China’s low-altitude economy is experiencing a moment, as homegrown manufacturers like ZeroG Aircraft Industry challenge established global players in the electric vertical takeoff and landing (eVTOL) market. With Beijing designating six pilot cities for eVTOL operations and the industry valued at nearly RMB 1 trillion in 2024, ZeroG’s three-aircraft strategy positions the Hefei-based startup at the forefront of China’s national low-altitude economy initiative.

ZeroG’s deliberate three-tier development model sets it apart in China’s increasingly competitive eVTOL landscape. The company’s RX1E-A “Ruixiang” electric fixed-wing aircraft achieved mass production in 2024, making it one of the first commercially available electric aircraft in China. This lightweight trainer aircraft operates with costs roughly one-fifth of conventional fuel-powered aircraft, targeting the pilot training market with over 1,000 intent orders and 60 confirmed purchases.

The second aircraft, the ZG-ONE “Quefei” multi-rotor eVTOL, targets the tourism and short-range transport market with type certification expected in early 2026.

The company’s most ambitious project, the six-seat ZG-T6 tiltrotor, aims for urban air taxi operations around 2028.

Competitive Landscape: Domestic and Global Players

ZeroG faces competition from both domestic and international players. EHang leads the Chinese market with over 2,800 orders for its EH216 autonomous eVTOL, having achieved type certification from China’s Civil Aviation Administration. AutoFlight follows with 700+ pre-orders for its Prosperity I lift-and-cruise design, while XPeng AeroHT plans 10,000 units annually of its modular “Land Aircraft Carrier” flying car by 2026.

International competitors include Joby Aviation and Archer Aviation, both publicly traded US companies with over $1 billion in funding each. Joby leads with nearly $1 billion in cash reserves and production capacity for dozens of aircraft annually, while Archer benefits from partnerships with Stellantis for high-volume manufacturing.

China’s Policy Framework Speeds Up Development

The Chinese government’s commitment to the low-altitude economy provides ZeroG with structural advantages. Beijing designated six cities, Hefei, Hangzhou, Shenzhen, Suzhou, Chengdu, and Chongqing, as pilot zones for eVTOL testing, with local governments managing airspace below 600 meters. This represents a major departure from China’s historically restrictive airspace management.

The regulatory environment is evolving rapidly. China’s Civil Aviation Administration released new airspace classification methods designating two unregulated low-altitude zones for general aviation, including drones and electric aircraft. The National People’s Congress is revising the Civil Aviation Law to explicitly support low-altitude economic development, providing a legal foundation for the industry.

Market Size and Growth Projections

China’s low-altitude economy reached RMB 980 billion ($137.8 billion) in 2024 and is projected to hit RMB 3 trillion by 2030. The global eVTOL market, valued at $420 million in 2024, is expected to reach $30.8 billion by 2030, with China representing approximately 25% of the total market.

Industry forecasts suggest China could have 100,000 eVTOLs serving families and travelers by 2030, with aircraft prices dropping from current RMB 10 million levels to RMB 2-3 million for four- to five-seat models.

Strategic Advantages and Challenges

ZeroG benefits from China’s integrated approach to low-altitude economy development. The company operates from Hefei, a designated pilot city with strong government support, receiving over RMB 200 million in state-backed funding across two rounds in 2024. Hefei’s strengths in electric vehicles, advanced manufacturing, and materials science create opportunities for electric aircraft development.

However, significant challenges remain. China still lags in critical components like engines and flight control chips, which are essential for global competitiveness against companies like Joby and Archer. Infrastructure development, including vertiports and charging stations, requires substantial investment before large-scale commercial operations become viable.

Infrastructure Development for Low-Altitude Operations

As ZeroG expands its role in China’s low-altitude economy, it’s essential to consider the infrastructure that will either support or hinder its plans. Vertiport development and charging networks are necessary for scaling eVTOL operations. Shenzhen leads the way, targeting 700 takeoff and landing points by 2027 to support urban air mobility and short-range transport. Nationally, China aims to establish hundreds of vertiports across pilot cities like Hefei, Hangzhou, and Chengdu in the same timeframe. These facilities, paired with charging stations for electric aircraft like ZeroG’s ZG-ONE and future ZG-T6, are critical to enable regular commercial services. Without this backbone, even certified aircraft risk sitting idle, so ZeroG’s timeline for expansion hinges on how fast this network comes online.

ZeroG Aircraft Specifications and Competitive Analysis

ZeroG’s three-aircraft strategy showcases distinct capabilities across different market applications, from proven electric fixed-wing aircraft to cutting-edge eVTOL technology.

RX1E-A Ruixiang (Electric Fixed-Wing Aircraft)

RX1E A Ruixiang Electric Fixed Wing Aircraft

RX1E A Ruixiang Electric Fixed Wing Aircraft

The RX1E-A represents ZeroG’s commercially available electric trainer aircraft, building on the original RX1E design with significantly improved performance. This lightweight electric aircraft features:

| Specification Category | Parameter | Value |

| Weight | Maximum takeoff weight | 630 kg (1,389 lb) |

| Empty weight | 470 kg (1,036 lb) | |

| Payload capacity | 160 kg (353 lb) | |

| Performance | Range | 240 km (149 miles) |

| Endurance | 2.5 hours | |

| Cruise speed | 118 km/h (73 mph) | |

| Maximum speed | 180 km/h (112 mph) | |

| Service ceiling | 3,000 meters (9,843 ft) | |

| Propulsion | Power system | 50 kW electric motor |

| Battery capacity | 50 kWh lithium battery pack | |

| Charging time | 2.7 hours (full charge) | |

| Operating cost | $2.64 per hour (electricity) | |

| Design | Configuration | Two-seat side-by-side with T-tail |

| Construction | Carbon fiber composite fuselage | |

| Seating capacity | 2 seats | |

| Certification | Status | CAAC certified, mass production (2024) |

| Market position | First commercially available electric aircraft in China |

The RX1E-A represents ZeroG’s entry into the electric training aircraft market, targeting flight schools and pilot training operations with significantly lower operating costs compared to conventional fuel-powered trainers. Its 240 km range and 2.5-hour endurance make it suitable for standard training missions, while the $2.64 hourly electricity cost provides substantial savings over traditional aircraft operations.

The RX1E-A achieved mass production status in 2024, making it one of the first commercially available electric aircraft in China with full CAAC certification.

ZG-ONE “Quefei” (Multi-rotor eVTOL)

ZG ONE Quefei Multi rotor eVTOL

ZG ONE Quefei Multi rotor eVTOL

ZeroG’s first eVTOL aircraft targets the tourism and short-range transport market with autonomous flight capabilities:

| Specification Category | Parameter | Value |

| Weight | Maximum takeoff weight | 650 kg (1,433 lb) |

| Capacity | Passenger capacity | 2 passengers |

| Performance | Range | 30 km (18 miles) |

| Flight time | 25 minutes | |

| Cruise speed | 75 km/h (46 mph) | |

| Maximum speed | 130 km/h (81 mph) | |

| Configuration | Aircraft type | Six-rotor multicopter |

| Fuselage design | Spherical fuselage | |

| Dimensions | Height | 2.6 m |

| Diameter | 5.9 m | |

| Propulsion | Motor configuration | Six electric motors |

| Propulsion type | Distributed electric propulsion | |

| Cabin Design | Configuration | Globe-type design |

| Windows | 270-degree panoramic windows | |

| Noise | Sound level | 65 dBA at 300 meters |

| Safety Systems | Flight control | Triple-redundant flight control |

| Emergency systems | Whole-aircraft ballistic parachute | |

| Certification | Target timeline | Early 2026 (CAAC certification) |

| Market Focus | Primary applications | Tourism and short-range transport |

The ZG-ONE completed over 100 test flights by September 2023, with the first production aircraft assembled in October 2023. Type certification is expected in early 2026.

ZeroG ZG-T6 Six-Seat Tiltrotor eVTOL Aircraft Planned Specifications

ZeroG ZG-T6 Six-Seat Tiltrotor eVTOL Aircraft Planned Specifications

ZeroG ZG-T6 Six-Seat Tiltrotor eVTOL Aircraft Planned Specifications

| Specification Category | Parameter | Value |

| Weight | Maximum takeoff weight | 2,500 kg (5,512 lb) |

| Capacity | Passenger capacity | 6 passengers |

| Performance | Range | 300 km (186 miles) |

| Flight time | 90 minutes | |

| Configuration | Aircraft type | Six tilt-propellers for vertical takeoff and forward flight |

| Market Focus | Target market | Air taxi and intercity travel |

| Timeline | Expected entry | Around 2028 |

| Development Status | Current phase | Early development stage |

The ZG-T6 represents ZeroG’s most ambitious aircraft project, targeting the high-capacity urban air mobility market with its six-passenger configuration. The 300 km range and 90-minute flight time position it for intercity connections rather than short urban hops. The tiltrotor design aims to combine the vertical takeoff capabilities needed for urban operations with the forward flight efficiency required for longer ranges.

At 2,500 kg maximum takeoff weight, the ZG-T6 competes directly with international players like Joby S4 (2,404 kg) and approaches the weight class of Archer Midnight (3,175 kg). The 2028 entry timeline places ZeroG several years behind established competitors but allows time for technology maturation and infrastructure development in China’s pilot cities.

Competitive Comparison Analysis

Comprehensive comparison of ZeroG aircraft specifications against major eVTOL competitors

Comprehensive comparison of ZeroG aircraft specifications against major eVTOL competitors

The comprehensive specifications comparison reveals ZeroG’s strategic positioning across different market segments:

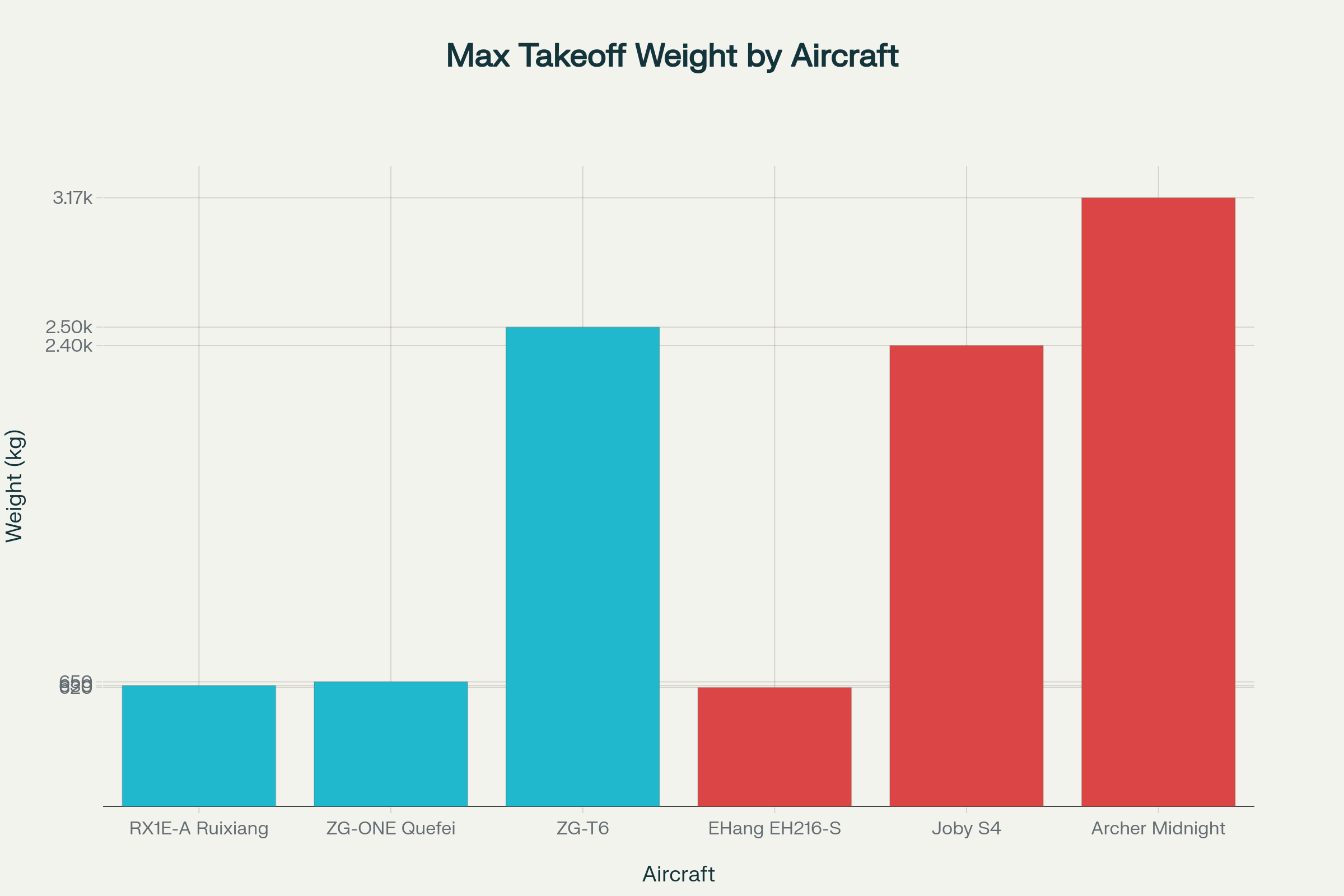

Weight and Scale Comparison

ZeroG’s aircraft span from lightweight trainers to heavy air taxis. The RX1E-A (630 kg) and ZG-ONE (650 kg) target similar weight classes to the EHang EH216-S (620 kg), while the planned ZG-T6 (2,500 kg) competes with larger aircraft like the Joby S4 (2,404 kg) and Archer Midnight (3,175 kg).

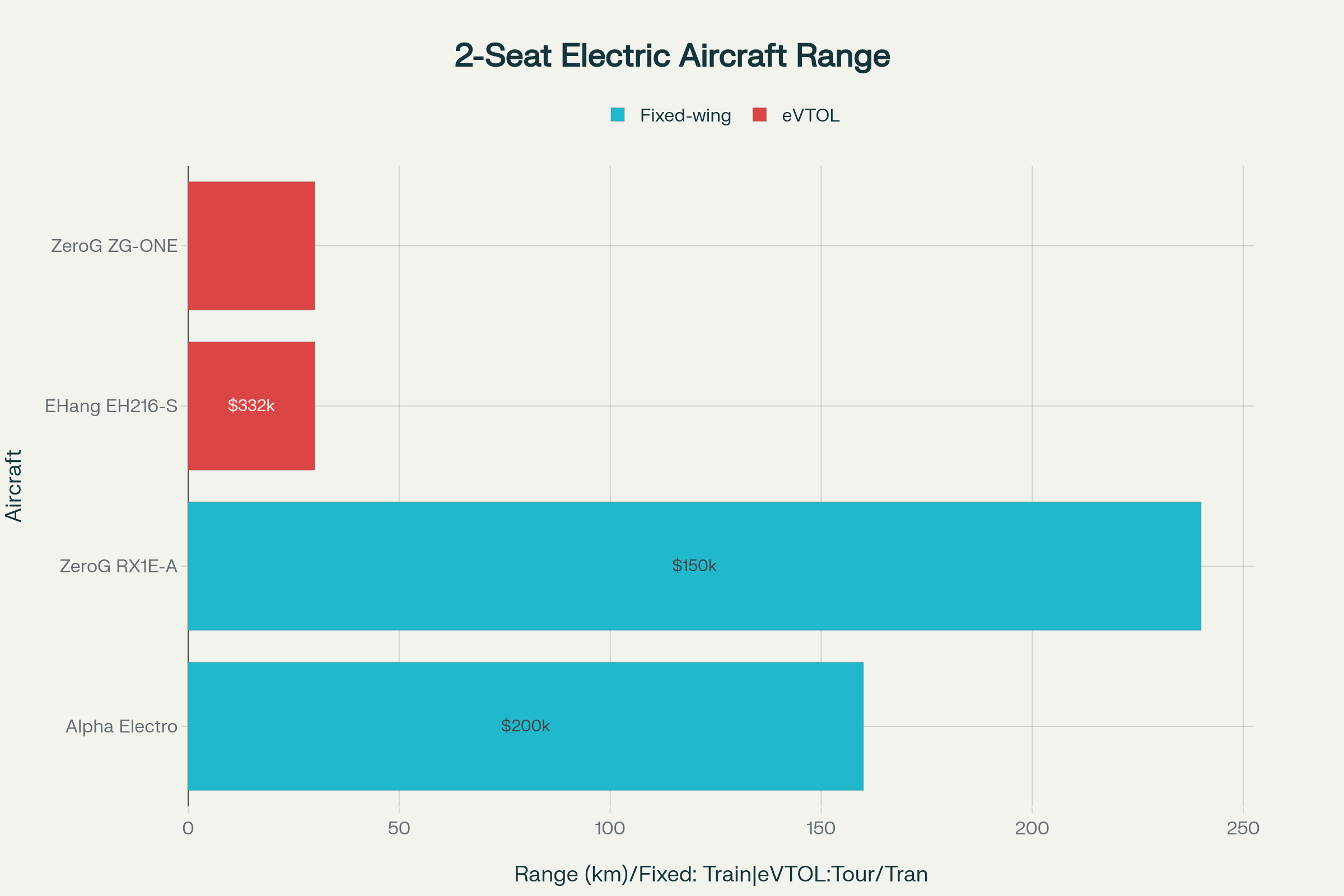

Range and Performance Analysis

Range comparison of two-seat electric aircraft: ZeroG’s conventional and eVTOL aircraft versus established competitors in training and tourism markets

Range comparison of two-seat electric aircraft: ZeroG’s conventional and eVTOL aircraft versus established competitors in training and tourism markets

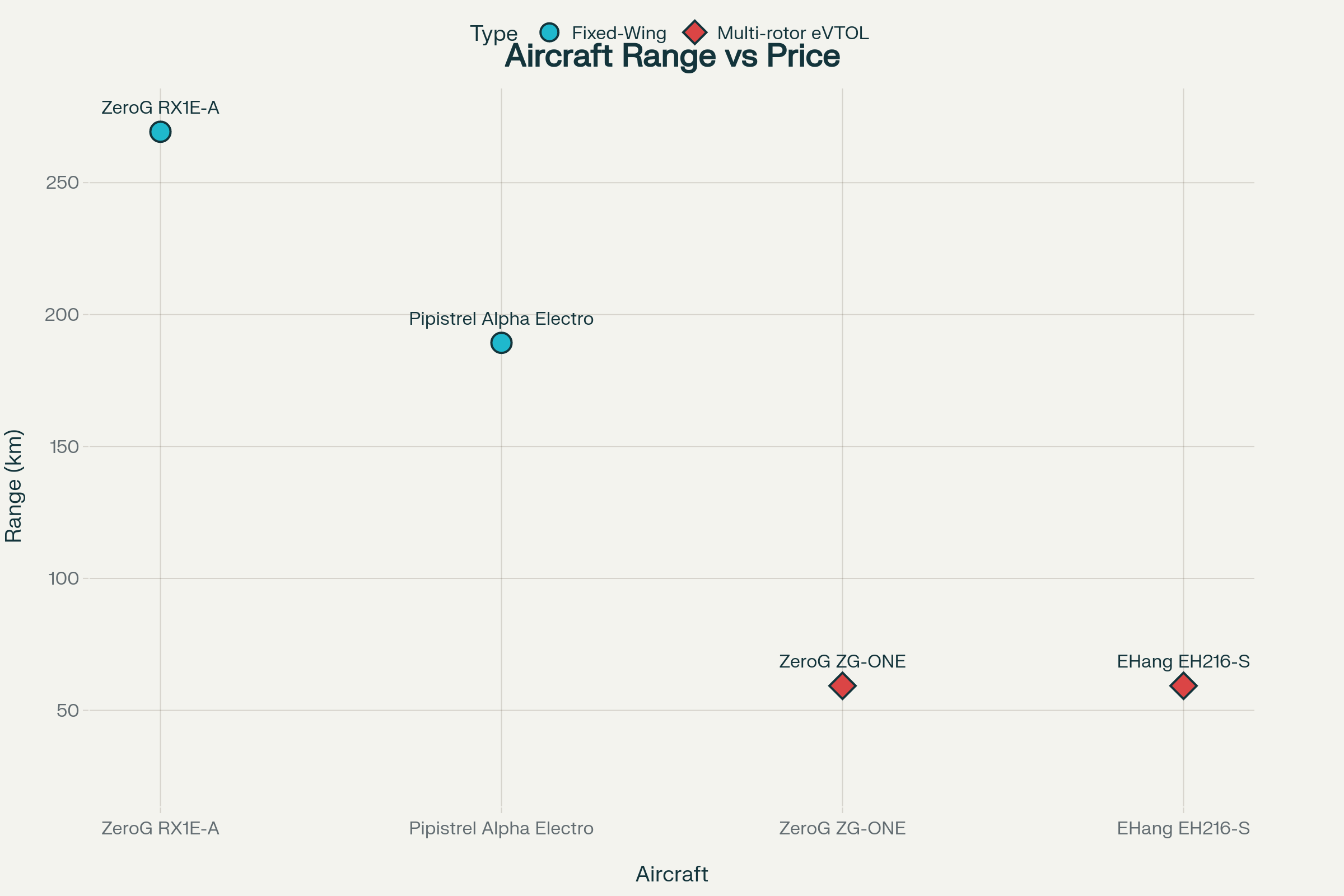

Aircraft Range vs. Price Comparison

Range vs. Price comparison of fixed-wing electric aircraft and multi-rotor eVTOL aircraft

Range vs. Price comparison of fixed-wing electric aircraft and multi-rotor eVTOL aircraft

Range vs. Price comparison of fixed-wing electric aircraft and multi-rotor eVTOL aircraft

The chart illustrates clear performance and pricing differences between fixed-wing electric aircraft and multi-rotor eVTOL aircraft.

Fixed-wing electric aircraft show superior range capabilities. ZeroG’s RX1E-A delivers 240 km range at $150,000, making it 50% more cost-effective than the Pipistrel Alpha Electro’s 160 km range at $200,000. This gives ZeroG a competitive advantage in the training aircraft market.

Multi-rotor eVTOL aircraft operate in a different performance category entirely. Both ZeroG’s ZG-ONE and EHang’s EH216-S offer 30 km range - adequate for urban air mobility but far below fixed-wing capabilities. The EHang EH216-S carries a $332,000 price tag, while ZeroG’s pricing remains undisclosed.

The data reveals the fundamental trade-off in electric aviation: fixed-wing aircraft excel at range and cost efficiency, while multi-rotor eVTOLs prioritize vertical takeoff capabilities for urban operations. ZeroG’s strategy of developing both aircraft types positions the company across these distinct market segments, leveraging proven fixed-wing technology to fund more complex eVTOL development.

Market Positioning and Pricing

ZeroG’s pricing strategy appears highly competitive, particularly for the RX1E-A trainer aircraft. At approximately $150,000, it undercuts the established Pipistrel Alpha Electro by $50,000 while offering 50% greater range. The EHang EH216-S, with a similar range to the ZG-ONE, carries a $332,000 price tag, suggesting potential pricing advantages for ZeroG’s eVTOL once commercialized.

Technology and Certification Status

| Aircraft | Certification Status |

| ZeroG RX1E-A | CAAC certified, mass production |

| EHang EH216-S | CAAC type certified, commercial sales active |

| AutoFlight CarryAll | Full CAAC certification (TC, PC, AC) |

| Joby S4 | Advanced FAA certification process, expected 2025-2026 |

| ZeroG ZG-ONE | CAAC certification expected early 2026 |

| Archer Midnight | FAA certification targeted for late 2024/2025 |

| ZeroG ZG-T6 | Early development, entry around 2028 |

Note: As of August 2025, Archer Midnight’s certification timeline may need updating since the original target was late 2024/2025. The other aircraft remain on their projected schedules, with Chinese manufacturers holding certified status advantages through CAAC approval processes.

ZeroG’s Competitive Strengths

| Competitive Strength | Description |

| Cost efficiency | RX1E-A offers superior range per dollar compared to Western competitors |

| Diverse portfolio | Only company simultaneously developing fixed-wing electric and multiple eVTOL configurations |

| Market timing | RX1E-A already in production while most competitors remain in development |

ZeroG’s Competitive Challenges

| Competitive Challenge | Description |

| Speed limitations | ZG-ONE's 75 km/h cruise speed trails EHang EH216-S (100 km/h) and far behind Joby S4 (200 km/h) |

| Payload capacity | Limited published payload specifications for eVTOL aircraft |

| International certification | Currently focused on Chinese market with CAAC approvals |

The specifications analysis reveals ZeroG’s pragmatic approach to market entry, leveraging proven electric aircraft technology to generate revenue while developing more advanced eVTOL capabilities. The company’s three-tier strategy positions it across multiple market segments, from cost-effective training aircraft to ambitious air taxi operations. However, success will depend on the execution of certification milestones and competitive pricing for the eVTOL aircraft.

ZeroG Leadership and Technical Foundation

Founder CEO: Li Yiheng

Li Yiheng founded ZeroG in March 2021 at age 25. As CEO, he leads technology and product development with hands-on aircraft certification experience. He graduated from Nanjing University of Aeronautics and Astronautics.

Li Yiheng founded ZeroG in March 2021 at age 25. As CEO, he leads technology and product development with hands-on aircraft certification experience. He graduated from Nanjing University of Aeronautics and Astronautics.

Under Li, ZeroG reached mass production of RX1E-A electric aircraft in 2024, delivered eight units for tourism and training, raised over RMB 400 million ($55 million), and built a three-aircraft portfolio (electric fixed-wing and eVTOLs). Forbes listed him as a notable young entrepreneur for advancing China’s electric aviation.

Business Development Lead: Shi Hong

Shi Hong handles business development at ZeroG. A licensed pilot with 500+ hours of flight time in China and abroad, he owns his aircraft and applies operational knowledge to pilot training and aircraft markets.

Shi’s experience covers multiple industries. He spotted opportunities in China’s low-altitude economy after the 2021 national transportation blueprint. His insights shaped ZeroG’s market strategy, especially for the RX1E-A trainer.

Technical and Corporate Overview

ZeroG has 51-200 employees and functions as a subsidiary of Nanjing Communications Holdings. This setup ensures financial stability, government ties for certification and airspace, transportation expertise (highways, railways, airports, ports), and supply chain access.

This structure combines academic strength, young leadership, aviation operations know-how, and state backing to advance ZeroG in China’s low-altitude economy, focusing on urban mobility, tourism, and training applications below 1,000 meters.

Strategic Advantages

ZeroG’s competitive positioning stems from several factors. Professor Xiang Jinwu’s Chinese Academy of Engineering membership and Beihang University affiliation provide academic credibility essential for regulatory approval. CEO Li Yiheng brings an aerospace engineering background and business execution capability. Shi Hong contributes aviation operations experience, while Terry Zhu from BlueRun Ventures provides investment and strategic guidance.

The state-owned enterprise backing offers advantages in government relations, crucial for aviation certification and airspace access in China’s controlled regulatory environment. Transportation industry expertise from the parent company creates synergies across highways, railways, airports, and ports operations.

This combination of academic credentials, technical expertise, financial backing, and government connections positions ZeroG to navigate China’s emerging low-altitude economy while developing commercially viable aircraft across multiple market segments.

Global Impacts on Low-Altitude Economic Activities

ZeroG’s growth path aligns with China’s goal to become a major player in low-altitude aviation technology, both as a user and exporter. Their three-tier model—using revenue from training aircraft like the RX1E-A to support advanced eVTOL projects—follows proven strategies from the automotive industry.

While Western companies target urban air mobility in developed nations, ZeroG and other Chinese firms focus on emerging markets in Southeast Asia, the Middle East, and Africa. These regions often have less strict regulations and lower infrastructure demands, offering easier entry. However, a significant challenge balances this advantage: aircraft certified by China’s Civil Aviation Administration (CAAC) may not meet the standards of the FAA or EASA. This could limit ZeroG’s access to developed markets in the US and Europe, restricting their global reach to primarily domestic and less-regulated regions.

The years 2026-2028 will be pivotal for market consolidation. With EHang already certified in China and companies like AutoFlight and ZeroG nearing commercialization, the question remains whether Chinese manufacturers can expand worldwide or stay mostly domestic. ZeroG’s steady approach, focusing on tested technology and gradual progress, differs from the bold fundraising and tight timelines of US firms like Joby and Archer, who have secured billions in public markets. This cautious strategy might sustain ZeroG better as the industry shifts from prototypes to real operations.

Ultimately, ZeroG’s success hinges on China’s efforts to build a supportive regulatory framework and the necessary infrastructure for low-altitude activities. With six pilot cities set for eVTOL testing and national laws backing the low-altitude economy, ZeroG is in a strong position to benefit from China’s drive into this growing field.