The Low Altitude Economy just received its most significant regulatory boost since the concept emerged from Silicon Valley boardrooms and engineering labs. Transportation Secretary Sean P. Duffy's announcement of the Electric Vertical Takeoff and Landing Integration Pilot Program represents a fundamental shift in how America approaches advanced air mobility, allowing companies to demonstrate commercial viability before completing the traditionally lengthy certification process.

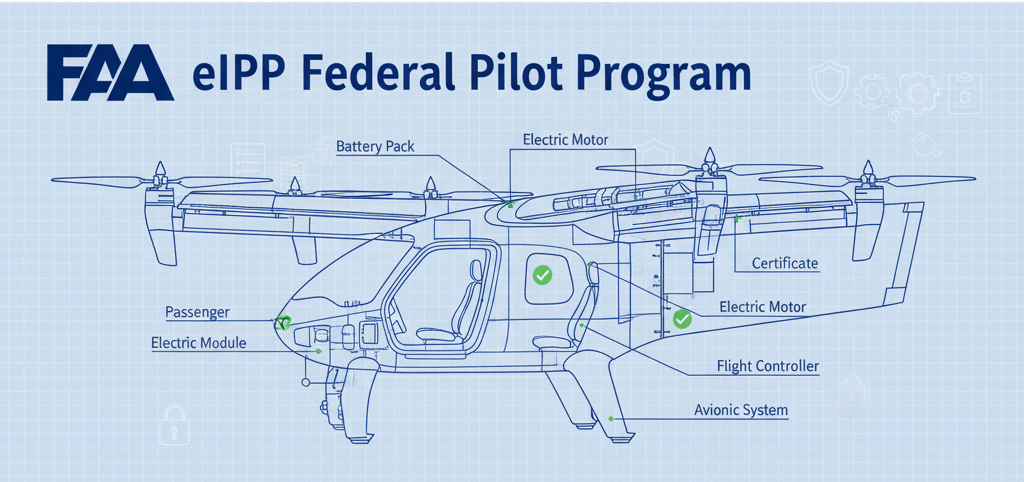

This isn't just another government program. The eIPP marks the first time the Federal Aviation Administration has created a pathway for eVTOL operations ahead of full type certification, potentially compressing years of regulatory waiting into months of real-world demonstration. For an industry that has burned through billions in venture capital while navigating certification hurdles, the timing couldn't be more critical.

Breaking Down Regulatory Barriers

The program's structure reveals careful consideration of both safety requirements and commercial realities. State, local, tribal, and territorial governments must partner with U.S.-based private companies to qualify, ensuring community involvement while maintaining federal oversight. With applications due December 11, 2025, and at least five pilot projects planned, the FAA has set an aggressive timeline that reflects the administration's commitment to American leadership in this emerging market.

FAA Administrator Bryan Bedford emphasized the program's learning-focused approach: "We will take the lessons learned from these projects to enable safe, scalable AAM operations nationwide". This philosophy represents a marked departure from traditional aviation regulation, where full certification typically preceded any commercial operations.

The operational scope encompasses the full spectrum of Low Altitude Economy applications. Short-range air taxis will demonstrate urban mobility solutions, while longer-range fixed-wing flights address regional connectivity challenges. Cargo operations, emergency medical transport, and logistics support for offshore energy facilities round out the testing portfolio, creating a comprehensive evaluation framework for advanced air mobility technologies.

Industry Leaders Position for Early Operations

Joby Aviation and Archer Aviation wasted no time announcing their participation, triggering immediate market reactions that underscore investor confidence in the program's potential. Joby's stock has already demonstrated remarkable volatility this year, surging from $5.33 per share in early 2025 to over $17 by mid-year. The company's Chief Policy Officer Greg Bowles positioned Joby as uniquely prepared, noting their 15 years of technology development and operational capability building.

Archer Aviation CEO Adam Goldstein called the announcement "a landmark moment for our industry and our country," highlighting the administration's pragmatic approach to eVTOL integration. Both companies bring substantial technical maturity to the program, with Joby currently in Stage 4 of the FAA's five-phase certification process and Archer maintaining its own advanced development timeline.

The market response extends beyond individual stock movements. Morgan Stanley's projection of a $1 trillion urban air mobility market by 2040, with optimistic forecasts reaching $9 trillion by 2050, provides context for investor enthusiasm. Bank of America forecasts compound annual growth rates of 62% from 2025 to 2030, indicating sustained expansion expectations across the entire advanced air mobility sector.

Reshaping the Low Altitude Economy Landscape

The eIPP's implications for the Low Altitude Economy extend far beyond individual company benefits. By enabling pre-certification operations, the program addresses one of the most persistent challenges facing the industry: the circular dependency between regulatory approval and operational demonstration. Companies have struggled to prove market viability without operational experience, while regulators have demanded extensive safety data before approving operations.

This regulatory innovation could accelerate infrastructure development across the country. Vertiports, charging networks, and air traffic management systems all require real-world testing to validate design assumptions and operational procedures. The program's three-year duration provides sufficient time for meaningful infrastructure scaling while maintaining safety oversight.

The timing aligns with significant technological advances in the industry. Battery energy density improvements now enable 150-mile ranges at 200 mph, representing a 40% increase from 2023 capabilities. These technical advances, combined with regulatory flexibility, create conditions for rapid market development that weren't possible even two years ago.

Medical transport and emergency services applications could see the most immediate benefits. Current helicopter-based medical transport faces significant limitations in urban environments, where noise restrictions and landing site availability constrain operations. Electric vertical takeoff and landing aircraft offer quieter operations with more flexible siting requirements, potentially expanding emergency medical coverage to underserved areas.

International Context: The Global Race for Low Altitude Dominance

While the United States launches its pilot program, China has already moved beyond testing phases into active commercial operations. EHang Holdings has achieved what American companies are still pursuing: full type certification and commercial passenger service. The Guangzhou-based company's EH216-S represents the world's first certified pilotless passenger-carrying eVTOL, with over 60,000 autonomous flights completed across 19 countries.

China's advantages extend beyond individual company achievements. The nation now holds over 70% of global low altitude unmanned aerial vehicle patents and hosts more than 50,000 enterprises in related businesses. This industrial depth reflects comprehensive government support through the "low-altitude economy" framework, which prioritizes airspace below 1,000 meters for commercial development.

The technical capabilities emerging from Chinese manufacturers demonstrate real operational maturity. AutoFlight recently delivered the world's first certified heavy-lift eVTOL exceeding one ton maximum takeoff weight, opening new possibilities for cargo operations. Meanwhile, multiple Chinese companies including TCab Tech and Geely Aerofugia are advancing through certification processes with aircraft targeting 200-plus kilometer ranges.

Europe presents a different competitive landscape, with companies like Lilium and Volocopter pursuing more traditional certification pathways while building operational partnerships across the continent. European regulators have maintained stricter safety requirements but are developing frameworks that could enable rapid scaling once certification hurdles are cleared.

This international context explains the urgency behind the eIPP program. Secretary Duffy's emphasis on cementing "America's status as a global leader in transportation innovation" reflects the reality that leadership in this industry is no longer guaranteed. China's operational head start and Europe's systematic approach create competitive pressure that traditional American regulatory processes may not address quickly enough.

The program's focus on U.S.-manufactured aircraft and domestic partnerships represents both protectionist policy and strategic necessity. As Chinese companies demonstrate commercial viability and European manufacturers build operational capabilities, American companies need regulatory pathways that match the pace of international competition while maintaining safety standards that support global market credibility. *** This addition provides the necessary international context while maintaining the article's expert tone and highlighting why the U.S. program represents such an important competitive response to global developments in the Low Altitude Economy.

Navigating Implementation Challenges

The program's success depends heavily on effective public-private partnerships and community acceptance. Local governments must balance economic development opportunities with resident concerns about noise, safety, and airspace intrusion. The requirement for government partnership ensures community involvement but also introduces political considerations that could complicate implementation.

Technical challenges remain substantial despite recent advances. While battery technology has improved significantly, energy density still constrains payload and range combinations for many applications. Weather limitations, particularly for smaller aircraft, will likely restrict operational availability compared to traditional ground-based alternatives.

The FAA faces its own implementation challenges. The agency must develop operational frameworks for aircraft that don't fit traditional certification categories while maintaining safety standards that satisfy both industry and public expectations. Balancing innovation encouragement with risk management requires regulatory creativity that historically has taken years to develop.

Infrastructure coordination presents another complex challenge. Successful operations require synchronized development of vertiports, charging facilities, air traffic management systems, and ground support equipment. The program's compressed timeline demands unprecedented coordination between federal, state, and local authorities along with private sector partners.

Market Implications and Competitive Dynamics

The eIPP could fundamentally alter competitive dynamics within the advanced air mobility industry. Companies with mature aircraft designs and operational capabilities gain significant advantages over those still in development phases. This reality has already influenced stock valuations, with established players like Joby and Archer seeing immediate market recognition.

International competition adds urgency to American efforts. China has already begun commercial eVTOL operations in limited applications, while European companies advance through their own regulatory processes. The eIPP positions the United States to maintain technological leadership while developing the operational experience necessary for global market expansion.

The program's focus on U.S.-manufactured aircraft and components supports domestic industrial development while creating export opportunities. As Secretary Duffy noted, success "will cement America's status as a global leader in transportation innovation" while creating "more high-paying manufacturing jobs and economic opportunity".

Supply chain considerations become increasingly critical as operations scale. The program's emphasis on domestic manufacturing aligns with broader national security objectives while supporting industrial base development. Companies participating in the program will need to demonstrate not just aircraft capability but also sustainable production and support infrastructure.

Looking Toward Commercial Reality

The eIPP represents more than regulatory accommodation; it signals a fundamental shift in how America approaches emerging transportation technologies. By creating pathways for demonstration before full certification, the program acknowledges that traditional regulatory approaches may not suit rapidly evolving technologies.

Success metrics for the program will extend beyond safety records to include operational efficiency, community acceptance, and economic viability. These broader measures reflect the reality that technological capability alone doesn't guarantee market success in the complex environment of urban transportation.

The three-year program timeline provides sufficient duration for meaningful evaluation while maintaining urgency for participants. Companies must demonstrate not just technical capability but also operational sustainability and market viability within this compressed timeframe. This pressure could accelerate industry maturation while identifying the most promising applications for commercial scaling.

The program's legacy will likely extend far beyond its initial participants. Lessons learned from these pilot projects will inform broader regulatory frameworks for the entire Low Altitude Economy, potentially influencing everything from autonomous cargo drones to supersonic passenger aircraft. In this context, the eIPP represents not just an opportunity for early movers but a foundation for the entire industry's future development.

As the December application deadline approaches, the program has already achieved its first objective: demonstrating that American innovation can find pathways through regulatory complexity when supported by thoughtful policy frameworks. Whether it can deliver on its broader promises of commercial viability and market leadership remains to be proven in the skies above participating communities across the nation.