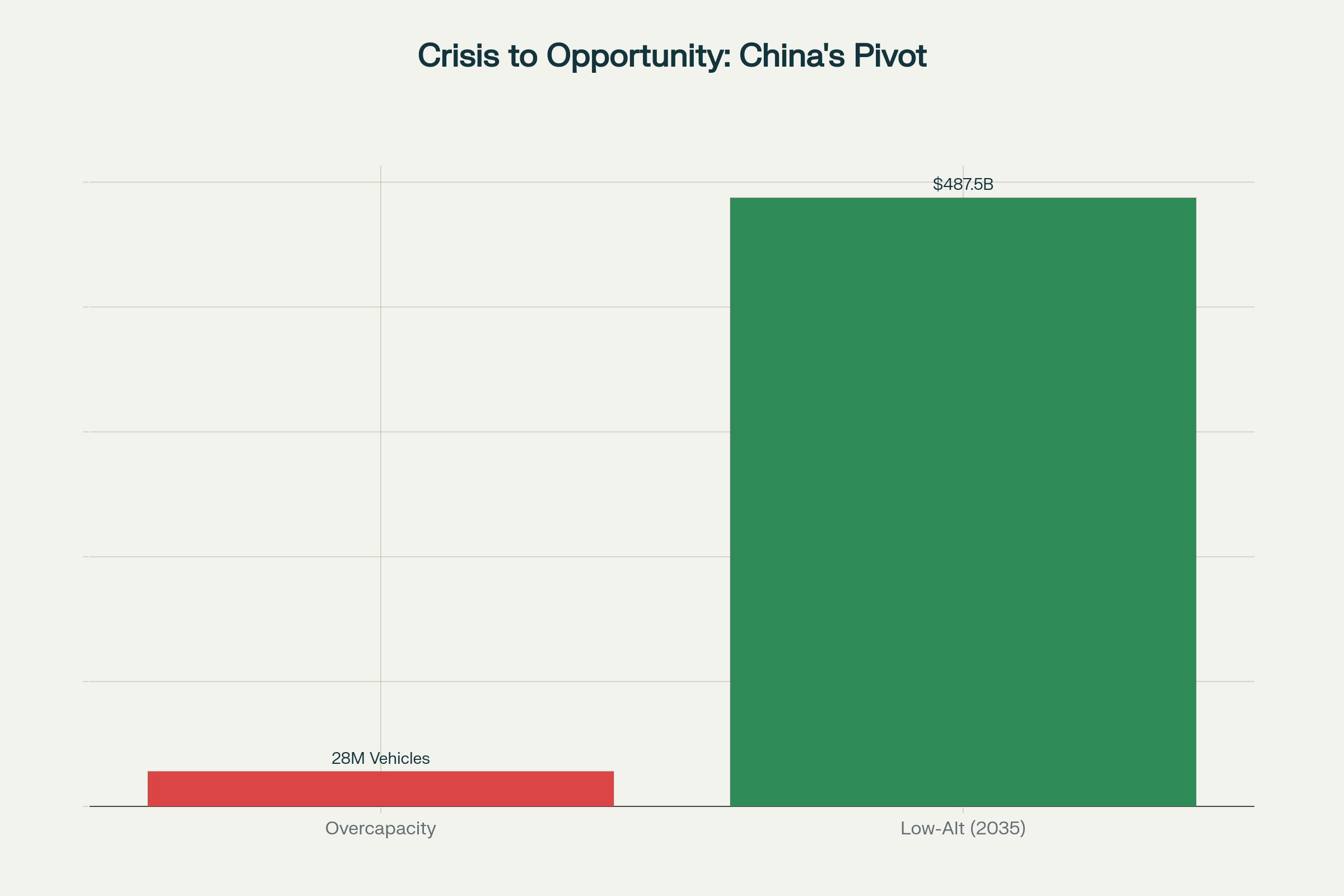

China's automotive factories produce 55.6 million vehicles annually. Chinese buyers purchase 27.6 million vehicles. These 28 million phantom vehicles will never roll off assembly lines. Beijing calls this neijuan, a term roughly translating to pointless self-destruction through competition. Average vehicle prices dropped 21% since 2021, falling from $31,000 to $24,000. More than 100 brands fight for shrinking customer pools. BYD's Stella Li expects 100 manufacturers to vanish. Aridge (formerly XPeng AeroHT) CEO He Xiaopeng puts the survivor count at five.

Brutal markets force companies to adapt. Factories that overproduced cars now build electric aircraft for urban skies. Most operations happen below 1,000 meters in dense cities, though regulations permit flights up to 3,000 meters. China's low-altitude economy, worth $211 billion by year-end 2025 and projected to hit $487.5 billion by 2035, offers manufacturers relief from ground-based market saturation. Assembly lines could produce 28 million more vehicles than buyers want. This overcapacity drives manufacturers into new markets—training an industry that now builds aircraft instead.

Supply Chains That Built Cars Now Build Aircraft

Overcapacity drove Chinese manufacturers to master capabilities that Western automakers spent decades acquiring. BYD manufactures 75% of its components in-house. Batteries, semiconductors, electric motors. Vertical integration gives BYD cost advantages and supply chain resilience that competitors cannot match quickly.

Competitive intensity compressed innovation cycles to what insiders call "China Speed." Development timelines that stretched years are now complete in months. Production ramps that traditional manufacturers approached cautiously became aggressive scaling exercises. Between 2018 and 2025, hundreds of Chinese EV companies ceased operations. Survivors emerged with capabilities in rapid product development, market-responsive design, and extreme cost optimization. eVTOL development demands precisely these skills.

Battery Makers Go Airborne

CATL and Gotion control 55.4% of the global automotive battery market. Both now develop aviation-grade batteries. eVTOLs demand performance specs dwarfing ground vehicle requirements. eVTOLs consume roughly 65 kWh per 100 kilometers, nearly four times automotive consumption at 12-18 kWh. They demand discharge rates of 2-3 °C versus standard automotive rates. They must operate over a temperature range of -40°C to 60°C.

This means eVTOL batteries work four times as hard as automotive batteries under more extreme conditions, driving the need for aviation-grade systems that traditional automotive suppliers cannot simply repurpose.

CATL invested hundreds of millions in AutoFlight, an eVTOL manufacturer, targeting energy densities of 500 Wh/kg. This enables flight ranges exceeding 200 kilometers and supports intercity mobility, which makes urban air mobility commercially viable. CATL chairman Robin Zeng projects an 8-ton civil electric aircraft with a 2,000-3,000-kilometer range by 2027-2028, powered by battery technology refined through competition in the automotive market.

The Physics Problems Nobody's Solved Yet

If you're planning eVTOL operations, battery density will be your first constraint. Battery energy density constrains every eVTOL design. Current lithium-ion batteries deliver roughly 250-300 Wh/kg. CATL's 500 Wh/kg target represents a doubling that may take years to achieve at scale. This constrains range, payload, and passenger capacity across all eVTOL designs.

Weather constrains operations. Wind speeds above 25 knots ground most eVTOL aircraft. Heavy precipitation limits visibility and affects electric propulsion systems. Temperature extremes below -20°C or above 45°C reduce battery performance by 20-30%, cutting effective range.

Noise levels challenge urban acceptance. While electric propulsion runs quieter than helicopters, distributed electric propulsion systems generate 65-75 decibels at 150 feet, exceeding acceptable urban noise thresholds in many jurisdictions. This forces higher operating altitudes that increase energy consumption.

Range limitations force infrastructure density requirements. Most eVTOLs operate effectively within 50-100 kilometers, requiring vertiport spacing of 30-40 kilometers for viable networks. This infrastructure density requires massive capital investment before revenue begins.

Charging and turnaround times limit utilization rates. Current fast-charging technology requires 30-45 minutes for an 80% charge, compared to 5 minutes for helicopter refueling. This reduces daily flight cycles and passenger throughput, directly impacting operating economics.

How Beijing Cleared the Regulatory Runway

Manufacturers moved fast. Regulators moved faster. China's National Development and Reform Commission established a dedicated Low-Altitude Economy Development Division in December 2024. The Civil Aviation Administration of China designated 25 cities as low-altitude airspace pilot zones, creating regulatory sandboxes comparable to those that accelerated automotive technology development. Nearly all Chinese provinces incorporated the low-altitude economy into local development plans.

Shenzhen pioneered the nation's first specialized regulation in February 2024, introducing a "layered and categorized" airspace management model. Sichuan Province committed $420 million to low-altitude industrial ecosystems. Shenzhen's "City of the Sky" initiative aims to deploy 1,200 vertiport platforms by 2026.

More than 750 vertiport projects span China's planned infrastructure development, representing approximately 50% of the 1,504 vertiports planned globally as of mid-2025. Planned global investment reaches $1.55 billion, though realistic projections expect approximately 980 vertiports to be completed by 2029. Construction costs range from $100,000 for modular suburban facilities to $20 million for metropolitan vertihubs with comprehensive passenger terminals and maintenance capabilities.

Infrastructure deployment borrows lessons from automotive electrification. Aridge maintains 2,348 charging stations and 677 retail stores, demonstrating the infrastructure density required for consumer adoption. The same geographic coverage and capital deployment patterns now apply to vertiport networks. Automotive companies leverage existing real estate, customer relationships, and operational expertise.

The Half-Trillion Dollar Question

China's low-altitude economy will reach 1.5 trillion yuan ($211 billion) by 2025 and 3.5 trillion yuan ($487.5 billion) by 2035. McKinsey research calculates the global industry will reach $500 billion by 2030. The global urban air mobility market was valued at $4.84 billion in 2024 and is projected to $54.03 billion by 2032, reflecting a 35.2% CAGR. China's manned eVTOL market alone is projected to $18 billion by 2040, with annual sales exceeding 7,000 units.

.png)

Urban air mobility infrastructure adds substantial economic activity beyond aircraft sales. Analysts project vertiport construction will grow from $0.4 billion in 2023 to $10.7 billion by 2030. Battery technology for eVTOLs will reach 112.6 billion yuan ($15.4 billion) in China by 2030. Companies across vertical mobility must invest $20-25 billion to break through key barriers by 2035. Hardware manufacturers will shoulder 50-60% of funding.

A half-trillion-dollar market attracts competitors. Speed determines who captures it first.

Automakers Beat Aerospace Giants at Their Own Game

Aridge beat projections. Trial production started in November 2025 at the world's first intelligent flying car factory. The facility targets the delivery of 10,000 detachable aircraft modules annually, beginning in 2026. Aridge's Land Aircraft Carrier integrates a ground vehicle accommodating four to five passengers with an electric flying module capable of vertical takeoff and a 30-kilometer range.

GAC Group launched the GOVY AirCab in June 2025, opening pre-orders at 1.68 million yuan ($233,000). Geely's Aerofugia subsidiary entered manned flight testing. These timelines mirror automotive development cycles, not the decade-long schedules aerospace considers normal.

| Company | Aircraft Model | Key Specifications | Status | Price |

| EHang | EH216-S | 30 km range, 2 passengers, autonomous | CAAC certified Oct 2023, commercial operations | Not disclosed |

| EHang | VT35 | 200 km range, tandem wings, 8 propellers | Announced Oct 2025 | RMB 6.5M (~$913K) |

| Aridge | Land Aircraft Carrier | 30 km range, 4-5 passengers, modular | Trial production Nov 2025, deliveries 2026 | Not disclosed |

| GAC Group | GOVY AirCab | Flying taxi configuration | Pre-orders open June 2025 | RMB 1.68M ($233K) |

| Geely | Aerofugia | Manned configuration | Flight testing phase | Not disclosed |

| AutoFlight | CarryAll | 2-ton cargo, logistics focus | CAAC certified 2024 | Not disclosed |

EHang secured type certification for its EH216-S from the Civil Aviation Administration of China in October 2023, becoming the world's first certified eVTOL aircraft. EHang ran 40,000 test flights over 31 months. By April 2025, EHang secured Air Operator Certificates enabling commercial passenger operations in Guangzhou and Hefei. EHang became the first eVTOL company globally to complete the full regulatory certification suite.

In October 2025, EHang introduced the VT35, featuring tandem wings, eight lifting propellers, and a pusher propeller configuration enabling a 200-kilometer range at nearly double the EH216-S's speed. The Chinese domestic standard version lists at RMB 6.5 million (approximately $913,000). The product iteration cycle mirrors automotive industry cadence rather than aerospace development patterns.

AutoFlight's CarryAll, a two-ton cargo eVTOL, received its type certificate in 2024, further demonstrating CAAC's certification velocity.

Certify Fast or Certify Safe? China Does Both

EHang achieved CAAC type certification in 31 months using 40,000 test flights. Compare this to FAA and EASA timelines stretching 5-7 years or longer. If you're tracking Western certification progress, Joby Aviation leads the pack, having begun power-on testing of its first conforming aircraft for Type Inspection Authorization in November 2025. The company entered the final stage of FAA Type Certification, with flight testing by Joby pilots expected later in 2025, ahead of FAA pilots taking controls in 2026.

Industry analysts project the first U.S. eVTOL certification unlikely before 2027, with some estimates ranging to 2028-2030.

CAAC's faster certification reflects a different regulatory philosophy. China certifies simpler aircraft first, allowing operational experience to mature the ecosystem before tackling complex mobility applications. The EH216-S operates autonomously with no pilot, reducing complexity compared to piloted Western designs. CAAC uses this approach to establish operational data that informs subsequent certifications.

.png)

FAA and EASA pursue comprehensive certification that addresses all operational scenarios before approval. The FAA published Advisory Circular 21.17-4 in July 2025, providing comprehensive guidance for certifying powered-lift aircraft. EASA released its Fifth Publication of Proposed Means of Compliance in July 2025, further aligning with FAA standards.

Both approaches prioritize safety. China's method generates operational data faster. Western methods ensure comprehensive safety validation before revenue operations begin. Neither approach has produced safety incidents in commercial operations, as Western eVTOLs have not yet achieved certification for passenger service.

CAAC's flexible framework for managing low-altitude airspace, introduced in 2023, reduces bureaucratic hurdles that slow progress in other countries, including the United States. This creates a pragmatic path that positions China to establish global leadership in urban air mobility operations.

The $200 Ticket Economics

Here's what you need to know about flying taxi economics: Operating costs per flight hour drive economic viability. Industry analysts estimate eVTOL operating costs at $250 to $400 per hour, compared with helicopter operating expenses of $300 to $600 per hour. This includes energy, maintenance, insurance, pilot costs, and infrastructure fees.

A typical city-to-airport mission of 30 minutes, including takeoff, flight, and landing, costs just over $200 in direct operating expenses.

Ticket pricing must cover these costs while competing with ground transportation. Helicopter rides from Manhattan to JFK airport cost $195-225 per passenger. eVTOL operators target similar pricing, requiring 4-5 passengers per flight to achieve profitability and break even on current costs.

Breakeven passenger volumes depend on utilization rates. An eVTOL aircraft flying 4-5 hours daily with 70% load factors generates roughly 12-15 passenger trips. At $150-200 per passenger, daily revenue reaches $1,800-3,000. With operating costs of $250-400 per hour, daily operating costs total $1,000-2,000 for 4-5 flight hours, leaving slim margins before capital cost recovery.

You might pay $150-200 for a 15-minute eVTOL flight versus $40-80 for a 45-minute taxi ride. Ground transportation provides a cost comparison. Taxi rides from downtown to the airport cost $40-80 in major cities. Ride-sharing services cost $30-60. Public transit costs $5-15. eVTOL pricing at $150-200 per passenger targets business travelers and time-sensitive customers willing to pay premium prices for 15-20 minute flights versus 45-90 minute ground journeys.

Current economics require scale. Early operators like EHang benefit from government support, infrastructure subsidies, and demonstration project funding. EHang achieved a milestone in Q2 2025, reporting adjusted net income of RMB 9.4 million (approximately $1.3 million) on revenues of RMB 147.2 million ($20.5 million), a 44% year-over-year revenue increase and 464% quarter-over-quarter increase. This makes EHang the first eVTOL manufacturer globally to achieve adjusted profitability, though sustainability depends on scaling production and expanding operations beyond government-supported demonstration projects.

Western operators like Joby and Archer project break-even operations 3-5 years after achieving certification, assuming successful manufacturing scale-up and market adoption.

Ten Months From Concept to Certified Aircraft

Vertical integration provides cost advantages and supply chain security that Western aerospace companies, accustomed to extensive supplier networks, cannot replicate quickly. BYD operates over 100 internal factories that produce components ranging from batteries to semiconductors, enabling production cost optimization that traditional aerospace manufacturers find impossible.

Traditional aircraft development cycles span up to 10 years, while eVTOL projects compress to two years or even 10 months. This speed demands agile technology development and tight supply chain management. Automotive manufacturers already possess these skills through rapid iteration. Industry observers note that eVTOL development increasingly informs next-generation aircraft design, inverting the traditional technology flow from aerospace to automotive.

Capital efficiency gives Chinese manufacturers their biggest advantage. Traditional aerospace certification and development costs run into billions over decade-long timelines. Chinese manufacturers use automotive practices to slash timelines and costs. Aridge's flying car facility was designed to achieve 10,000 units per year from inception. Western eVTOL manufacturers discuss initial production in dozens or hundreds of units. The difference reflects automotive industry assumptions about manufacturing scale from day one.

Western Aerospace Watches China Fly While Awaiting Approval

Traditional automakers lost ground in China's electric vehicle market. Now they confront the same manufacturers in the urban air mobility market. Chinese players start with operational experience, certified platforms, and manufacturing ecosystems already built. EHang operates revenue-generating flights today while Western eVTOL companies pursue certification.

Joby Aviation leads Western certification efforts, entering the final stage of FAA Type Certification in November 2025. The company began power-on testing of its first conforming aircraft for Type Inspection Authorization, conducting thousands of hardware and software integration tests in preparation for "for credit" flight testing with FAA test pilots. Joby expects flight testing by company pilots to begin later in 2025, ahead of FAA pilots taking controls in 2026.

Archer Aviation secured three of four necessary FAA certifications: Part 135 Air Carrier & Operator Certificate in June 2024, Part 145 certification in February 2024, and Part 141 pilot training academy certification in February 2025. The company pursues Part 142 certification while continuing aircraft testing. Archer trails Joby by roughly one year in the certification timeline.

Western eVTOL manufacturers face mounting financial pressures. Lilium, once among Europe's most prominent air taxi startups, ceased operations in December 2024 after filing for insolvency. Archer acquired Lilium's patent portfolio for €18 million in October 2025. Volocopter similarly filed for insolvency in December 2024, though it continues operations under provisional insolvency proceedings.

Western and Chinese manufacturers pursue opposing manufacturing strategies. Western companies maintain traditional aerospace supply chain models, partnering with established aerospace suppliers for major components. Chinese manufacturers pursue vertical integration, controlling more of the production chain and compressing development cycles.

| Factor | Chinese Manufacturers | Western Manufacturers |

| Certification Status | EHang: Certified & operational (2023); AutoFlight: Certified (2024) | Joby: In final stage (target 2026-2027); Archer: 3 of 4 certs complete |

| Manufacturing Strategy | Vertical integration (75%+ in-house) | Traditional supply chain partnerships |

| Development Timeline | 10 months to 2 years | 5-7 years typical |

| Market Approach | Mass-market, autonomous operations | Premium routes, piloted operations |

| Current Operations | Revenue-generating flights (EHang) | Pre-certification testing |

| Financial Status | EHang profitable Q2 2025 ($1.3M) | Joby: $2B raised, pre-revenue; Archer: $1.1B raised, pre-revenue |

| Government Support | Multi-billion coordinated funding | Fragmented federal programs |

Market approaches diverge. Western operators target premium urban routes in high-income markets, emphasizing piloted operations and incremental deployment. Chinese manufacturers pursue mass-market strategies with autonomous operations and aggressive infrastructure buildout.

Technology differences include aircraft configurations, battery technology choices, and autonomy levels. Joby and Archer develop piloted aircraft with single main rotor configurations. EHang and Aridge pursue fully autonomous multi-rotor designs. Battery partnerships differ: Western companies work with multiple suppliers, while Chinese manufacturers leverage CATL and Gotion's automotive-to-aviation technology transfer.

Financial positions show stark contrasts. Joby raised over $2 billion and maintains public company status, providing capital access. Archer raised approximately $1.1 billion and also trades publicly. Chinese manufacturers benefit from government funding, provincial investment programs, and integration with profitable automotive operations, which provide internal capital.

Western aerospace suppliers recognize these dynamics. Companies including FACC, GKN Aerospace, Diehl Aviation, and ASE now partner extensively with eVTOL manufacturers, acknowledging that refusing to participate cedes technological leadership. Chinese vertical integration strategies threaten supplier relationships, forcing these aerospace suppliers to choose between partnership and displacement.

Government funding patterns compound Western challenges. China's national, provincial, and municipal governments coordinate multi-billion-dollar commitments to low-altitude economy development. The U.K. government's £1.2 million ($1.5 million) grant to Urban-Air Port, covering 20% of Air-One vertiport development costs, represents a dramatically different scale of public investment. U.S. federal programs remain fragmented across agencies, lacking a cohesive industrial policy comparable to China's integrated approach.

President Trump's executive order in June 2025 established an eVTOL pilot program to encourage safe advancement within the U.S., with Transportation Secretary Sean Duffy stating the goal to "solidify America's position as a global leader in transportation innovation." The program aims to establish at least five projects through public-private collaborations, allowing supervised trials beginning in 2026.

While Western and Chinese manufacturers compete for developed market share, emerging markets present a different competitive landscape entirely.

Why Emerging Markets Skip Highways for Sky Infrastructure

China exported EVs to more than 200 countries in the first three quarters of 2025, generating nearly $48 billion in revenue. Europe accounts for roughly 50% of exports, but the fastest growth is in emerging markets. Africa demonstrated 184% year-over-year growth, the Middle East 71%, and Latin America 17%.

Emerging markets offer structural advantages for both ground and aerial mobility because they lack entrenched automotive competitors and can leapfrog directly to electric and aerial mobility without defending legacy infrastructure investments.

Brazil imported approximately 138,000 EVs and hybrids from China in 2024, up nearly 100,000 from 2023. Chinese brands account for over 80% of electric car sales. Great Wall Motor opened a factory in São Paulo, producing 50,000 vehicles annually. BYD reported nearly 16,000 vehicles sold through August 2025, up 20% year over year.

Consider what happens when you lack highway infrastructure. Vertiport networks cost $100,000 to $275,000 for modular designs versus millions per kilometer for roads. Emerging markets present structural advantages for both ground and aerial mobility. Places lacking robust road networks and aviation infrastructure can leapfrog development stages. Basic vertiports cost far less than highway infrastructure.

Dubai collaborates with Skyports on vertiport facilities at Dubai International Airport. India registered 5.675 million electric vehicles through February 2025. The Middle East invested heavily in UAM infrastructure, with Saudi Arabia and the UAE actively funding vertiport development. The Asia Pacific region is emerging as the fastest-growing urban air mobility market, projected to grow at a 35% CAGR by 2032.

Crisis as Dress Rehearsal

The automotive overcapacity crisis and low-altitude economy opportunity represent two phases of a single industrial shift. Overcapacity drove Chinese manufacturers to develop capabilities in vertical integration, rapid iteration, cost optimization, and supply chain resilience under extreme competitive pressure. These capabilities transfer directly to eVTOL development, where similar requirements for weight reduction, power density, thermal management, and manufacturing scale determine competitive success.

The low-altitude economy launches with advantages that automotive electrification never had. Infrastructure requirements start lower, with vertiports costing orders of magnitude less than highway networks or airport construction. Regulatory frameworks evolve faster as governments recognize first-mover advantages in establishing standards that could define global norms. Battery technology refined through hundreds of millions of automotive applications reduces development risk for aviation-grade systems.

The low-altitude economy offers Chinese manufacturers a strategic opportunity to reposition into higher-growth industries beyond ground-based market saturation. A market projected to reach $500 billion globally by 2030 and $487.5 billion domestically by 2035 provides growth trajectories that justify repurposing manufacturing capacity. Emerging markets lacking both developed road networks and incumbent aerospace industries present greenfield opportunities where Chinese cost advantages and speed to market prove decisive.

The question facing the traditional automotive and aerospace industries is not whether China's low-altitude economy strategy succeeds, but how rapidly it scales and which markets it captures first. With more than 100 eVTOL prototypes constructed, over 750 planned vertiports, regulatory frameworks enabling commercial operations, and automotive supply chains pivoting to aerial applications, Chinese manufacturers possess the supply chain, regulatory framework, and operational experience to dominate vertical mobility.

For Western competitors, the automotive overcapacity crisis in China represents preparation for capturing entirely new industries. Overcapacity, when coupled with technological capability and government coordination, shifts liability into a strategic advantage. The same manufacturers struggling to survive China's ground vehicle price war establish positions in urban air mobility before Western aerospace companies complete initial certifications.

What appears as an overcapacity crisis from a ground-based perspective becomes strategic preparation when viewed from altitude. The 28 million phantom vehicles that will never leave Chinese factories trained an industry to build aircraft instead.

Frequently Asked Questions

1. What does neijuan mean in China's automotive context? Neijuan translates roughly to pointless self-destruction through extreme competition. In China's automotive industry, the term describes how over 100 brands compete for insufficient market share, forcing prices down 21% since 2021 and driving average vehicle prices from $31,000 to $24,000. Industry leaders predict 100 manufacturers must exit, leaving only five survivors.

2. How many Chinese eVTOL companies currently hold type certifications? Two Chinese eVTOL aircraft hold CAAC type certifications as of November 2025. EHang's EH216-S received certification in October 2023, becoming the world's first eVTOL to be certified. AutoFlight's CarryAll cargo eVTOL received accreditation in 2024. Both companies achieved certification in 24-31 months, significantly faster than Western timelines.

3. When will Aridge's flying cars be delivered to customers? Aridge commenced trial production in November 2025 at its intelligent flying car factory. Deliveries begin in 2026, with the facility targeting 10,000 detachable aircraft modules annually. The Land Aircraft Carrier integrates a ground vehicle with an electric flying module capable of a 30-kilometer range. Pre-order pricing has not been publicly disclosed.

4. Which Chinese cities lead vertiport development? Shenzhen leads with plans for 1,200 vertiport platforms by 2026 under its "City of the Sky" initiative. Guangzhou and Hefei host EHang's first commercial Air Operator Certificate operations. Sichuan Province committed $420 million to low-altitude industrial ecosystems. The CAAC designated 25 cities as low-altitude airspace pilot zones for regulatory development.

5. How does CAAC certification compare to FAA approval? CAAC certification for EHang's EH216-S took 31 months and involved 40,000 test flights. FAA certification timelines stretch 5-7 years or longer, with leading companies like Joby entering the final stage of Type Inspection Authorization in November 2025 and targeting certification in 2026-2027. CAAC certifies simpler autonomous aircraft first, while the FAA pursues comprehensive validation before approval. Neither approach has produced safety incidents in commercial operations.

6. What altitude does China's low-altitude economy operate at? China defines the low-altitude economy as commercial activities in airspace below 3,000 meters. Dense urban operations generally occur below 1,000 meters. This encompasses eVTOL passenger mobility, urban air mobility, cargo delivery, and emergency services. The definition differs from initial reports suggesting a 1,000-meter ceiling.

7. How much do eVTOL flights cost compared to ground transportation? eVTOL operators target $150-200 per passenger for city-to-airport routes, competing with helicopter services at $195-225. Ground alternatives cost $40-80 for taxis, $30-60 for ride-sharing, and $5-15 for public transit. eVTOL pricing targets business travelers willing to pay a premium for 15-20 minute flights rather than 45-90 minute ground journeys. Operating costs run $250-$400 per flight hour.

8. Which battery companies supply eVTOL manufacturers? CATL and Gotion, which together control 55.4% of the global automotive battery market, both develop aviation-grade batteries for eVTOLs. CATL invested hundreds of millions in AutoFlight, targeting 500 Wh/kg energy density to enable 200+ kilometer ranges. CATL chairman Robin Zeng projects an 8-ton civil electric aircraft with a 2,000-3,000-kilometer range by 2027-2028. Western eVTOL companies work with multiple battery suppliers rather than exclusive partnerships.