The global eVTOL market is projected to reach $87.6 billion by 2026, growing at a compound annual rate (CAGR) of 37.2%, fueled by demand for urban air mobility solutions and strategic partnerships with automotive and aerospace giants. However, the industry faces momentous challenges, including capital-intensive certification processes, volatile stock performance, and infrastructure gaps. Investors must weigh the high-risk, high-reward potential of pure-play eVTOL stocks against broader market uncertainties.

The electric Vertical Take-Off and Landing (eVTOL) industry is poised for growth in 2025, driven by regulatory milestones, infrastructure development, and advancements in battery technology. Joby Aviation (NYSE: JOBY) and Archer Aviation (NYSE: ACHR) lead the industry, with both companies nearing Federal Aviation Administration (FAA) certification and preparing for commercial launches in late 2026 or early 2027. Morgan Stanley projects the total addressable market for urban air mobility could reach $1.5 trillion by 2040, with optimistic scenarios pushing this figure to $2.9 trillion as adoption accelerates. In 2025 alone, the market is forecast to expand from $4.2 billion to $87.6 billion, marking a critical inflection point for commercial scalability. There are three interconnected factors that support this growth trajectory.

- Battery technology: Battery technology breakthroughs eliminate range limitations that once constrained eVTOL viability. Energy density improvements now enable aircraft like Joby’s five-seat model to achieve 150-mile ranges at 200 mph speeds, a 40% increase over 2023 capabilities. These advancements stem from collaborations with automotive leaders. Toyota’s solid-state battery expertise directly supports Joby’s powertrain efficiency gains.

- Regulatory: Regulatory milestones are de-risking the path to commercialization. Joby has entered Phase 4 of the FAA’s five-stage certification process, with third-party audits confirming 80% compliance, while Archer completes final tests on its Midnight aircraft’s noise and safety protocols. Parallel progress in Europe (EASA’s SC-VTOL framework) and China (CAAC’s autonomous flight approvals) creates a global regulatory tailwind.

- Vertiport infrastructure: Vertiport infrastructure investments are materializing in key markets. Joby’s exclusive partnership with Dubai’s Road and Transport Authority will establish a 10-vertiport network by late 2025, including a flagship hub at Dubai International Airport capable of 1,000 daily flights. In the U.S., Archer and United Airlines are co-developing Skyports at Newark and Los Angeles International Airports, integrating eVTOLs into existing passenger workflows through shared booking platforms.

JPMorgan predicts that these factors will converge to unlock a $1 trillion revenue opportunity by 2035, with 2025 serving as the operational launchpad. Defense sector partnerships further de-risk growth. Joby’s $933 million in Department of Defense contracts validate its technology and fund dual-use applications like medical evacuation systems. This multifaceted momentum positions urban air mobility not as a niche experiment but an inevitable layer of future transportation ecosystems.

Leading eVTOL Companies and Investment Prospects

The electric vertical takeoff and landing (eVTOL) sector features a diverse mix of pure-play innovators and established aerospace giants, each pursuing unique strategies to capitalize on the rapidly growing urban air mobility (UAM) market.

Archer Aviation: A Production Model with Minimal Asset Investment

Archer Aviation (NYSE: ACHR) is positioning itself as a leader in urban air mobility with its Midnight aircraft, optimized for 20-mile urban hops and designed for quick 10-minute charging cycles. Archer’s strategic partnerships are central to its success. The company secured a significant order from United Airlines for 200 aircraft, targeting high-demand routes like Newark to Manhattan, reducing travel time to eight minutes.

Additionally, Archer’s partnership with Stellantis provides a capital-efficient production model. Stellantis is retrofitting its Illinois manufacturing facility to produce up to 650 aircraft annually by 2026, significantly reducing upfront capital expenditures. Archer’s advanced FAA certification progress and strong liquidity position make it a compelling player, though its $7 billion valuation assumes flawless execution amid regulatory and operational challenges.

Boeing: Diversified Exposure via Wisk Aero

Boeing (NYSE: BA) offers indirect exposure to the eVTOL market through its $450 million investment in Wisk Aero, which is developing a six-passenger autonomous air taxi. While Wisk lags behind pure-play competitors in certification timelines, Boeing’s extensive aerospace experience provides crucial advantages.

The company leverages its expertise in aerostructures and avionics, adapted from its 787 Dreamliner program, to support Wisk’s development efforts. Additionally, Boeing’s global maintenance, repair, and overhaul (MRO) network of over 650 service centers positions it as a key player in future eVTOL operations. Boeing offers a stable entry point with long-term potential for risk-averse investors seeking exposure to the sector without the volatility of pure-play stocks.

EHang Holdings: Autonomous Flight Pioneer

EHang (NASDAQ: EH) dominates China’s urban air mobility market with its EH216-S autonomous eVTOL aircraft. This aircraft holds the world’s first Civil Aviation Administration of China (CAAC) certification for pilotless passenger operations. The company’s focus on autonomous technology sets it apart from other competitors.

EHang’s growth is driven by its operational vertiport network in Shenzhen, which supports over 500 daily flights for sightseeing and emergency response missions. Geely's pending $95 million investment further strengthens EHang’s financial position and supports its expansion into Southeast Asia. While EHang lacks FAA certification for U.S. operations, its dominance in China’s $28.6 billion eVTOL market makes it a leader in autonomous flight innovation.

Embraer: Diversified Aerospace Expertise

Embraer (NYSE: ERJ), one of the world’s largest aerospace manufacturers, owns Eve Holding and provides stable exposure to the eVTOL sector. With over five decades of experience in aircraft design and certification, Embraer lends technical expertise and manufacturing capabilities to Eve’s operations while maintaining its diversified revenue streams from traditional aerospace markets.

Embraer is also exploring advanced air mobility opportunities beyond passenger services, including defense applications for eVTOL technology through a partnership with BAE Systems. For investors seeking less volatile exposure to the eVTOL market, Embraer offers a balanced option backed by decades of aerospace leadership.

Eve Holding: Latin America’s eVTOL Leader

Eve Holding (NYSE: EVEX), Embraer’s eVTOL subsidiary, has emerged as a leader in urban air mobility. Its impressive order pipeline includes 2,850 Letters of Intent (LOIs) across 13 countries, valued at approximately $8 billion. Eve focuses on developing its eVTOL aircraft and creating an integrated ecosystem with urban air traffic management systems and maintenance services.

With $646.2 million in funding and strong support from Embraer’s established supply chain and manufacturing expertise, Eve is well-positioned for growth in Latin America and beyond. The company unveiled its first full-scale prototype at the Farnborough Airshow in 2024. It plans to begin production at a new facility in Brazil funded by a loan of $88 million from Brazil’s National Development Bank.

Joby Aviation: Certification Leader with Multimodal Ambitions

Joby Aviation (NYSE: JOBY) remains at the forefront of FAA certification efforts, having completed four of the five stages required for commercial passenger operations. Its five-seat eVTOL aircraft, capable of speeds up to 200 mph and ranges of 150 miles, has logged over 10,000 test flights across major cities like New York and Los Angeles. Joby has secured critical partnerships that enhance its competitive edge:

- Delta Air Lines: A potential $200 million investment would support integrated “home-to-airport” services with seamless booking via Delta's app.

- Toyota: An investment of $824 million enables scalable production using Toyota's manufacturing expertise.

- Dubai exclusivity: A six-year agreement with Dubai International Airport positions Joby as an early mover in Middle Eastern markets.

With $933 million in cash reserves and Department of Defense contracts validating dual-use applications, Joby is well-capitalized but faces near-term challenges tied to operational scaling.

Textron: Leveraging Legacy Brands for AAM Innovation

Textron (NYSE: TXT) is advancing its role in the eVTOL sector through Textron eAviation and its Nexus aircraft program. The Nexus is designed as a multi-mission vehicle capable of passenger transport, cargo delivery, and emergency response operations. Textron has also strengthened its position by acquiring Pipistrel, a leader in electric aviation manufacturing.

Textron’s established brands, like Bell Helicopter and Cessna, provide additional synergies for integrating advanced technologies into its eVTOL development efforts. With flight testing for Nexus set to begin in 2025 at Salina Regional Airport, Textron offers diversified exposure to AAM innovation while leveraging legacy aerospace expertise.

Vertical Aerospace: European Certification Gambit

Vertical Aerospace (NYSE: EVTL) targets the European market with its VX4 aircraft, a 150 mph eVTOL designed for regional routes up to 100 miles. Despite delays caused by supply chain issues, Vertical has secured pre-orders from major airlines like American Airlines and Japan Airlines for over 150 aircraft.

The company recently raised $90 million to fund critical Phase 3 wing-borne testing but faces significant challenges tied to certification timelines and manufacturing readiness. Trading below $1 post-reverse split, Vertical represents a speculative bet on European regulatory tailwinds.

From pure-play innovators like Joby Aviation and Archer Aviation to established aerospace giants like Boeing, Embraer, and Textron. All are working toward transforming urban air mobility into a viable transportation solution by addressing unique challenges across production scalability, certification progress, and ecosystem integration.

Leading Infrastructure and Power Companies in the AAM Ecosystem

The Advanced Air Mobility (AAM) sector relies heavily on infrastructure and power solutions to support eVTOL operations. While there are no publicly traded vertiport companies, several key players in battery technology and infrastructure are shaping the industry's foundation. Below is an analysis of publicly traded companies driving innovation in energy storage and sustainable infrastructure for AAM.

Amprius Technologies: High-Energy Battery Innovator

Amprius Technologies (NYSE: AMPX) is a leader in lithium-ion battery innovation, specializing in high-energy-density batteries critical for eVTOL aircraft. With energy densities reaching 500 Wh/kg, Amprius enables extended flight ranges and improved performance for eVTOL developers. The company is scaling production to meet increasing demand from AAM manufacturers, positioning itself as a vital supplier in the ecosystem. Amprius has also partnered with aerospace firms to integrate its advanced battery solutions into next-generation aircraft designs, making it a compelling investment for those seeking exposure to AAM power technologies.

SES AI Corporation: Next-Generation Li-Metal Batteries

SES AI Corporation (NYSE: SES) develops advanced Li-Metal batteries with high energy density and rapid charging capabilities for eVTOL applications. These batteries enhance flight efficiency and extend operational ranges, addressing one of the industry's most pressing challenges. SES collaborates with automotive and aerospace leaders to accelerate the adoption of its technology across AAM platforms. As demand for high-performance batteries grows, SES AI’s innovative solutions position it as a key player in powering the future of urban air mobility.

ACS Group: Infrastructure Giant Supporting Vertiports

ACS Group (BME: ACS), a global leader in infrastructure development, has invested heavily in vertiport projects through partnerships with Skyports Infrastructure. ACS brings decades of experience in large-scale transportation projects, including airports and urban transit systems, to the AAM sector. Its involvement underscores the importance of sustainable infrastructure in enabling eVTOL operations at scale. While ACS is not a pure-play AAM company, its strategic investments are essential to the industry's growth trajectory.

Ferrovial: Vertiport Development Expertise

Ferrovial (BME: FER) has been instrumental in vertiport development. It previously operated Ferrovial Vertiports before selling the division to Atlantic Aviation. The company remains active in infrastructure projects that support advanced mobility solutions globally. Ferrovial’s expertise in designing transportation hubs positions it as a valuable partner for eVTOL operators seeking scalable vertiport networks. Its diversified portfolio includes investments in sustainable energy and urban transit systems, aligning with the broader goals of the AAM industry.

Textron: Leveraging Legacy Aerospace Expertise

Textron (NYSE: TXT) combines its legacy aerospace experience with innovative solutions for AAM through Textron eAviation and its Nexus aircraft program. While primarily focused on eVTOL development, Textron’s infrastructure capabilities extend to maintenance facilities and operational support systems critical for scaling urban air mobility networks. Its acquisition of Pipistrel further strengthens its position as a provider of integrated solutions across the AAM value chain.

Blade Air Mobility: Transitioning to eVTOL and Expanding Urban Air Mobility

Blade Air Mobility (NASDAQ: BLDE) is a pioneering air mobility platform that leverages an asset-light model to provide air transportation services across congested urban routes. Founded in 2014 and headquartered in New York City, Blade operates through two primary segments: Passenger Services (helicopter, seaplane, and charter flights) and MediMobility Organ Transport, which focuses on logistics for organ transplants. The company is actively transitioning to Electric Vertical Aircraft (EVA), positioning itself as a leader in the evolving Advanced Air Mobility (AAM) market.

As the sector matures, these companies are expected to play increasingly prominent roles in supporting eVTOL commercialization efforts globally, making them attractive options for investors seeking diversified exposure to the AAM industry’s foundational technologies.

Vertiport Development: The Foundation of Urban Air Mobility

As eVTOL aircraft approach commercialization, the development of vertiport infrastructure has emerged as a critical enabler for scaling Advanced Air Mobility (AAM). Vertiports are specialized hubs facilitating eVTOL operations, providing takeoff, landing, passenger services, charging, and maintenance facilities. While the industry has made significant strides in aircraft design and certification, vertiport development remains a bottleneck due to high costs, regulatory hurdles, and the need for integration with existing urban infrastructure. Below, we explore key vertiport projects, challenges, and their role in shaping the future of urban air mobility.

Dubai’s Vertiport Network (Joby Aviation)

Joby Aviation has partnered with Dubai’s Roads and Transport Authority (RTA) to construct a network of four vertiports across the city by 2026. The first phase includes facilities at Dubai International Airport (DXB) and Palm Jumeirah, with plans to expand to Dubai Marina and Downtown Dubai. These vertiports will feature advanced passenger terminals and charging stations, supporting up to 1,000 daily flights.

Vertiport Chicago (Archer Aviation)

Archer Aviation and United Airlines are collaborating to launch the first eVTOL route in Chicago by 2025. Vertiport Chicago, North America’s largest vertical takeoff and landing facility, will connect O’Hare International Airport (ORD) with downtown Chicago in 10 minutes. This project highlights the potential for airport-to-city-center routes to reduce congestion and travel times.

UK Vertiport Testbed (Skyports Infrastructure)

Skyports Infrastructure has broken ground on the UK’s first vertiport testbed at Bicester Motion in Oxfordshire. Scheduled for completion in early 2025, this facility will serve as a testing ground for eVTOL flight operations, ground infrastructure, and air traffic management systems. The project aims to establish best practices for scaling vertiport networks across Europe.

EHang-Shenzhen:

EHang Holdings (NASDAQ: EH) has set a new benchmark for urban air mobility infrastructure with its fully automated vertiport launch at Shenzhen's Luohu Sports and Leisure Park. This facility, dedicated to the commercial operations of EHang’s EH216-S pilotless eVTOL aircraft, represents a groundbreaking innovation in vertiport design and functionality. Spanning 753 square meters, the Luohu UAM Center integrates advanced automation systems to optimize space usage and reduce operational costs, setting the stage for scalable eVTOL operations in urban environments.

Paris Olympic Vertiports

In preparation for the 2024 Paris Olympics, several vertiports were constructed to support eVTOL operations between key locations like Charles de Gaulle Airport and central Paris. These facilities served as proof of concept for integrating urban air mobility into major events while addressing noise reduction and passenger flow challenges.

Challenges in Vertiport Development

Vertiport development is critical to the success of Advanced Air Mobility (AAM), but several challenges must be addressed to ensure its scalability.

Regulatory Hurdles: Developing standardized guidelines for vertiport design, safety protocols, and airspace management requires collaboration between aviation regulators like the FAA and EASA, city planners, and private developers.

High Costs: Building vertiports involves significant capital investment for infrastructure such as charging stations, passenger terminals, and maintenance facilities. Retrofitting existing structures like parking garages or helipads can mitigate costs but add complexity.

Power Supply Integration: Rapid charging systems capable of recharging eVTOL batteries within 10–12 minutes are essential for operational efficiency. However, integrating these systems into urban power grids poses technical and logistical challenges.

Public Acceptance: Noise pollution and visual impact remain major concerns for urban communities. Designing vertiports with sound-absorbing materials and incorporating green spaces can help address these issues.

Strategic Allocation Guidelines

Due to its high-risk, high-reward nature, the eVTOL sector requires careful planning. Based on their risk tolerance and investment goals, investors should focus on three categories of companies.

Pure-play leaders like Joby Aviation and Archer Aviation are nearing FAA certification and are positioned for early commercialization. These companies are suitable for 1-2% portfolio allocations for investors who can handle the volatility tied to regulatory milestones.

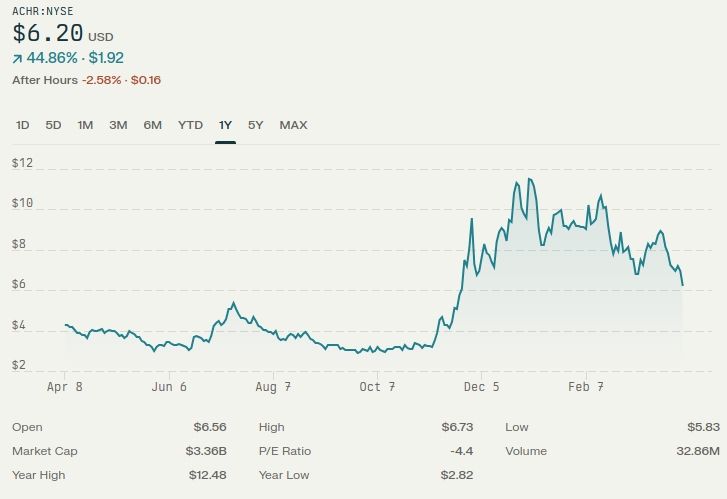

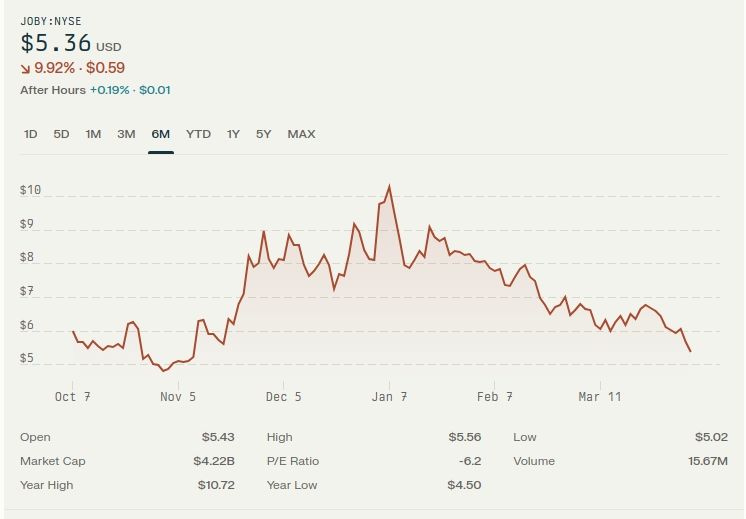

Regional specialists like EHang in Asia and Vertical Aerospace in Europe provide targeted exposure to specific markets. These stocks are better suited for more minor satellite positions (2.0), meaning their stock prices are highly sensitive to market fluctuations. For example, Joby’s stock declined by 27% year-to-date (April 2025) due to cost overrun concerns, while Archer experienced a 20% correction despite certification progress. EHang saw a dramatic 1,000% rally in 2024 but dropped by 35% in Q1 2025, reflecting speculative trading patterns. Investors must be prepared for significant 30–50% price swings, similar to early-stage biotech or EV sectors.

Regulatory and Infrastructure Developments

The regulatory landscape is a critical factor shaping the eVTOL sector’s future. In 2025, Joby Aviation and Archer Aviation will lead Western certification efforts under the FAA’s five-stage process. Joby will enter its TIA phase (in-flight testing) ahead of a planned commercial launch in 2026. EASA’s SC-VTOL framework in Europe is accelerating approvals for companies like Volocopter, which aims to launch routes between Paris and Rome. However, delays remain a significant risk; Vertical Aerospace’s test crash in 2024 pushed its certification timeline back to 2026.

Infrastructure development also presents challenges. As of Q1 2025, only 45 vertiports are operational globally, a bottleneck for scaling eVTOL services. Key projects include Joby’s Dubai vertiport network at Dubai International Airport (DXB), Archer’s collaboration with Skyports for hubs at Los Angeles (LAX) and Newark (EWR), and EHang’s automated vertiport in Shenzhen capable of supporting over 500 daily flights. Companies like Blade Air Mobility and Ferrovial are emerging as infrastructure players but have yet to achieve profitability.

Conclusion: A High-Stakes Investment Frontier

The eVTOL sector represents a compelling asymmetric investment opportunity in 2025, with industry leaders Joby and Archer poised to capitalize on first-mover advantages as certification milestones approach. Investors should consider selective exposure of 1-3% portfolio allocation to pure-play stocks, focusing on three critical success factors that separate viable contenders from speculative ventures.

1. Prioritize companies demonstrating clear FAA or EASA certification momentum. Joby's Phase 4 status and Archer's final testing phases indicate that regulatory pathways are materializing.

2. It favors those securing transformative partnerships, Toyota-Joby and Stellantis-Archer manufacturing alliances or United-Archer and Delta-Joby route development agreements—that provide external validation and capital efficiency.

3. Concentrate on operators maintaining substantial liquidity buffers exceeding $500 million, essential for weathering certification delays without destructive dilution.

Avoid eVTOL developers dependent on emergency equity raises (Vertical Aerospace) or government intervention (Lilium), as these funding uncertainties typically signal fundamental business model weaknesses. While the sector's $1.5 trillion total addressable market justifies speculative positioning, the inherent volatility and binary outcomes demand disciplined allocation limits. The next 12-18 months will decisively separate viable commercial operations from conceptual prototypes, making 2025 the defining year for eVTOL investment as the industry transitions from certification to commercialization.