The electric vertical takeoff and landing (eVTOL) aircraft industry is one of the most exciting growth opportunities in aviation, with the market expected to expand significantly. The Low Altitude Economist predicts substantial growth from around $0.76-3.5 billion in 2024 to $17.3-77 billion by 2035. The Low Altitude Economist’s comprehensive analysis explores the top pure-play eVTOL investment opportunities and their prospects for 2025.

The eVTOL industry is at a critical stage as it moves decisively from the prototype trials and development phases to real-world products and services. Regulatory milestones, infrastructure growth, and progress in battery technology fuel it. Morgan Stanley estimates that the total market potential for urban air mobility could reach $1 trillion by 2040, with optimistic forecasts pushing it to $9 trillion by 2050. Bank of America forecasts a compound annual growth rate of 62% from 2025 to 2030 and 85% from 2025 to 2035, emphasizing the sector’s strong growth prospects.

The industry benefits from several technological advances. Breakthroughs in battery technology have removed previous range limitations, with improvements in energy density now allowing aircraft to reach 150-mile ranges at 200 mph, a 40% increase from 2023 capabilities. Regulatory progress has also sped up, with the FAA releasing detailed guidance for powered-lift aircraft certification in July 2025, providing much-needed clarity for manufacturers.

Top Five eVTOL Investment Opportunities

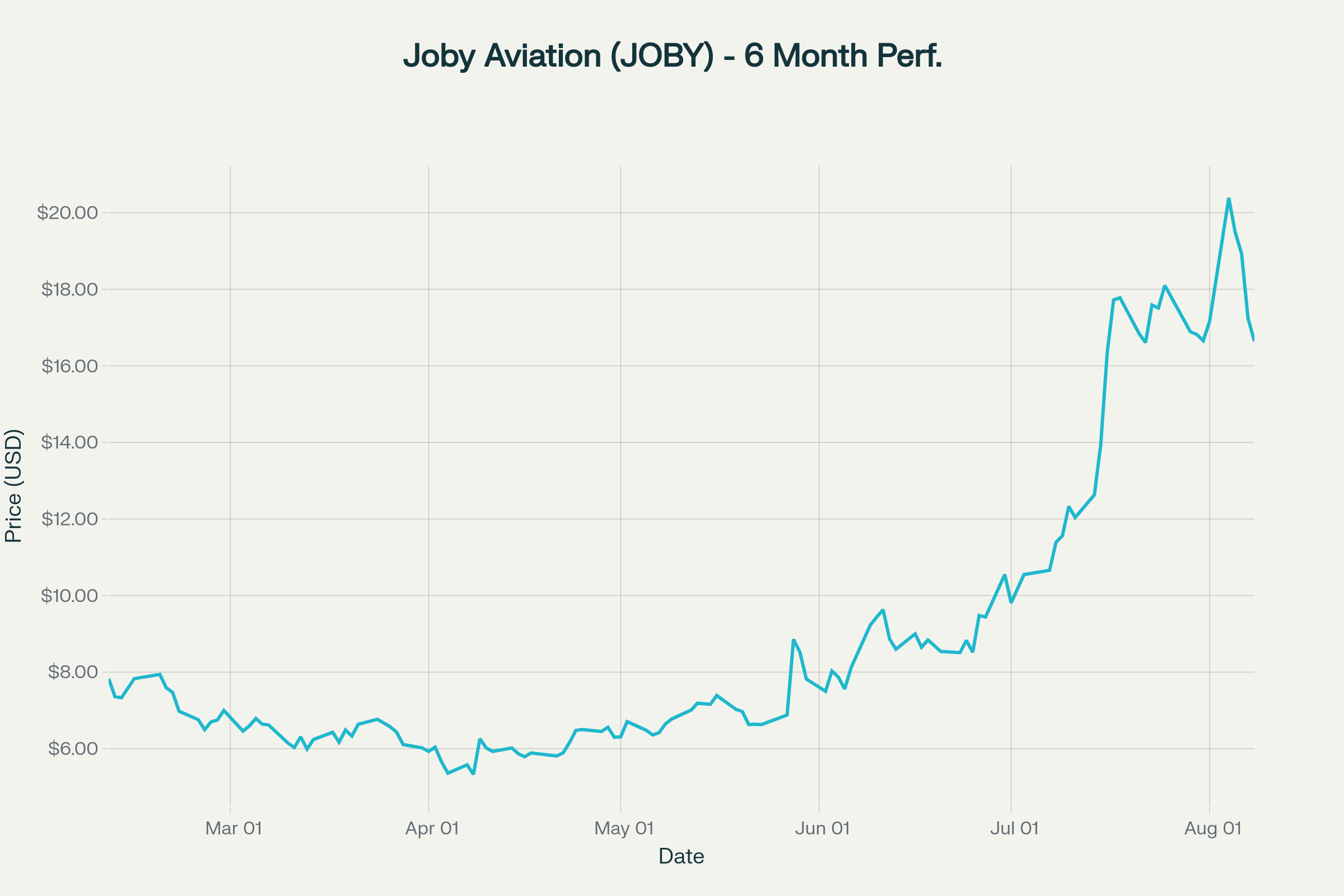

Joby Aviation (NYSE: JOBY) stands out as the most significant player in this space, with a market capitalization of approximately $5.5 billion. The company has made significant progress through the FAA's certification process, currently in Phase 4 of the five-stage approval system. Joby's stock has seen remarkable gains, surging from $5.33 per share in early 2025 to $17.78 by July, representing a 233% increase. The company recently expanded its manufacturing capacity in California. It acquired a 140-acre site at Dayton International Airport in Ohio, planning a 2 million square foot facility capable of producing up to 500 aircraft annually.

| Status | Details |

| Sector Position | Frontrunner in eVTOL with rapid 2025 recovery and advanced certification progress. |

| Share Performance | Rose from $5.33 to $17.78 over three months (+233%); trading around $16.66 as of August 2025. |

| Certification Progress | Stage 4 (Testing & Analysis): 43% FAA-side, 62% Joby-side as of May 2025; progressed to 70% Joby-side by August 2025. |

| Cash & Liquidity | Ended 2024 with $933M in cash, equivalents, and short-term investments. |

| Strategic Backing | Toyota committed $500M in two tranches; the first $250M tranche closed in 2025, strengthening the manufacturing partnership. |

| Revenue Diversification | Active U.S. defense collaborations and testing at Edwards AFB support near-term non-commercial revenue. |

| Global Expansion | Partnerships with ANA (Japan) and international initiatives underpin early market access. |

| Operations Timeline | First passenger operations targeted for late 2025/early 2026; conforming aircraft headed to final assembly for TIA testing. |

| Manufacturing Footprint | California pilot line expanding; Ohio facility planned for scaled production with Toyota support. |

Key Investment Highlights

Certification Leadership — Joby leads peers in FAA Type Certification progress, moving through Stage 4 with measurable quarterly gains and preparing for TIA flight testing in 2025.

Strong Financial Position — $933M cash at 2024 year-end provides runway through critical certification milestones.

Strategic Partnerships — Toyota’s $500M commitment (first $250M tranche closed) adds capital plus preferred manufacturing alignment and potential MRO/operations roles in Japan.

Diverse Revenue Streams — Defense work, including testing at Edwards AFB, complements commercial plans and supports interim revenue.

Global Expansion — Deployment pathways supported by partners such as ANA and regional test campaigns, strengthening international commercialization prospects.

Operations Timeline — Conforming aircraft advancing to final assembly; pilot and FAA testing slated to enable late-2025/early-2026 service launch window.

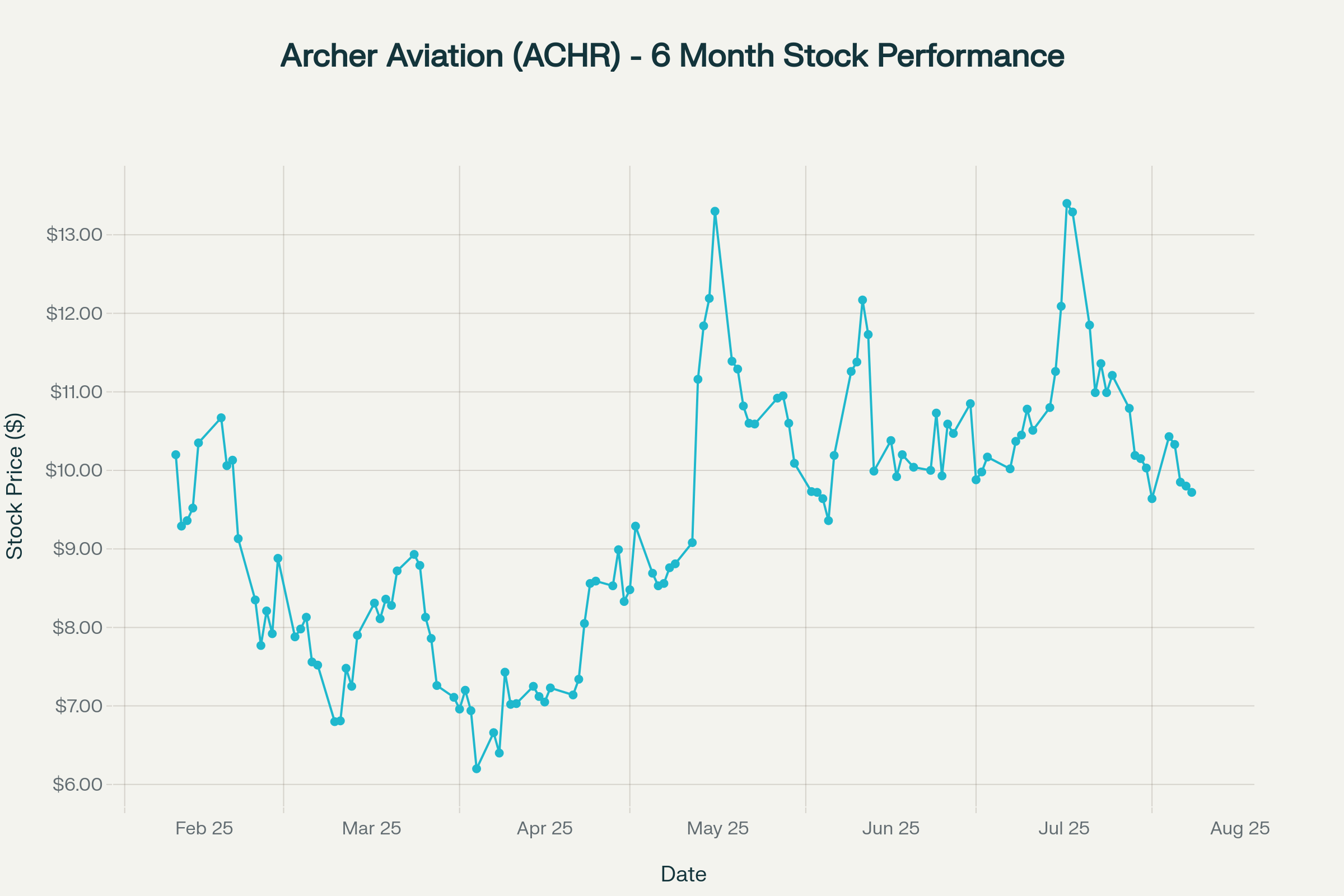

Archer Aviation (NYSE: ACHR) follows as the second-largest company in the industry. Trading around $9.48 per share, Archer has secured major partnerships that set it apart from competitors. The company landed a significant order from United Airlines for 200 aircraft, targeting high-demand routes like Newark to Manhattan, which could reduce travel time to just eight minutes. Archer's partnership with Stellantis provides manufacturing advantages, with the automotive giant retrofitting its Illinois facility to produce up to 650 aircraft annually by 2026. The company expects to receive FAA certification in 2025

| Status | Details |

| Market Position | Strong second-place contender with $7B valuation and strategic diversification focus. |

| Share Performance | Trading around $9.72 with year-to-date gains of approximately 120%. |

| Manufacturing Scale | Stellantis partnership targeting 48 units annually by 2026 with dedicated production infrastructure. |

| Defense Revenue | $142M U.S. Air Force contract for Midnight eVTOLs designed for battlefield applications. |

| Financial Position | $1.4B in cash and committed capital providing substantial operational runway through certification. |

| Commercial Pipeline | $1B order pipeline from United Airlines validates strong market demand and commercial viability. |

| Growth Strategy | Recent strategic acquisitions expand technological capabilities and strengthen market positioning. |

| Cash Management | Quarterly burn rate of $95-110M requires careful milestone monitoring and execution discipline. |

Key Investment Highlights

Manufacturing Scalability — Stellantis partnership delivers dedicated production infrastructure with a clear 48-unit annual capacity target by 2026, providing manufacturing credibility and scale pathway.

Defense Market Penetration — $142M U.S. Air Force contract for Midnight eVTOLs validates dual-use applications and provides near-term revenue diversification beyond commercial operations.

Strong Liquidity — $1.4B cash and committed capital creates substantial operational runway through certification phases and early commercial deployment.

Commercial Orders — $1B United Airlines order pipeline demonstrates market validation and provides revenue visibility for scaled operations.

Strategic Acquisitions — Recent acquisitions broaden technological capabilities and strengthen competitive positioning across key eVTOL value chain components.

Cash Management — The quarterly burn rate of $95-110M necessitates disciplined milestone execution and careful monitoring of certification progress to maintain capital efficiency.

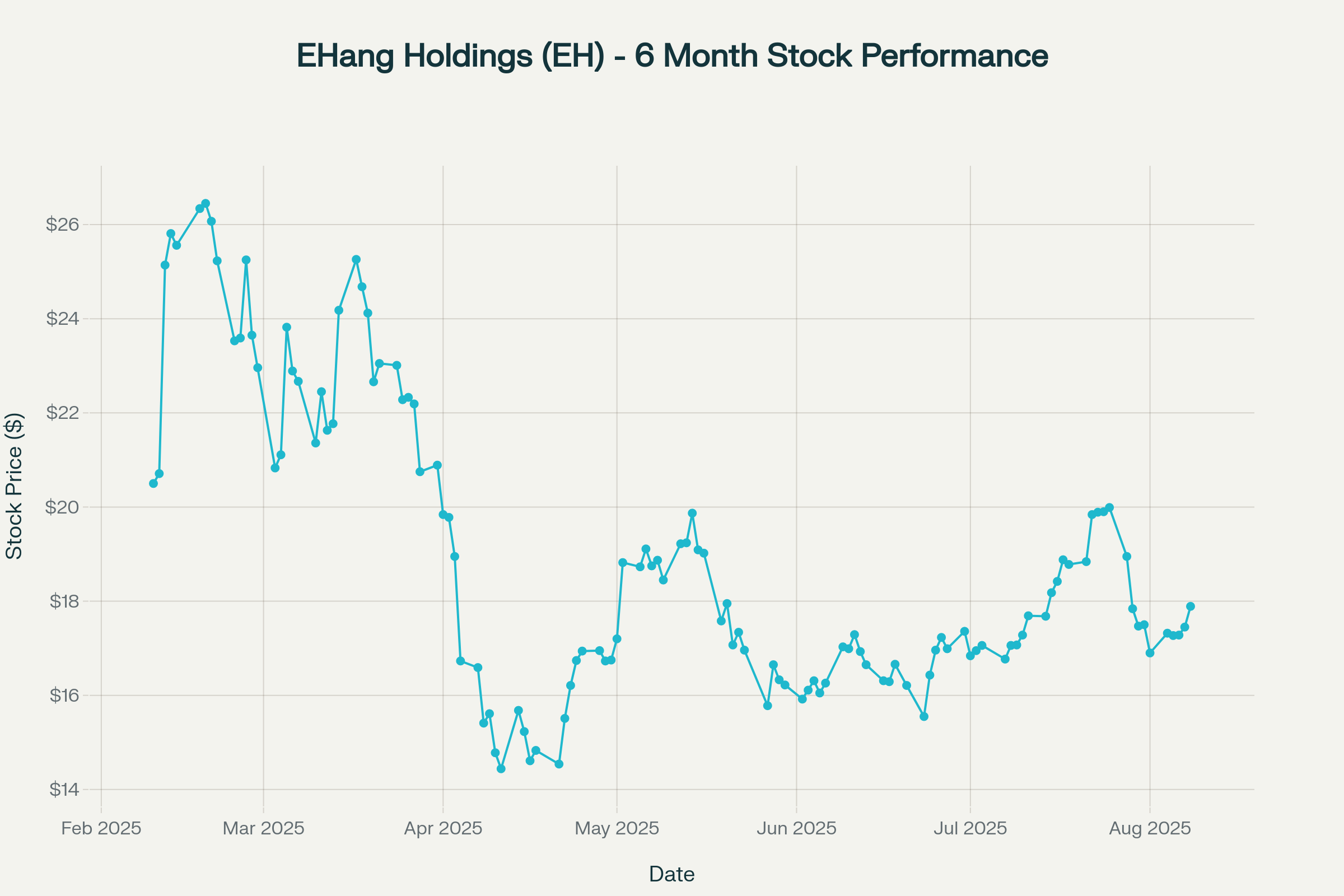

EHang Holdings (NASDAQ: EH) dominates the autonomous flight space, particularly in China's market. Currently trading at $17.84 per share, EHang holds the world's first Civil Aviation Administration of China (CAAC) certification for pilotless passenger operations. The company operates an active vertiport network in Shenzhen, supporting over 500 daily flights for sightseeing and emergency response missions. Geely's pending $95 million investment strengthens EHang's financial position for Southeast Asia expansion.

| Status | Details |

| Market Leadership | Dominates China’s urban air mobility with the world’s first autonomous passenger flight certification. |

| Share Performance | Trading around $17.31, reflecting operational achievements and regulatory leadership position. |

| Operations Scale | Active Shenzhen network supporting over 500 daily flights with proven commercial operations. |

| Regulatory Edge | World's first CAAC certification for pilotless passenger operations provides a significant competitive moat. |

| Market Opportunity | Leadership position in China's substantial eVTOL market with established operational presence. |

| Investment Support | Geely's pending $95M investment provides additional capital and strategic backing. |

| Market Dynamics | High volatility is driven by regulatory developments and evolving market sentiment patterns. |

Key Investment Highlights

Operational Network — Active flight operations in Shenzhen supporting over 500 daily flights, demonstrating real-world commercial viability and operational experience unmatched by global peers.

Regulatory Achievement — World’s first CAAC certification for pilotless passenger operations creates a substantial competitive moat and validates autonomous flight technology leadership.

Market Position — Established leadership in China’s substantial eVTOL market opportunity with proven operational capabilities and regulatory approval advantage.

Investment Backing — Geely’s pending $95M investment provides additional strategic support and capital resources for continued expansion and development.

Market Volatility — The Stock exhibits characteristic sector volatility with significant price movements driven by regulatory developments and shifting market sentiment dynamics.

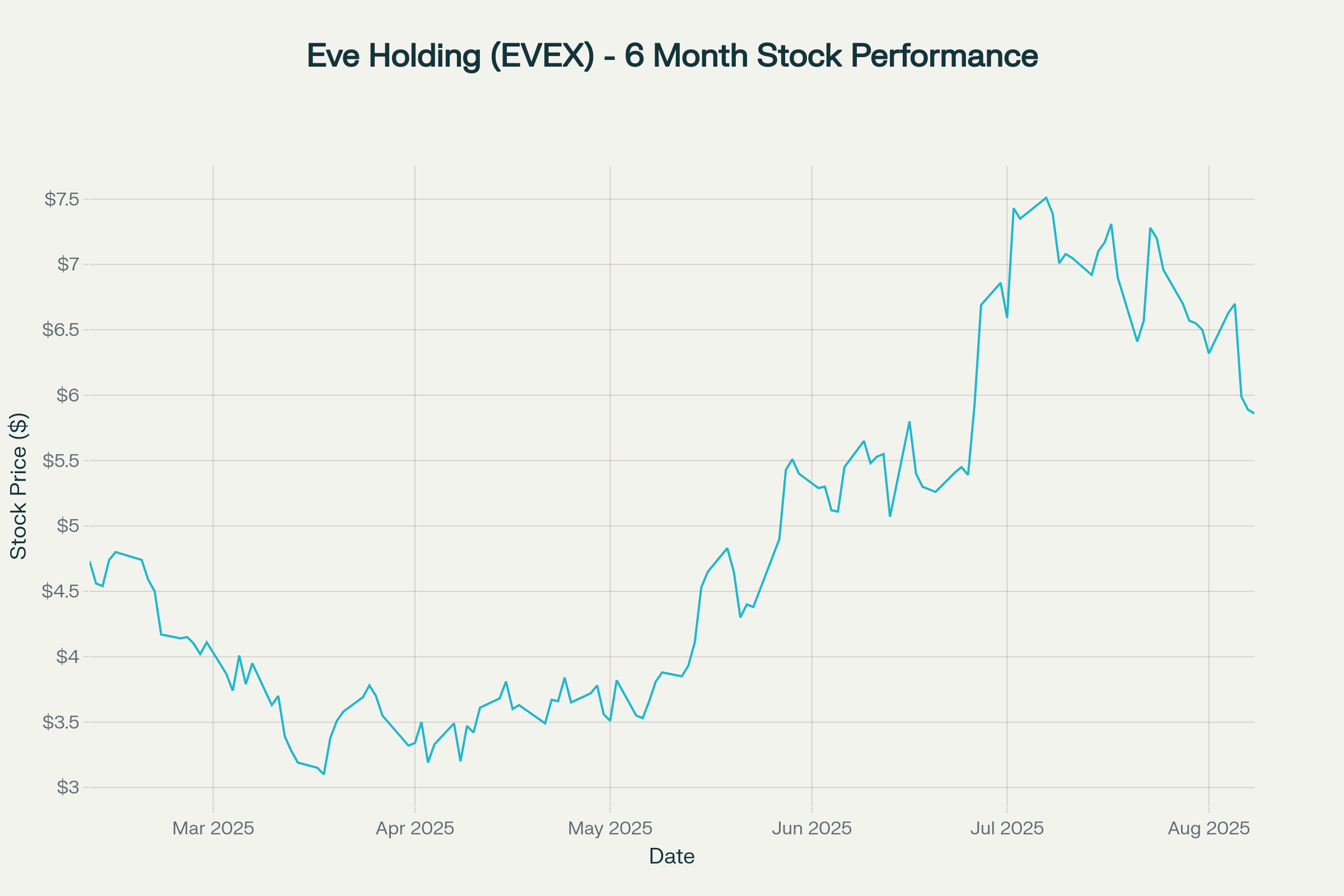

Eve Holding (NYSE: EVEX), the Embraer spinoff, trades at $5.94 per share and brings decades of aerospace manufacturing expertise to the eVTOL space. As Brazil's leading eVTOL company, Eve capitalizes on its parent company's international presence and manufacturing heritage. The company has conducted multiple component and system tests, with flight trials launched this summer and commercial service projected for next year.

| Status | Details |

| Strategic Backing | Benefits from Embraer's five decades of aerospace expertise and certification experience. |

| Share Performance | Trading around $5.86 with exposure to Latin American markets and a stable investment profile. |

| Order Pipeline | 2,850 Letters of Intent across 13 countries valued at approximately $8B in potential revenue. |

| Business Model | Complete ecosystem approach covering aircraft, services, and air traffic management solutions. |

| Financial Position | $646.2M in funding with Brazil's National Development Bank support providing stability. |

| Analyst Outlook | "Moderate Buy" rating with average price targets of $6.67, indicating upside potential. |

| Geographic Focus | Strategic positioning in Latin American markets with an established aerospace heritage. |

Key Investment Highlights

Aerospace Heritage — Backed by Embraer’s five decades of aircraft design and certification experience, providing proven aerospace expertise and regulatory navigation capabilities.

Order Pipeline — 2,850 Letters of Intent across 13 countries valued at approximately $8B creates substantial revenue potential and demonstrates global market interest.

Integrated Approach — Complete ecosystem focus encompassing aircraft, services, and air traffic management delivers comprehensive urban air mobility solutions.

Financial Stability — $646.2 million in funding, supported by Brazil’s National Development Bank, provides a stable capital foundation and government backing.

Analyst Confidence — “Moderate Buy” rating with $6.67 average price targets suggests continued upside potential and professional investment community support.

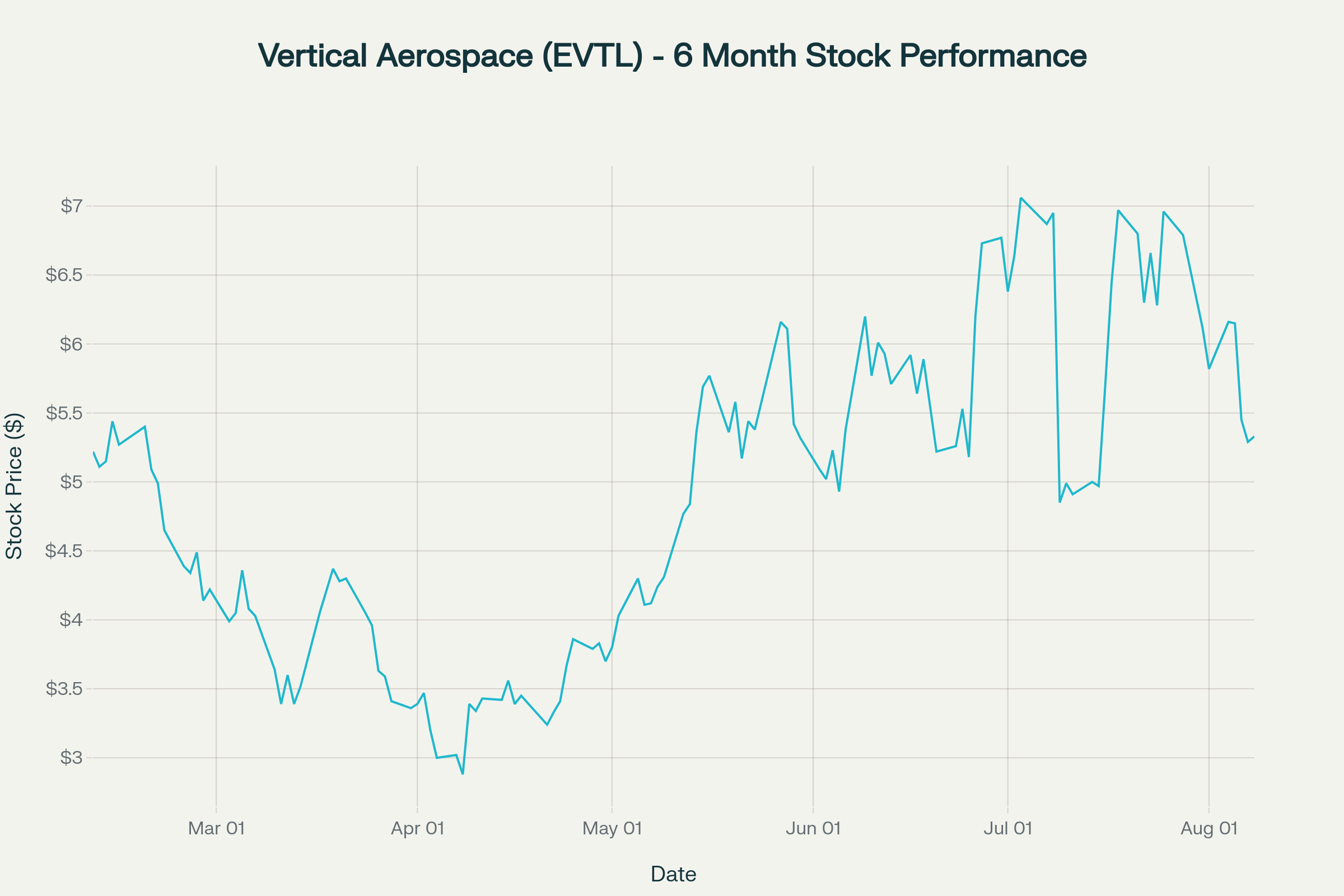

Vertical Aerospace (NASDAQ: EVTL) brings European innovation to the eVTOL space, trading around $4.90 per share with a strategic focus on regional connectivity rather than pure urban mobility. The UK-based company holds the distinction of securing conditional orders from major airlines including American Airlines (up to 250 aircraft), Virgin Atlantic, and Japan Airlines, totaling over 1,300 units with actual down payments demonstrating genuine commercial commitment. Vertical's VX4 aircraft targets the underserved 100-mile regional flight market, connecting city pairs at 150 mph with capacity for four passengers plus pilot, while leveraging established suppliers like Rolls-Royce for electric propulsion and Honeywell for flight controls. The company pursues EASA certification in Europe rather than FAA approval, potentially offering a faster regulatory pathway, though recent operational challenges required a reverse stock split and $90 million in fresh funding to extend runway through late 2025.

| Status | Details |

| Market Position | UK-based eVTOL pioneer with strong airline partnerships and a focus on European certification. |

| Share Performance | Underwent reverse split after falling below $1 due to supply chain delays; rebuilding from challenging 2024. |

| Airline Partnerships | Conditional orders from American Airlines, Virgin Atlantic, and Japan Airlines totaling over 1,300 units. |

| Technology Approach | VX4 aircraft designed for four passengers plus pilot, targeting 100-mile regional flights at 150 mph. |

| Strategic Suppliers | Collaborations with Rolls-Royce (electric propulsion) and Honeywell (flight controls). |

| Regulatory Strategy | Pursuing EASA certification in Europe, potentially by 2026, leveraging more accommodating EU regulations. |

| Financial Position | Raised $90 million in new funding for critical flight tests; cash runway extends into late 2025. |

| Market Validation | American Airlines made a down payment on 50 aircraft, signaling a real commercial commitment. |

Key Investment Highlights

Airline Partnerships — Vertical secured conditional orders and pre-orders from major airlines, including American Airlines (up to 250 aircraft), Virgin Atlantic, Japan Airlines, and Avolon aircraft leasing, totaling over 1,300 units and validating significant market demand.

Established Supplier Network — Strategic collaborations with industry leaders Rolls-Royce for electric propulsion systems and Honeywell for flight controls reduce technology development risks while leveraging proven aerospace expertise.

European Certification Strategy — Pursuing EASA certification rather than FAA approval, potentially offering a faster regulatory pathway with Europe’s more accommodating regulatory environment for eVTOL innovation.

Commercial Validation — American Airlines’ down payment on 50 aircraft represents a tangible financial commitment beyond letters of intent, demonstrating real commercial traction and airline confidence in the technology.

Regional Focus — VX4 aircraft targets 100-mile regional flights connecting city pairs, differentiating from pure urban mobility plays and addressing underserved short-haul aviation markets.

High-Risk Profile — Recent reverse split and supply chain challenges in 2024 highlight execution risks, while cash runway extending only to late 2025 creates urgency for successful certification and additional funding.

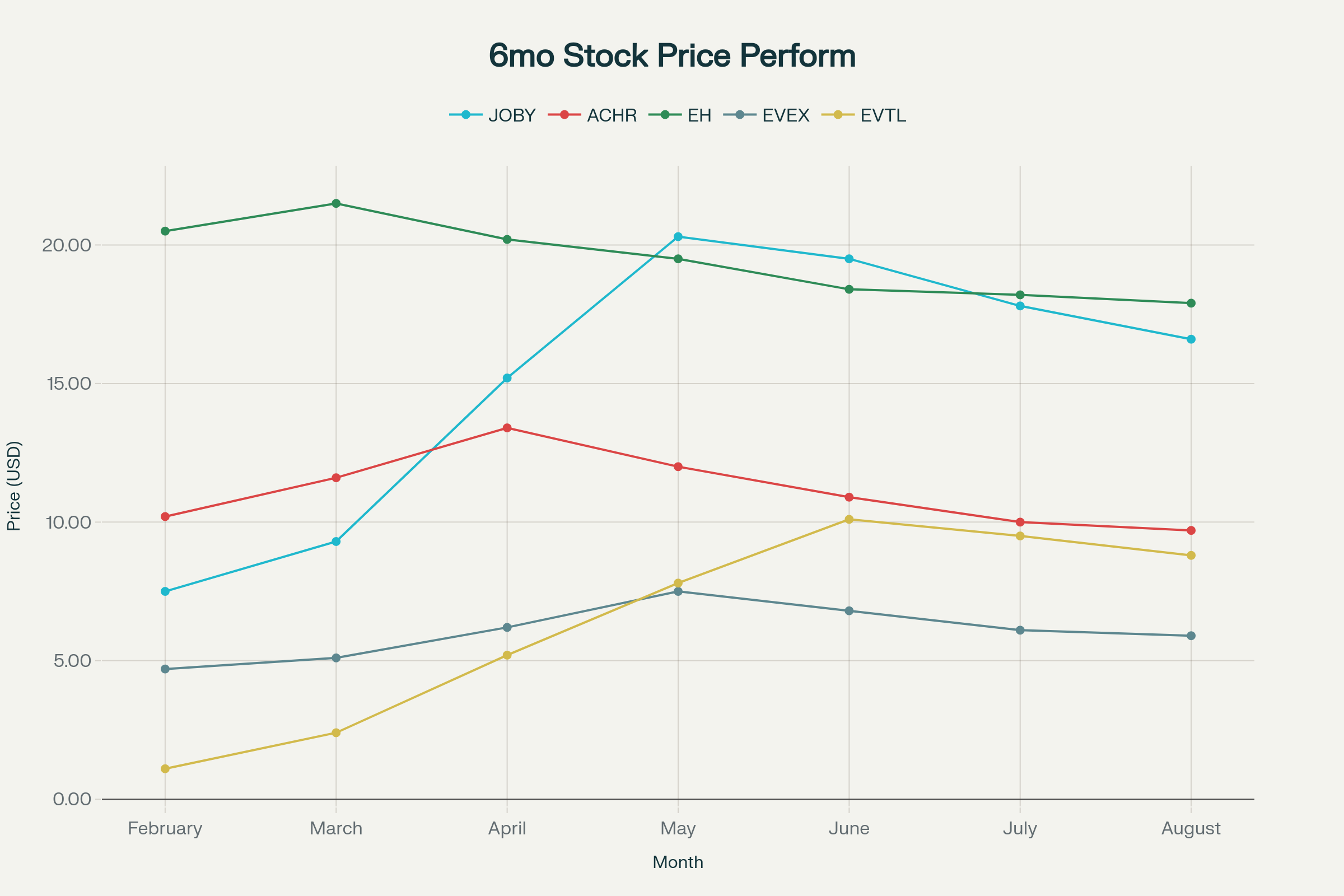

eVTOL PERFORMANCE DASHBOARD - 6 MONTH ANALYSIS

| Company | Ticker | Return % | Volatility % | MCap | Price Aug 2025 | Grade | Evaluation |

| Joby Aviation | JOBY | 121.33 | 70.51 | -18.23 | 16.6 | A+ | Superstar Performer |

| The clear sector leader with consistent upward momentum, recovering dramatically from March lows of $5.33 to peak at $20.39 before settling at $16.64. Demonstrates the strongest fundamental execution and market confidence. | |||||||

| Vertical Aerospace | EVTL | 2.1 | 107.8 | -47.1 | 5.33 | B- | High Risk Recovery |

| Modest gains mask extreme volatility, ranging from $2.88 lows to $7.06 highs before settling at $5.33. Recovery story with significant execution risks but potential for explosive moves. | |||||||

| Eve Holding | EVEX | 25.53 | 35.48 | -21.33 | 5.9 | B+ | Solid Winner |

| Solid second-place performance with steady gains from $4.73 to $5.86, peaking at $7.51 in May. Shows a consistent growth trajectory with manageable volatility compared to peers. | |||||||

| Archer Aviation | ACHR | -4.9 | 28.96 | -27.61 | 9.7 | C+ | Mixed Performer |

| Slight decline from $10.20 to $9.72 despite reaching $13.40 peak in April. Strong partnerships offset by execution challenges and competitive pressures. | |||||||

| EHang Holdings | EH | -12.68 | 9.79 | -16.74 | 17.9 | D | Underperformer |

| Consistent underperformance with a decline from $20.50 to $17.89, despite an early surge to $25.81. Chinese market dynamics and regulatory uncertainties weigh on performance. | |||||||

Key Chart Insights

Divergent Trajectories: The chart clearly shows three distinct performance patterns: Joby's consistent recovery, EHang’s steady decline, and the high volatility exhibited by Vertical Aerospace and Archer Aviation.

Sector Volatility: All companies demonstrate significant price swings, confirming the high-risk nature of eVTOL investments, with some stocks experiencing 50-100% intraperiod moves.

Recovery Patterns: Most companies (4 of 5) recovered from mid-period lows, suggesting sector resilience and growing investor confidence in commercialization timelines.

Market Leadership: Joby Aviation's consistent outperformance establishes it as the definitive sector leader, while the wide performance dispersion highlights the importance of company-specific execution in this emerging industry.

The comprehensive comparison reinforces that eVTOL investing requires careful stock selection, with clear winners and losers emerging as the industry approaches commercialization milestones.

Risk Factor Analysis

Pre-Revenue Status: Most eVTOL companies operate without meaningful revenue while incurring substantial cash burn during intensive certification phases, creating significant financial runway management challenges and dependency on external funding sources.

Regulatory Dependencies: Certification delays present existential risks that could push commercial timelines beyond 2026-2027 targets, potentially extending cash burn periods and creating competitive disadvantages for slower-moving companies.

Infrastructure Requirements: Widespread adoption depends critically on vertiport development and supporting infrastructure, creating adoption bottlenecks that could limit market penetration regardless of aircraft certification success.

Capital Intensity: Industry estimates suggest up to $40 billion may be required globally to achieve commercial scale, indicating massive capital requirements that could strain public and private funding markets.

Market Catalyst Framework

FAA Certification Progress: Recent guidance publication accelerates regulatory clarity and provides standardized certification pathways, reducing uncertainty and enabling more predictable development timelines across the sector.

Defense Spending: Growing military applications provide alternative revenue streams through defense contracts, offering near-term cash flow opportunities while commercial markets develop and mature.

Infrastructure Development: Over 1,500 vertiports worldwide are in various planning stages, demonstrating strong infrastructure momentum and a coordinated effort to develop an ecosystem that supports commercial viability. The eVTOL sector presents compelling yet asymmetric investment opportunities, accompanied by notable risks. Stocks in this sector are highly sensitive to market swings, often experiencing 30-50% price fluctuations, similar to those seen in early-stage biotech sectors. Success in this field depends on careful assessment of each company’s certification status, disciplined cash management, and strategic positioning within this rapidly changing market landscape.

Current Market Trends

Recent market data indicates strong positive momentum across the sector in 2025. The eVTOL Integration Pilot Program launched by the White House, along with updated FAA regulations, has created favorable conditions for industry growth. Increased defense spending, especially in unmanned systems, further boosts development, with the fiscal 2025 DoD budget allocating parts of $61.2 billion for air power through unmanned aircraft systems.

Investment Strategy Recommendations

The eVTOL sector represents an excellent investment opportunity for 2025, with industry leaders positioned to capitalize on first-mover advantages as the market approaches commercial viability. However, investors should approach these investments with appropriate risk tolerance given the sector’s early-stage nature and inherent volatility.

For investors seeking immediate commercialization potential, Archer’s aggressive timelines and global partnerships present compelling opportunities. Those focused on long-term stability might find Joby’s manufacturing discipline and Toyota alliance more appealing. EHang provides exposure to the Chinese market with operational experience, while Eve grants access to Latin American opportunities supported by established aerospace expertise.

The next 12-18 months will prove decisive in separating viable commercial operations from conceptual prototypes, making 2025 the pivotal year for eVTOL investment as the industry moves from certification to commercialization.