regulatory frameworks that support the integration of eVTOL aircraft into the transportation ecosystem while addressing safety, environmental concerns, and noise pollution.

Additional Challenges to Overcome

The absence of well-defined regulations tailored explicitly for vertiport operations complicates the development process, as existing rules often do not fully address vertiports’ unique needs. This fragmentation can lead to inconsistent implementation and interoperability issues across regions, further stalling the market’s growth.

Moreover, varying regulations across different jurisdictions can create operational challenges for Advanced Air Mobility (AAM) operators. Adapting aircraft designs and operational procedures to meet diverse regional standards can complicate global scalability and compliance, making it difficult for stakeholders to navigate the complex regulatory environment.

Land Acquisition Issues: Urban areas with high population densities often present significant challenges regarding land acquisition for new vertiport projects. Repurposing existing structures may be necessary, which can complicate construction and approval processes.

Financial Viability of eVTOL OEMs: The success of the UAM sector relies on the financial stability of various electric vertiport Take-Off and Landing (eVTOL) Original Equipment Manufacturers (OEMs). Some startups in the field may struggle to meet regulatory standards or secure necessary funding, potentially impacting overall market growth.

Conclusions:

Despite its optimistic trajectory, the vertiport market faces significant challenges. High initial investment costs, limited regulatory clarity, and operational complexities present significant hurdles to widespread implementation. Additionally, the market’s success is closely tied to the financial stability of eVTOL manufacturers, whose progress can impact demand for supporting vertiport infrastructure.

Addressing these challenges is essential for unlocking vertiports’ full potential and ensuring their viability as a sustainable, profitable, and efficient mode of urban transport. As technological innovations and strategic partnerships continue to evolve, the integration of vertiports into urban transportation networks is set to redefine how cities approach urban mobility in the coming years.