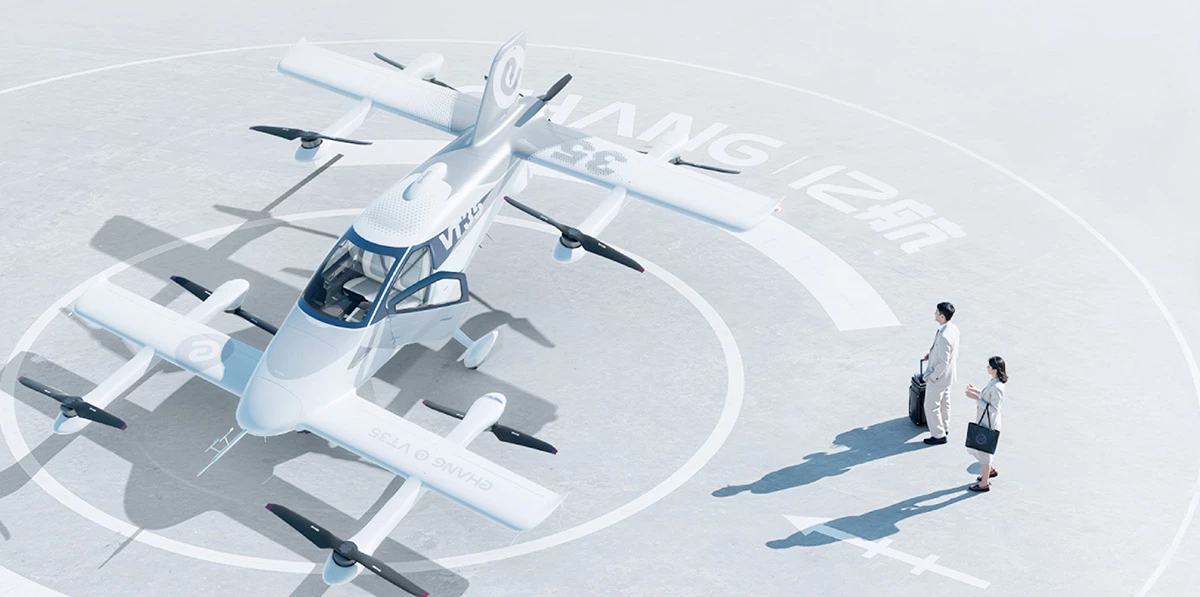

EHang unveiled the VT35 on October 13, 2025, in Hefei, marking a calculated expansion beyond the company’s certified EH216-S urban air taxi. Priced at RMB 6.5 million (approximately $910,000), the two-seat pilotless aircraft targets intercity corridors with a 200-kilometer range and cruise speed of 216 kilometers per hour. The tandem-wing lift-and-cruise design features eight distributed lift propellers for vertical operations and transitions to a single pusher propeller for forward flight, maintaining a compact 8-meter footprint that is compatible with existing EH216-S vertiports.

This launch matters because EHang already holds full type, production, and standard airworthiness certification from China's Civil Aviation Administration (CAAC) for its EH216-S, the first pilotless passenger eVTOL to achieve this regulatory milestone globally. The VT35 entered CAAC type certification review in March 2025 and has completed transition flight testing, positioning the aircraft along an established regulatory pathway that Western competitors continue to navigate.

The EHang VT35 – a next-generation long-range pilotless passenger eVTOL

China's low-altitude economy encompasses all commercial aviation activities below 3,000 meters, and the market scale is projected to reach 1.5 trillion yuan ($209.9 billion) by 2025, climbing to 3.5 trillion yuan by 2035, according to CAAC projections. The VT35 addresses a critical gap in this emerging industry by connecting city centers across distances that ground transportation struggles to serve efficiently.

You can book an air taxi for sightseeing in several Chinese cities today using the EH216-S, but your trip ends where the battery does, typically within 25 to 35 kilometers. The VT35 stretches that operational envelope nearly sixfold, opening cross-sea routes, mountain crossings, and city-to-city links that convert hour-long drives into 20-minute flights. This extension from intra-urban to intercity operations creates what EHang describes as a “one-hour flight zone” connecting major Chinese metropolitan clusters.

The infrastructure compatibility matters more than the specifications suggest. Operators who invested in EH216-S vertiports won’t need to build separate facilities for the VT35. This interoperability reduces capital requirements and accelerates network expansion, allowing the same charging platforms, command-and-control systems, and ground infrastructure to support both aircraft types. The approach mirrors how commercial aviation developed, where airports served multiple aircraft models rather than requiring dedicated facilities for each airframe.

China’s emphasis on the low-altitude economy as a strategic industry receives government backing at national and provincial levels. The city’s vice mayor attended the Hefei launch event, the deputy director of Anhui Province’s Low-Altitude Economy Division, and representatives from major manufacturing partners, including JAC Group. This institutional support creates regulatory pathways, infrastructure funding, and operational frameworks that facilitate the acceleration of commercial deployment.

Competing Aircraft and Market Position

The VT35 enters a crowded field but occupies a distinct niche. Joby Aviation’s S4 carries four passengers plus a pilot across 100 miles at 200 miles per hour, targeting premium urban air taxi services with a maximum payload of 1,000 pounds and an empty weight of approximately 4,300 pounds. Archer’s Midnight follows similar specifications, with a 100-mile range, four-passenger capacity, and a 150-mile-per-hour cruise speed, optimized for quick turnaround times, enabling up to 40 flights per day. Both aircraft require pilots and are subject to ongoing FAA certification processes, which are expected to conclude around 2025 to 2026.

Volocopter’s VoloCity operates at the other end of the spectrum, carrying one passenger plus a pilot across 35 kilometers at 110 kilometers per hour with an 18-rotor multicopter configuration and a maximum payload of 200 kilograms. The German company positions the VoloCity for dense urban environments where short hops between vertiports dominate the use case.

The VT35 splits the difference. Two seats keep the aircraft compact and affordable compared to four-passenger designs, while the 200-kilometer range doubles what Joby and Archer offer. The pilotless configuration eliminates pilot costs and training requirements, though it raises regulatory questions in markets outside China. With a maximum takeoff weight of 950 kilograms and an approximately 200 kilograms useful payload, the VT35 sacrifices passenger capacity for increased range and operational simplicity.

Western manufacturers pursue piloted aircraft partly because FAA and EASA certification for autonomous passenger operations remains undefined. China’s CAAC adopted a more permissive stance, granting EHang full certification for the pilotless EH216-S in 2023 and opening the door for the VT35 to follow the same pathway. This regulatory divergence gives Chinese manufacturers a 12- to 24-month commercialization advantage while Western competitors wait for their agencies to finalize autonomous flight standards.

EHang faces competition from domestic Chinese manufacturers as well. AutoFlight received approval for its CAAC type certificate application for its eVTOL design, and multiple Chinese companies entered the low-altitude industry with government support. The crowded domestic market will test whether EHang’s first-mover certification advantage translates into sustained market leadership.

Comprehensive Comparison Table

| Aircraft | Country | Range (km) | Cruise Speed (km/h) | Passengers | Pilot Req | Max Payload (kg) | MTOW (kg) | Configuration | Price (USD) | Certification | Primary Mission |

| EHang VT35 | China | 200 | 216 | 2 | No | 200 | 950 | Lift+Cruise | $910,000 | CAAC Review | Intercity |

| Joby S4 | USA | 161 | 322 | 4 | Yes | 454 | 2,177 | Tilt-rotor | TBD | FAA Process | Urban Taxi |

| Archer Midnight | USA | 161 | 241 | 4 | Yes | 454 | 3,175 | Lift+Cruise | TBD | FAA Process | Urban Taxi |

| Volocopter VoloCity | Germany | 35 | 110 | 1 | Yes | 200 | 900 | Multicopter | TBD | EASA Process | Urban Taxi |

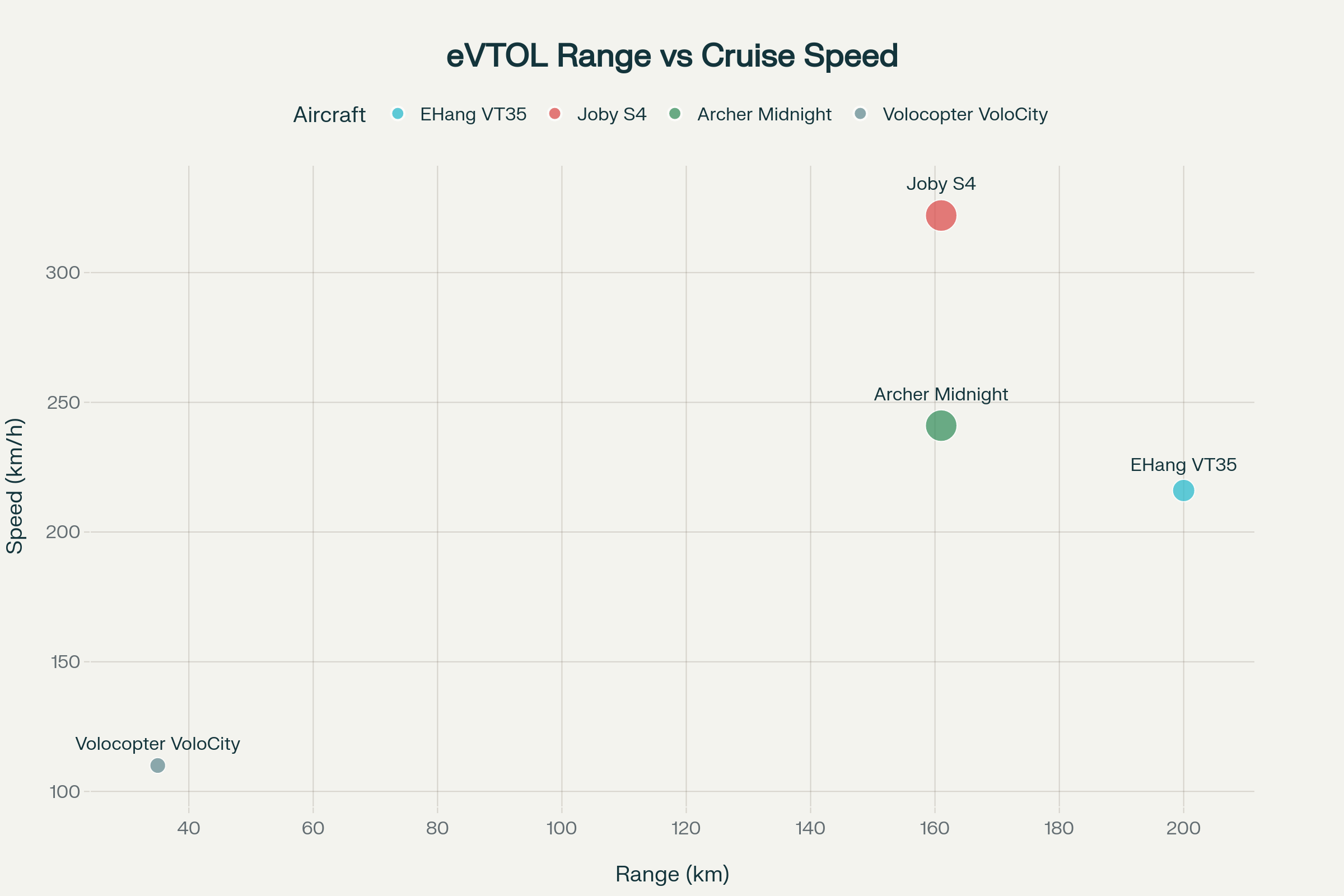

Range vs Speed Performance

Performance comparison of leading eVTOL aircraft showing range vs cruise speed, with bubble size indicating passenger capacity

Performance comparison of leading eVTOL aircraft showing range vs cruise speed, with bubble size indicating passenger capacity

The performance scatter plot reveals distinct positioning strategies among manufacturers. The EHang VT35 occupies a unique middle ground, boasting a moderate cruise speed and exceptional range, targeting intercity corridors rather than urban hops. Joby Aviation prioritizes speed over range, achieving the highest cruise velocity at 322 km/h but limiting range to 161 kilometers. Archer balances speed and range more conservatively, while Volocopter focuses entirely on urban operations with limited range and speed but reliable multicopter simplicity.

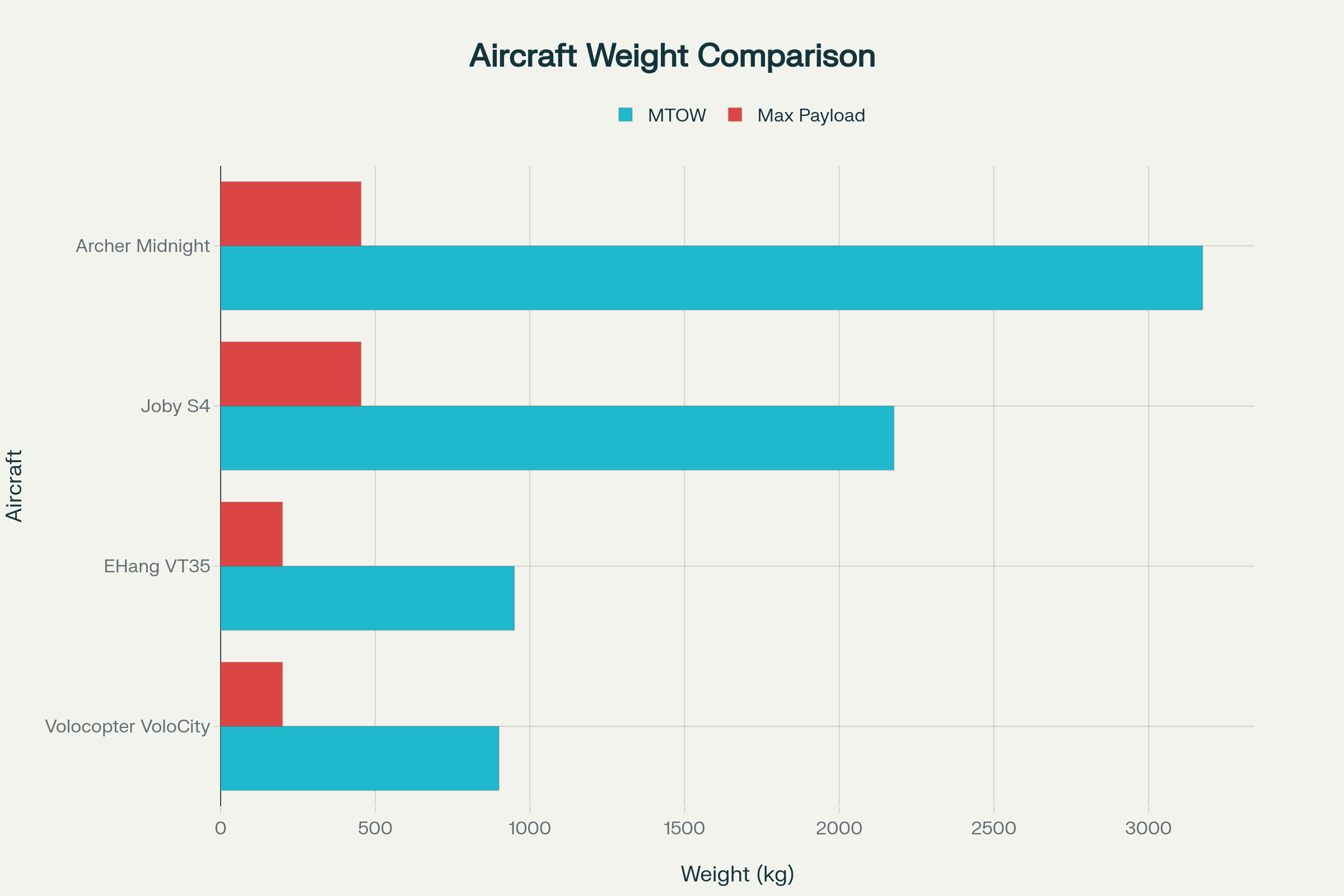

Weight and Payload Comparison

Weight comparison showing maximum takeoff weight and payload capacity for competing eVTOL aircraft

Weight comparison showing maximum takeoff weight and payload capacity for competing eVTOL aircraft

The weight analysis exposes fundamental design philosophies. Archer’s Midnight carries the highest maximum takeoff weight at 3,175 kilograms, reflecting a robust airframe designed for intensive commercial operations. Joby’s S4 achieves the best payload-to-weight ratio, carrying 454 kilograms of passengers and cargo within a 2,177-kilogram airframe. The EHang VT35 and Volocopter VoloCity cluster around 900-950 kilograms MTOW, prioritizing efficiency over payload capacity.

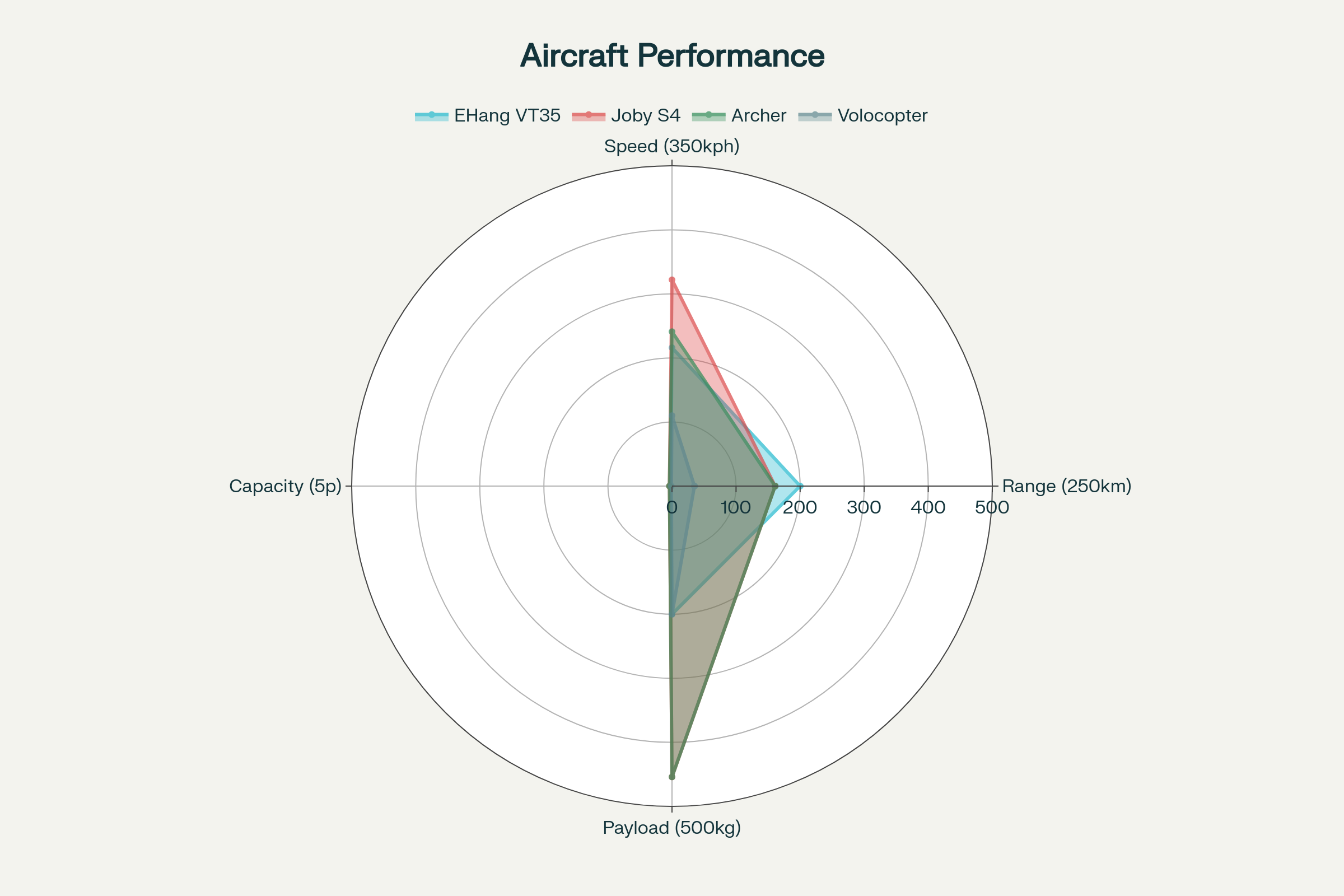

Multi-Dimensional Performance Radar

Multi-dimensional performance comparison radar chart for competing eVTOL aircraft across key metrics

Multi-dimensional performance comparison radar chart for competing eVTOL aircraft across key metrics

The radar chart synthesizes key performance metrics across normalized scales. Joby’s S4 dominates in speed and payload capacity while maintaining a competitive range. The EHang VT35 shows balanced performance across all metrics with superior range capability. Archer’s Midnight exhibits substantial payload and passenger capacity but sacrifices some speed. Volocopter’s VoloCity concentrates on urban operations with a limited range but adequate speed for short-distance missions.

Strategic Positioning Insights

The comparison reveals three distinct market approaches. American manufacturers Joby and Archer are pursuing premium urban air taxi services with a four-passenger capacity, pilot-operated systems, and high-performance specifications. This strategy targets business travelers and affluent consumers willing to pay premium prices for time savings on intracity routes.

EHang positions the VT35 for intercity travel between secondary cities, tourist destinations, and business centers where ground transportation takes hours but air routes require only minutes. The pilotless operation reduces operating costs while the two-passenger configuration keeps the aircraft compact and affordable relative to four-seat competitors.

Volocopter focuses on dense urban environments where short flights between nearby vertiports serve specific transportation needs. The multicopter configuration provides inherent safety through redundancy but limits range and speed compared to more complex lift-and-cruise or tilt-rotor designs.

The certification timeline differences matter significantly. China’s CAAC granted EHang full certification for the EH216-S and accepted the VT35 into type certificate review, providing a regulatory pathway that Western competitors lack. FAA and EASA processes remain undefined for pilotless passenger operations, potentially delaying Western market entry by 12 to 24 months even after technical development concludes.

Pricing strategy also differs markedly. EHang announced a specific price point of $910,000 for the VT35, suggesting confidence in manufacturing costs and market positioning. Western manufacturers typically withhold pricing until closer to certification, reflecting uncertainty about production volumes, regulatory requirements, and competitive positioning.

Global Low Altitude Economic Ramifications

The VT35 launch underscores a regulatory and industrial split in advanced air mobility. China has certified and commercialized pilotless passenger eVTOLs, while the FAA and EASA continue to develop airworthiness criteria for similar designs. The FAA published Advisory Circular 21.17-4, establishing certification processes for powered-lift aircraft weighing up to 12,500 pounds and accommodating a maximum of six passengers. However, no pilotless passenger aircraft has completed this pathway.EASA’s SC-VTOL Issue 2 similarly increased maximum certified takeoff mass to approximately 12,500 pounds while maintaining stringent safety targets, including a 10^-9 probability of catastrophic failure for commercial passenger operations.

Western regulators prioritize safety validation over speed to market, requiring extensive testing and operational data before granting certification. Chinese authorities accepted faster timelines, potentially giving domestic manufacturers operational experience and safety data that could inform global standards. This approach carries risks if insufficient validation leads to accidents that damage public confidence across the industry.

International market access presents challenges for Chinese-certified aircraft. FAA and EASA bilateral agreements with CAAC focus on conventional aircraft types, and pilotless passenger eVTOLs fall outside established reciprocal certification frameworks. EHang and other Chinese manufacturers pursuing international sales will likely need to conduct separate certification programs in each jurisdiction, adding years and substantial cost to market entry.

The commercial implications extend beyond aircraft sales. China’s integrated approach combines domestic manufacturing, supportive regulation, infrastructure investment, and operational deployment in a coordinated industrial policy. The low-altitude economy strategy allocates government resources to vertiport construction, airspace management systems, and local pilot programs, creating immediate markets for domestic manufacturers. Western markets fragment responsibility across private manufacturers, airport authorities, air navigation service providers, and multiple regulatory agencies, slowing coordinated development.

Bank of America Global Research projects that the global civil adoption of eVTOL will grow 62 percent annually from 2025 through 2030, with the urban air mobility market expanding from $4.6 billion in 2024 to $23.5 billion by 2030 and $41.5 billion by 2035. China’s first-mover advantage in certification and deployment positions domestic manufacturers to capture significant market share during the industry’s formative years.

The VT35 also tests the viability of pilotless operations for passenger transport. Public acceptance of autonomous aircraft remains uncertain outside China, where cultural attitudes toward technology adoption and regulatory trust differ significantly from those in Western markets. If EHang accumulates tens of thousands of flight hours and millions of passenger-kilometers without serious incidents, the operational data could shift regulatory attitudes globally. Conversely, a catastrophic failure would likely set back the entire autonomous eVTOL industry regardless of geographic market.

Technology transfer concerns complicate international partnerships. Western companies seeking to access the Chinese market face requirements to share intellectual property, manufacturing processes, and operational data with domestic partners or regulators. Chinese manufacturers seeking Western certification often encounter export control restrictions on specific avionics, propulsion systems, and autonomous flight systems. These barriers fragment the global eVTOL industry into regional markets, resulting in limited technology exchange.

The intercity mission profile that EHang targets with the VT35 differs from the urban air taxi focus dominating Western development. Connecting city pairs across 100 to 200 kilometers serves commuter, tourism, and business travel markets without requiring dense vertiport networks within urban cores. This approach sidesteps some regulatory and public acceptance challenges associated with frequent low-altitude operations over densely populated areas. If the intercity model proves commercially viable, Western manufacturers may shift their focus toward similar applications rather than competing directly with ground transportation for intra-urban trips.

The VT35 demonstrates that eVTOL development has progressed from prototypes to commercial products, with defined pricing, production timelines, and established regulatory pathways. Whether pilotless operations gain acceptance outside China, how quickly Western manufacturers complete certification, and which business models prove economically sustainable will determine whether the low-altitude economy fulfills its projected growth trajectory or becomes another aviation technology that promises more than it delivers.