The airspace beneath 1,000 meters above our cities could become one of the most significant economic opportunities of our time. Hong Kong's newly unveiled comprehensive strategy for developing its low-altitude economy reads more like a blueprint for urban aviation supremacy than a government report. This isn't just another policy paper gathering dust on bureaucratic shelves; it’s a calculated gambit to position Hong Kong as the global command center for an industry projected to reach $9 trillion by 2050.

The Economics of Empty Sky

Most people look up and see nothing but air. Hong Kong's policymakers see untapped economic potential worth approximately HK$350 billion by 2050. The territory isn't just planning to participate in the low-altitude economy; it’s positioned to capture the most lucrative segments of this industry.

The strategy reveals a crucial aspect of Hong Kong’s approach. Rather than competing in manufacturing drones or electric vertical takeoff and landing aircraft (eVTOLs), the territory is laser-focused on high-value supporting services: financial expertise, legal frameworks, testing and certification, insurance products, and professional services that enable low-altitude enterprises to scale globally. It's a classic Hong Kong move: identify where the real money lies and dominate those spaces.

The numbers tell a compelling story. Morgan Stanley projects the global market for urban air mobility and logistics will explode from essentially nothing today to $9 trillion by 2050, with China capturing 24% of that massive opportunity. For Hong Kong, even a modest slice of this pie represents substantial economic upside, particularly when concentrated in areas where the territory maintains competitive advantages.

Three Pillars Supporting Sky-High Ambitions

Hong Kong’s approach is based on three interconnected foundations, each building upon the others.

Foundation Layer: Building the World's Sky Urbanism

The first pillar transforms Hong Kong's dense urban environment into what the report calls the world’s “Sky Urbanism”, safely integrating low-altitude flying with high-density vertical development.

The infrastructure requirements are both sophisticated and expensive. Hong Kong needs a multi-layered communication network featuring upgraded 5G-Advanced stations, Low Earth Orbit satellites for coverage in country parks, and integrated sensing capabilities that function as radar-like detection systems. The monitoring infrastructure must handle both authorized and unauthorized flights, utilizing radio frequency detectors, electro-optical cameras, and anti-drone jammers as necessary.

Navigation presents particular challenges. Hong Kong's urban canyons create GPS signal problems that require enhanced Network Real Time Kinematic services and 5G-based positioning as backup systems. Weather monitoring also becomes critical, requiring specialized equipment such as atmospheric electric field meters and wind profiling radar at vertiports and along flight corridors.

The concept of vertiports, dedicated platforms for low-altitude aircraft takeoffs and landings, gets particular attention. Rather than mandating specific locations, Hong Kong plans to integrate these facilities into urban planning for new development areas while facilitating their installation in existing districts. The Northern Metropolis serves as the primary testing ground, with different zones designated for specific applications: cross-boundary logistics, innovative construction management, and biomedical sample transfer.

Innovation and Talent: The Human Capital Equation

The second pillar addresses a critical weakness in Hong Kong's current approach. University research shows significant overlap in Hong Kong’s areas while leaving crucial topics like cybersecurity and community acceptance woefully understudied.

The solution involves expanding the existing Smart Traffic Fund, which currently has HK$459 million available, to coordinate low-altitude technology research and ensure resources target the most critical knowledge gaps. This isn't just about throwing money at problems; it’s about strategic resource allocation to maximize the impact of research.

Training and talent development require a complete overhaul. The report proposes a "1+N" training structure, where all remote pilots complete basic Civil Aviation Department Advanced Rating certification and then pursue specialized courses tailored to specific applications, such as payload management for delivery, proximity flying for building inspection, and night operations for search and rescue.

Perhaps most critically, Hong Kong currently has no systematic approach to attracting low-altitude talent. The territory's official Talent List doesn't include low-altitude professions, and the territory's rapid industry growth in China and elsewhere isn’t supported by a clear strategy. The plan involves creating a specific list of low-altitude professions and integrating them into existing visa schemes.

Industry and Services: Where Money Gets Made

The third pillar focuses on translating infrastructure and talent into actual business opportunities and revenue streams. Here, Hong Kong faces immediate practical challenges that could derail the entire strategy if not addressed.

Current participants in the Regulatory Sandbox, the government’s testing program for low-altitude applications, face significant hurdles. A single test flight might require approvals from multiple government departments if the intended path crosses different jurisdictions. The proposed solution establishes a “one-stop contact and approval” mechanism, accompanied by performance pledges.

Cross-boundary logistics with mainland China represents perhaps the biggest near-term opportunity, but it's also the most complex challenge. The report outlines detailed technical solutions, including pre-flight cargo declarations via the Trade Single Window, designated flight corridors with restricted access, real-time monitoring systems, and emergency intervention capabilities.

Hong Kong's traditional strength in professional services gets significant emphasis. The territory should enhance its testing and certification capabilities specifically for low-altitude aircraft, helping Chinese manufacturers access global markets. Insurance services require the development of actuarial models based on operational data. Legal and financial services supporting low-altitude enterprises could become major export industries.

The FAA's Digital Infrastructure: Learning from the FAA Model

Hong Kong's strategy places exceptional emphasis on international collaboration, particularly drawing lessons from the United States Federal Aviation Administration's approach to low-altitude airspace management. The FAA’s Unmanned Aircraft Systems Data Exchange, specifically the Low Altitude Authorization and Notification Capability (LAANC), provides a crucial blueprint for Hong Kong's own airspace management system.

The LAANC system represents perhaps the FAA’s sophisticated operational framework for managing low-altitude aircraft traffic globally. Remote pilots apply for authorization prior to takeoff through an automated process that cross-checks requests against multiple airspace data sources, including UAS Facility Maps, Special Use Airspace data, airport classifications, Temporary Flight Restrictions, and Notices to Airmen. When requests meet all requirements, approvals get granted in near real-time.

This automation delivers significant value by reducing bureaucratic delays while maintaining safety standards. Hong Kong's strategy explicitly recommends adapting this model for its own low-altitude airspace management system, integrating artificial intelligence technology for automatic authorization while maintaining three core functions: risk assessment, authorization, and airspace control.

Building Bridges with International Regulators

The report emphasizes that Hong Kong cannot develop its low-altitude economy in isolation. The territory must actively engage with international regulatory bodies to ensure its systems integrate seamlessly with global aviation frameworks. This includes working with the International Civil Aviation Organization's Remotely Piloted Aircraft Systems Panel, which convenes to advance regulatory frameworks for unmanned aviation.

Hong Kong's unique position as part of China while maintaining its own regulatory framework creates opportunities to serve as a bridge between Chinese and international aviation authorities. The strategy envisions Hong Kong becoming a platform for the participation of local and mainland experts in global standard setting, and a conduit for translating Greater Bay Area standards into global benchmarks.

One of the most significant barriers facing Chinese low-altitude enterprises in global markets involves the lack of mutual recognition for certifications. eVTOLs that receive airworthiness certification from the Civil Aviation Administration of China often require extensive re-testing and re-certification to comply with FAA or European Union Aviation Safety Agency standards.

Hong Kong's strategy positions the territory to address this gap by becoming the national center for low-altitude aircraft testing and certification. The Hong Kong Accreditation Service already maintains mutual recognition arrangements with 125 partners in 118 economies through membership in key international accreditation bodies. Expanding these capabilities specifically for low-altitude aircraft could help Chinese manufacturers access global markets more efficiently.

The report suggests that Hong Kong could host flagship events attracting global low-altitude aviation standard-setting expert groups, including FAA officials and other international regulators. These events would focus on critical domains like air traffic management, airworthiness standards, safety management systems, and personnel performance and licensing.

Data Sharing and Safety Protocols

International collaboration extends beyond regulatory frameworks to operational safety and data sharing. The FAA's approach to collecting and analyzing flight data provides valuable insights for risk assessment and insurance pricing, areas where Hong Kong currently faces significant gaps.

The strategy recommends establishing a centralized Regulatory Sandbox data platform that captures real-time flight tracking, aircraft condition metrics, and accident reporting data in a single location. This platform could interface with international systems, creating opportunities for cross-border data sharing that enhances safety while respecting sovereignty and security concerns.

Such collaboration becomes particularly important for cross-boundary operations between Hong Kong and mainland China. The report outlines technological solutions for fail-safe cross-boundary logistics mechanisms, but notes that implementation requires coordination with both Chinese and international authorities to ensure compliance with varying regulatory requirements.

The Montreal Playbook: Standards and Influence

The report uses Montreal as a template, as the city hosts the International Civil Aviation Organization, International Air Transport Association, and Airports Council International, making it the de facto global center for aviation standards.

No equivalent hub exists for low-altitude aviation standards, which vary significantly across regions and lack mutual recognition frameworks. Hong Kong could fill this gap by hosting flagship events that attract global low-altitude aviation expert groups and regulatory bodies. This positioning would give Hong Kong significant influence in regulatory development while attracting businesses and professionals to the territory.

The economic benefits extend beyond direct participation. Standard-setting hubs attract specialized ecosystems of legal experts, consultants, engineers, and corporate headquarters. They generate conference tourism, create high-value jobs, and establish the host city as the natural gathering place for industry decision-makers.

Learning from Shenzhen: The Competitive Context

Hong Kong's strategy frequently references developments in Shenzhen, which has been identified as mainland China’s leader in the low-altitude economy. Shenzhen plans to build 8,000 5G- Advanced stations and over 1,200 vertiports by 2026, while establishing multiple low-altitude economy pilot zones.

Rather than simply copying Shenzhen's approach, Hong Kong leverages its unique advantages: an international framework, global financial connections, an English-language business environment, and an established professional services industry. The territory positions itself as the bridge between mainland Chinese low-altitude enterprises and international markets.

Real-World Applications: Beyond the Theoretical

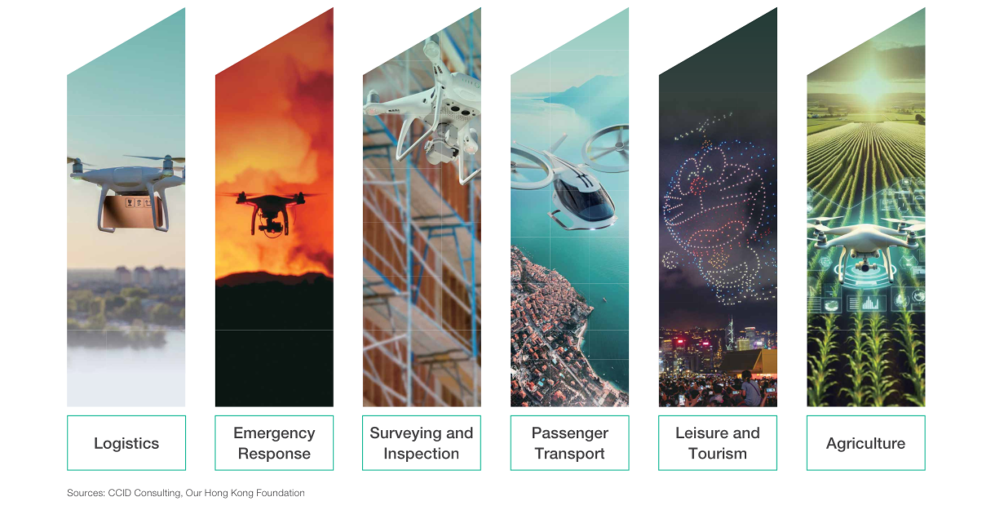

The report does an excellent job grounding its vision in specific, practical applications. Emergency response scenarios illustrate the technology's potential: drones provide real-time aerial views of disasters, deliver defibrillators to cardiac arrest victims faster than ground units, and conduct search and rescue operations in Hong Kong's extensive country parks and coastlines.

Logistics applications extend beyond simple package delivery. Medical supplies, blood products, and organs for transplant could bypass ground traffic entirely. Construction and public works benefit from automated surveying and inspection, creating detailed 3D "digital twins" of infrastructure.

Tourism and leisure applications include spectacular drone light shows over Victoria Harbour and unique aerial filming opportunities. Even agriculture in the New Territories can benefit from precision farming techniques, including drone monitoring and targeted treatment applications.

The San Tin Vision: Making It Tangible

All these elements converge in the proposed San Tin Aerospace Park within the forthcoming San Tin Technopole. This wouldn’t be just another industrial park; it represents Hong Kong’s tangible commitment to becoming a global hub for the low-altitude economy.

Diverse Infrastructure Solutions

The vision encompasses different space solutions tailored for businesses of all sizes. Standard manufacturing facilities will accommodate eVTOL producers, while flexible multi-tenant buildings serve smaller enterprises and startups. Advanced test facilities will simulate complex urban flight environments, eliminating the typical regulatory restrictions associated with city-wide operations.

Innovation Ecosystem

The concentration of pilot training centers, government research agencies, and university laboratories creates a unique ecosystem designed for collaboration and cross-fertilization. This clustering effect positions San Tin as more than infrastructure—it becomes a knowledge hub where theoretical research meets practical application.

Strategic Advantages

The Technopole's location near the mainland border provides natural advantages for cross-boundary logistics testing, while its integration with Hong Kong's broader development plans ensures long-term sustainability. Rather than competing with existing aviation manufacturing centers, San Tin focuses on high-value services: certification testing, regulatory compliance, and international market access—areas where Hong Kong maintains clear competitive advantages.

Implementation Framework

The phased development approach allows infrastructure to scale with demand while maintaining flexibility for emerging technologies. Initial facilities target immediate needs like pilot training and regulatory testing, with expansion phases adding manufacturing capabilities and international collaboration spaces as the industry matures.

This integrated approach transforms San Tin from concept to Hong Kong's concrete stake in the global low-altitude economy, providing the physical foundation needed to execute the territory's ambitious strategic vision.

From Blueprint to Highway in the Sky : The Art of Patient Ambition

Hong Kong isn't rushing toward a future filled with flying cars. Instead, the city has chosen the harder path of doing this right the first time. The strategy unfolds like a carefully orchestrated symphony across four movements: controlled operations using select venues, expanded trials in dedicated pilot zones, routine services along public flight corridors, and finally a territory-wide network of "sky highways" connecting every district.

This methodical progression isn't bureaucratic timidity—it's surgical precision. Each phase builds operational knowledge while testing both regulatory frameworks and public acceptance. The Northern Metropolis becomes Hong Kong's aviation laboratory, where cross-boundary logistics, smart construction monitoring, and biomedical sample transport prove the concepts that will later scale citywide.

Playing the High-Stakes Numbers Game

Here's where Hong Kong's strategy gets brutally realistic about the mathematics of success. The territory will never compete with Shenzhen's 1,200 planned vertiports or Guangzhou's RMB 10 billion investment fund. Hong Kong doesn't need to.

Instead, the city targets the industry's profit centers: the specialized services that enable everyone else's ambitions. While Shenzhen builds the hardware and manufactures the aircraft, Hong Kong provides the testing certificates that unlock global markets, the insurance policies that enable operations, the legal frameworks that structure deals, and the financial instruments that fund expansion. These aren't consolation prizes—they're the industry's commanding heights.

The projected HK$350 billion in industry value by 2050 tells the story: supporting services dominate the pie, generating more wealth than manufacturing or operations combined. Hong Kong positions itself not as a participant in the low-altitude economy, but as its indispensable enabler.

The Execution Gauntlet

Hong Kong must thread multiple needles simultaneously. The government must orchestrate infrastructure deployment, talent development, regulatory modernization, and international partnerships while avoiding the bureaucratic quicksand that currently bogs down simple test flights. The proposed "one-stop contact and approval” mechanism for the Regulatory Sandbox represents more than administrative efficiency, it's proof of concept for the streamlined governance the entire strategy requires.

The financial challenge is equally daunting. Rather than matching mainland China’s dedicated funds, Hong Kong retrofits its existing investment apparatus—the Innovation and Technology Venture Fund, the Innovation and Technology Industry-Oriented Fund, and the Hong Kong Investment Corporation- to support low-altitude ventures at every stage, from startup to global expansion. It's a more sophisticated approach than simply throwing money at the problem, but it requires these institutions to evolve their investment strategies and risk tolerance.

The real test comes from competition with deep-pocketed mainland cities that treat low-altitude economy development as economic warfare. Guangzhou's HK$11 billion fund dwarfs anything Hong Kong can deploy directly. But Hong Kong's bet is that money alone doesn't guarantee success—that the combination of international connectivity, regulatory sophistication, and service excellence creates value that can't be replicated elsewhere.

The window of opportunity won't remain open indefinitely. While Hong Kong deliberates and plans, other cities are building and deploying. The strategy's measured approach maximizes the chances of getting it right, but only if the execution matches the ambition of the vision.

The Stakes: Future Economic Relevance

This isn't just about drones and flying taxis. Hong Kong’s low-altitude economic strategy represents a broader bet on the territory’s future economic relevance. As traditional industries face increasing competition and disruption, the low-altitude economy offers a pathway to future prosperity that builds on past strengths while embracing new possibilities.

The strategy’s success could establish Hong Kong as an essential enabler for the new industry’s global development. Failure could leave the territory watching the industry’s sidelines as other cities capture the economic benefits of the next significant technological shift.