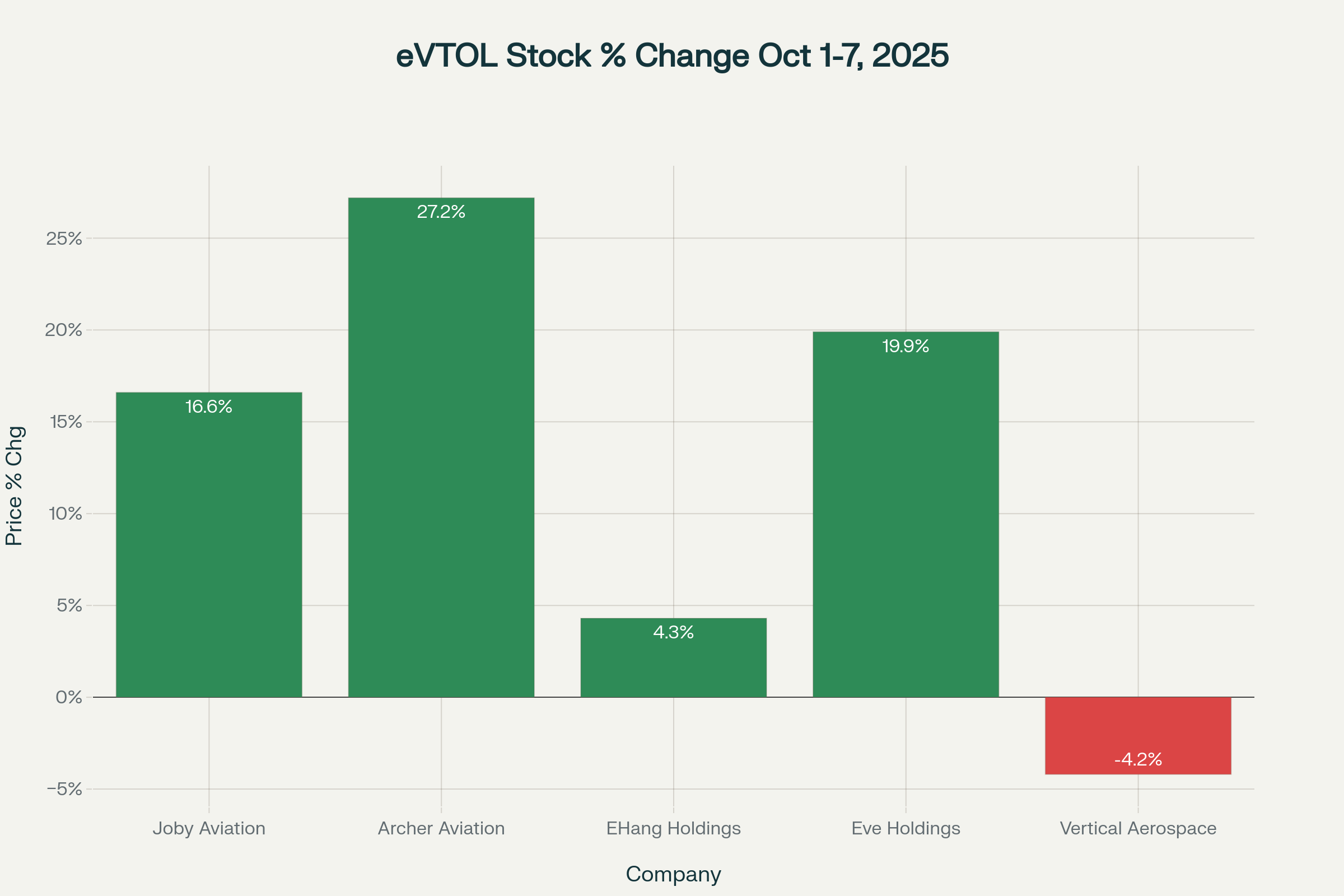

The last five trading days of eVTOL stocks experienced unprecedented market volatility, with speculation and day trader activity driving price movements that bore no relation to operational fundamentals. While Joby Aviation and Archer Aviation dominated headlines, EHang Holdings, Eve Holdings, and Vertical Aerospace experienced similar whipsaws in what became a defining moment for the industry’s credibility as an investment category.

Data reveals the stark disconnect between market behavior and technical progress. Between October 1 and 7, 2025, Archer Aviation led the surge with a 27.2 percent price increase, followed by Eve Holdings at 19.9 percent and Joby Aviation at 16.6 percent. Only Vertical Aerospace declined, dropping 4.2 percent as its fundamental challenges proved immune to sector-wide speculation.

The Volatility Reality

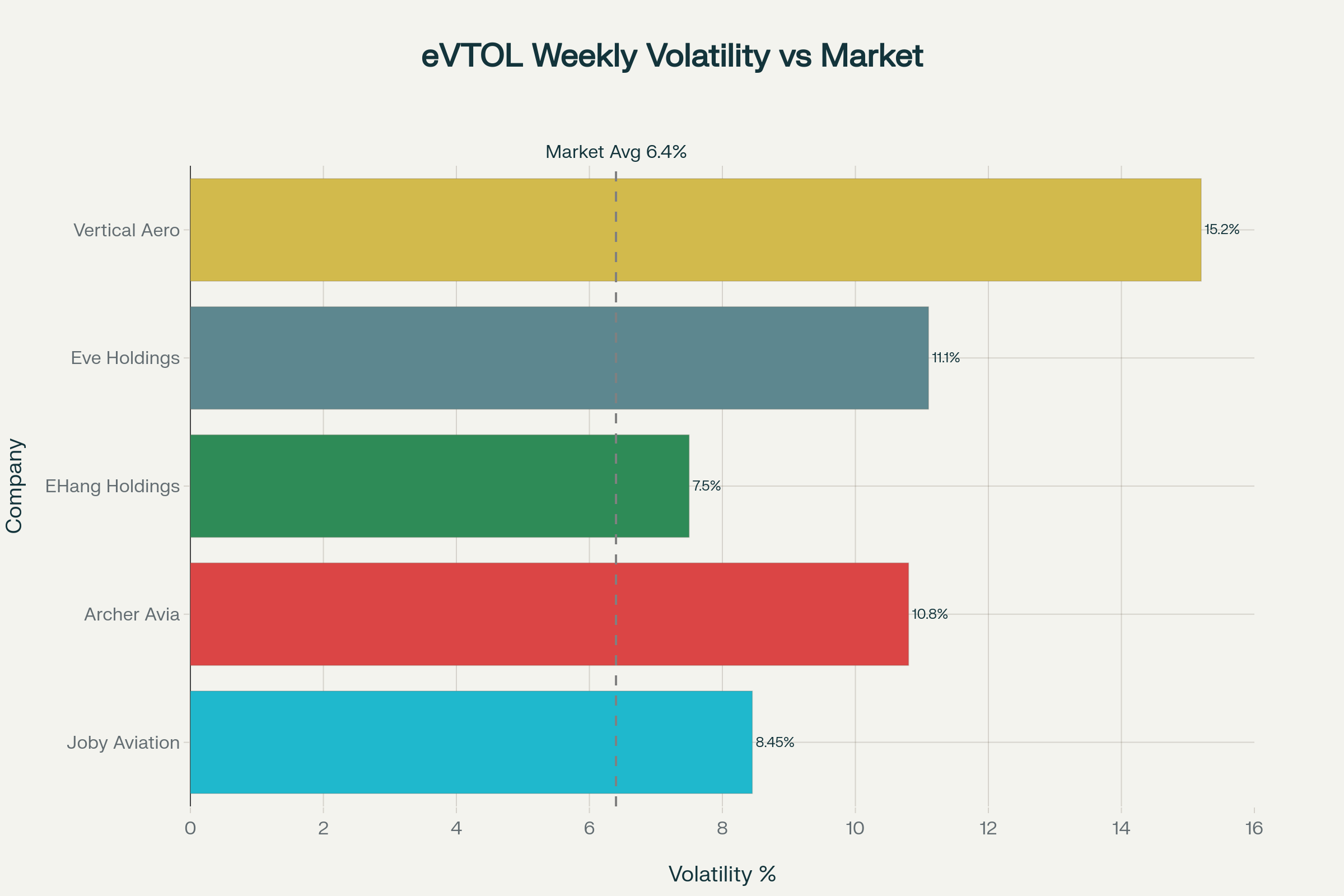

Every eVTOL stock trades with volatility levels that exceed market norms by substantial margins. Vertical Aerospace leads with 15.2 percent weekly volatility, more than double the 6.4 percent market average. Eve Holdings registers 11.1 percent weekly swings, while Archer Aviation hits 10.8 percent. Even the most “stable” performer, EHang Holdings, still exceeds market volatility at 7.5 percent weekly movement.

This volatility pattern reflects the fundamental mismatch between current market behavior and the long-term nature of aerospace certification. Stocks trade like speculative instruments rather than shares in companies developing complex aircraft systems that require years of testing and regulatory approval.

Technical Development Status

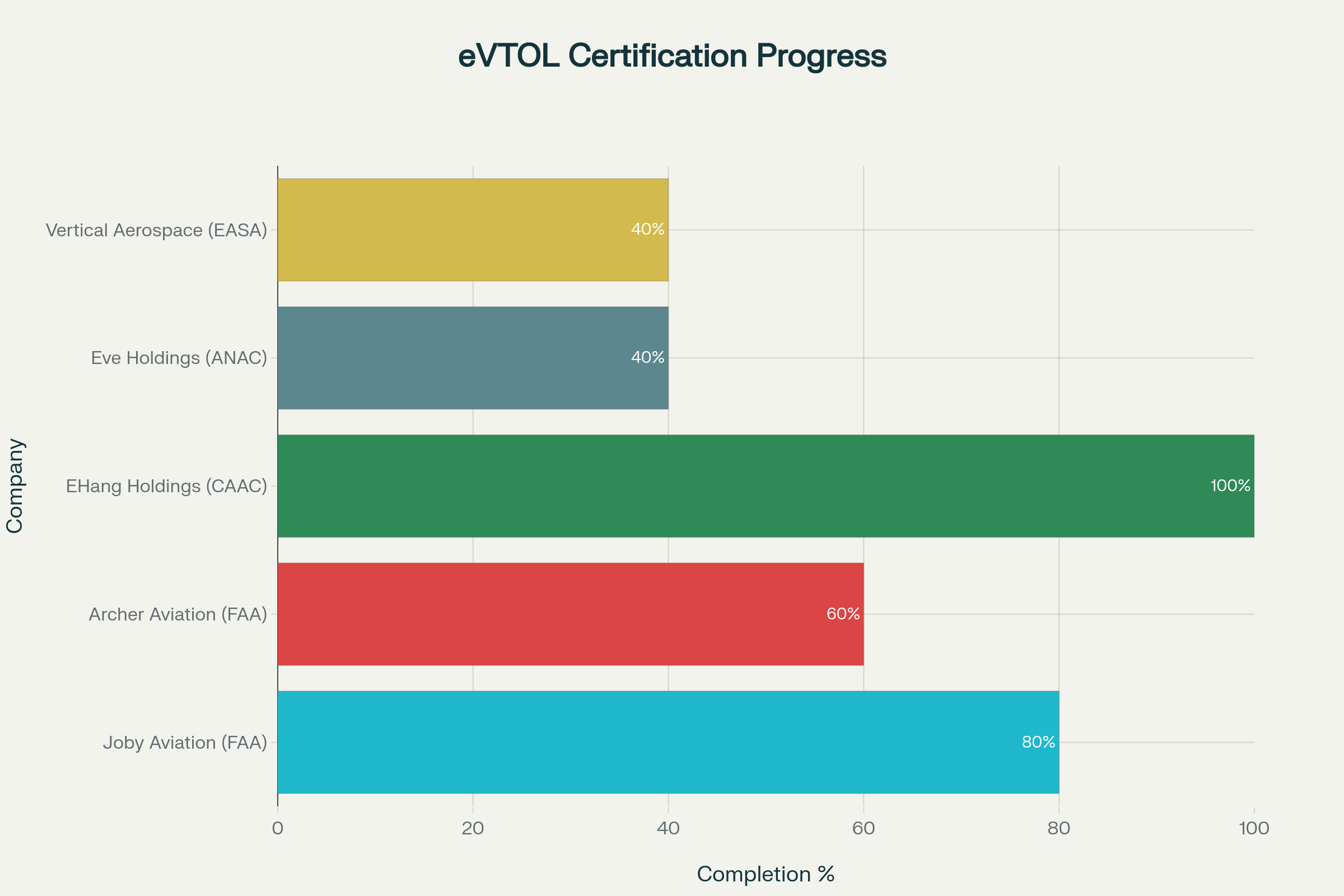

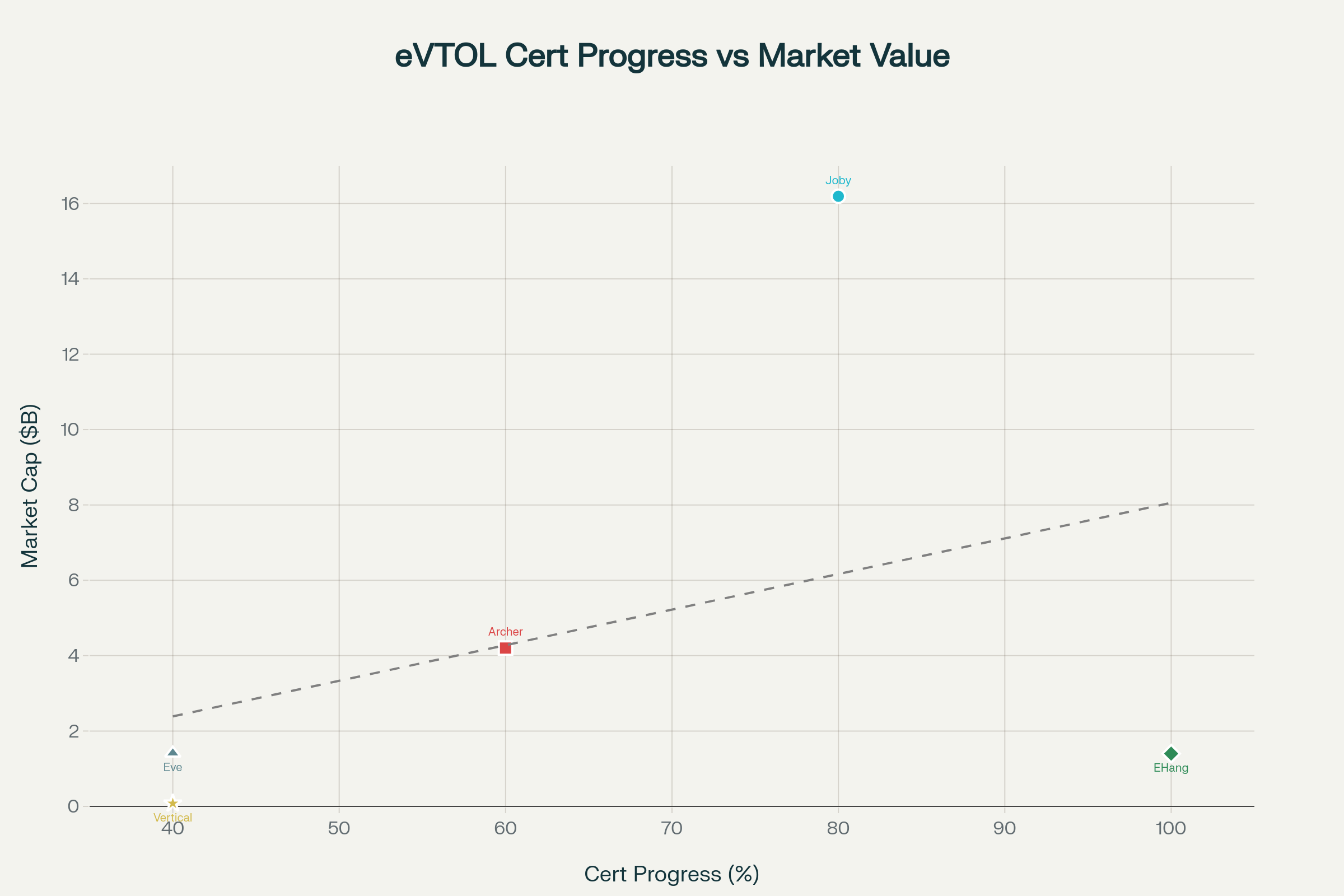

Certification progress analysis reveals significant disparities in actual development status versus market valuations. EHang Holdings stands alone, having achieved full regulatory approval with complete CAAC certification in China and commenced limited commercial operations. Yet its market capitalization of $1.40 billion reflects a fraction of the value assigned to companies still years from commercial launch.

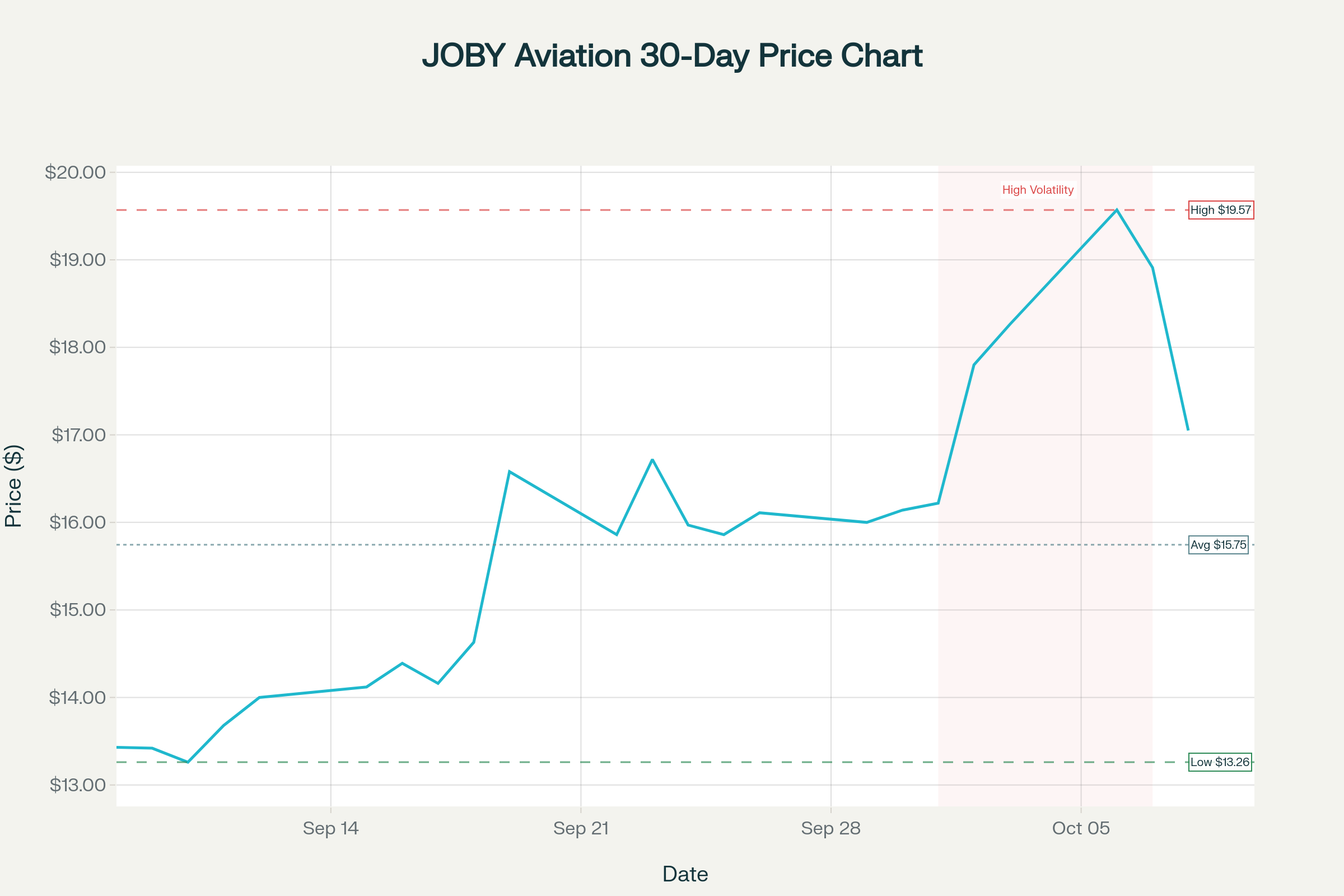

Joby Aviation (JOBY) 30-Day Stock Performance: September 8 - October 8, 2025

Joby Aviation (JOBY) 30-Day Stock Performance: September 8 - October 8, 2025

Joby Aviation leads Western certification efforts, having completed 80 percent of the FAA’s five-stage process, with Stage 4 submissions largely complete. The company has accumulated over 30,000 flight test hours across eight prototype aircraft, demonstrating the most extensive operational validation in the industry. Its S4 aircraft achieves a 200 mph cruise speed with a 100-mile range while maintaining 45 dBA noise levels, specifications that position it favorably for urban operations.

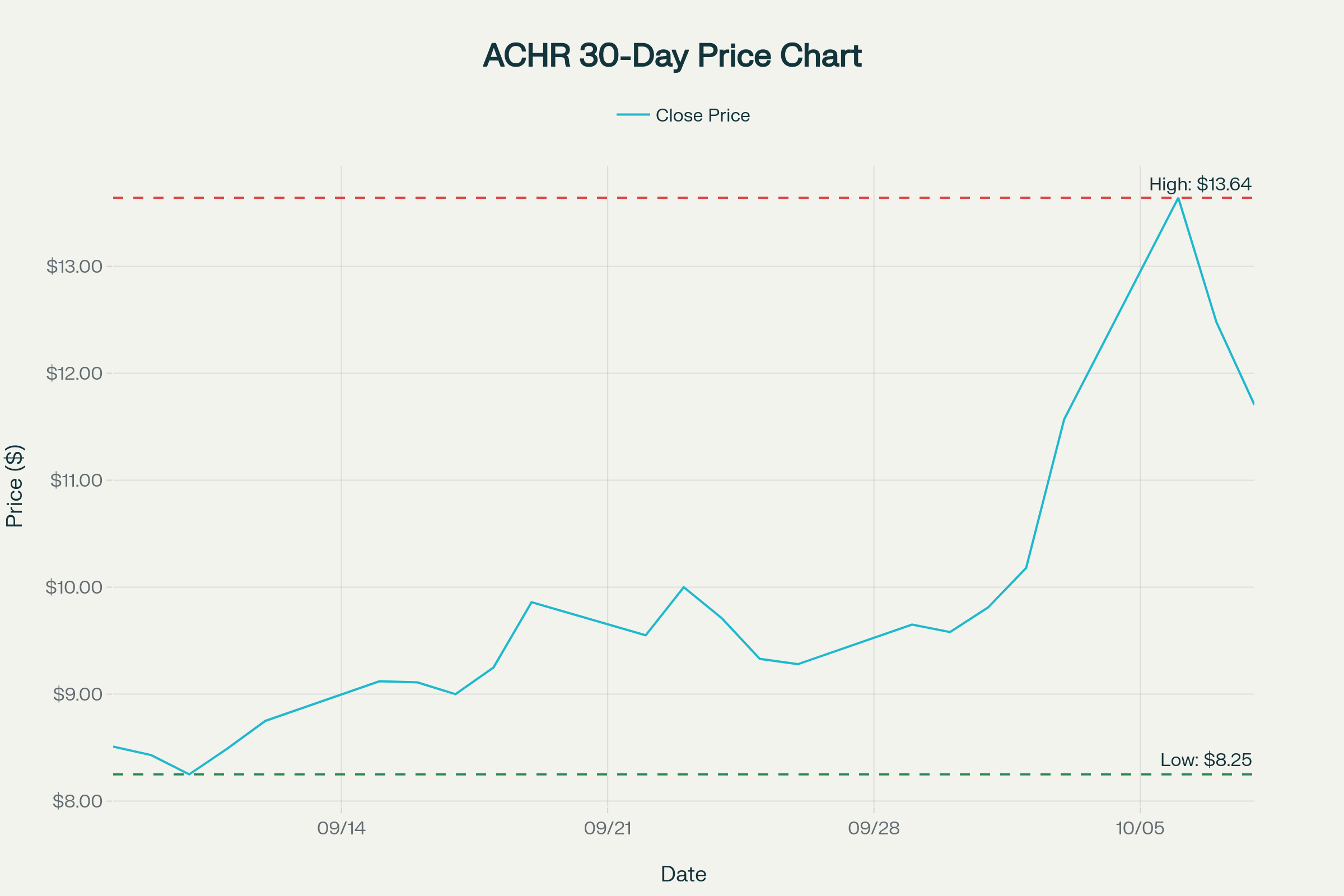

Archer Aviation (ACHR) 30-Day Stock Performance: September 8 - October 8, 2025

Archer Aviation (ACHR) 30-Day Stock Performance: September 8 - October 8, 2025

Archer Aviation progresses through Stage 3 of FAA certification with approximately 5,000 flight test hours logged. The Midnight aircraft matches Joby’s range capabilities at 100 miles but cruises at 150 mph maximum speed. Recent high-altitude testing reached 7,000 feet, validating operational flexibility for urban air traffic management.

Eve Holdings and Vertical Aerospace lag considerably in certification progress, both at 40 percent completion. Eve benefits from Embraer’s aerospace expertise and maintains a substantial order book valued at $14 billion, yet has conducted minimal flight testing with only two prototype aircraft built. Vertical Aerospace faces a particularly challenging position, with its cash runway extending only to late 2025 and recent warrant delistings signaling financial distress.

Aircraft Performance Analysis

Technical specifications reveal meaningful performance differentiations that market pricing ignores. Joby’s S4 delivers superior speed capabilities, reaching a 200 mph cruise, enabling longer-distance missions that could justify premium pricing in commercial operations. The aircraft’s 1,000-pound payload capacity accommodates four passengers plus the pilot with baggage, matching urban air mobility requirements.

Archer’s Midnight emphasizes operational efficiency with 12 motors, providing redundancy, but limits cruise speed to 150 mph. The configuration targets rapid turnaround operations with 20-mile segments and 12-minute charging intervals, optimizing for high-frequency urban routes.

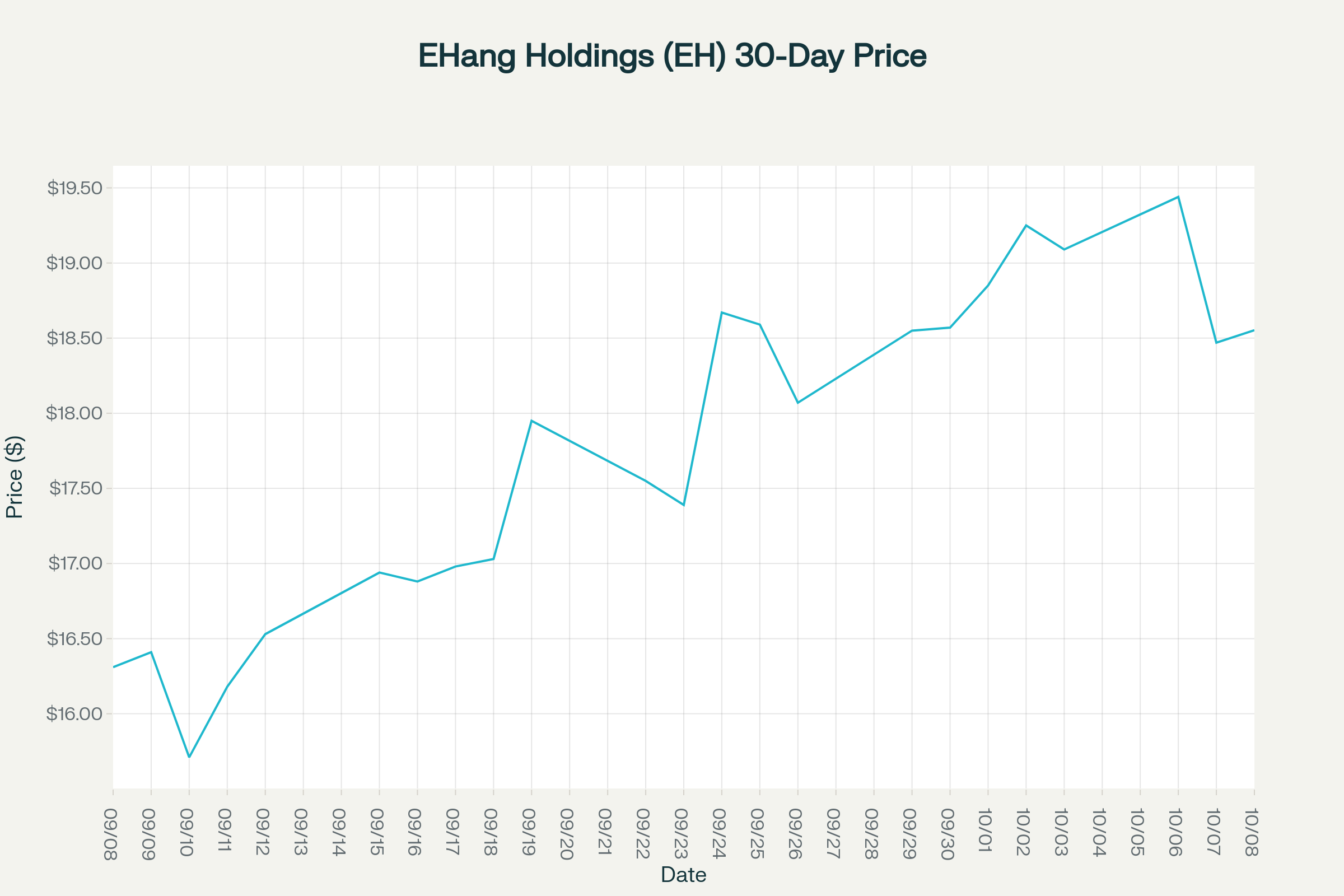

EHang Holdings (EH) 30-Day Stock Performance: September 8 - October 8, 2025

EHang Holdings (EH) 30-Day Stock Performance: September 8 - October 8, 2025

EHang’s EH216-S operates as a two-passenger autonomous vehicle with a 22-mile range, serving tourism and short-hop applications rather than transportation utility. The 16-motor, 16-propeller configuration provides exceptional redundancy but limits payload and range capabilities.

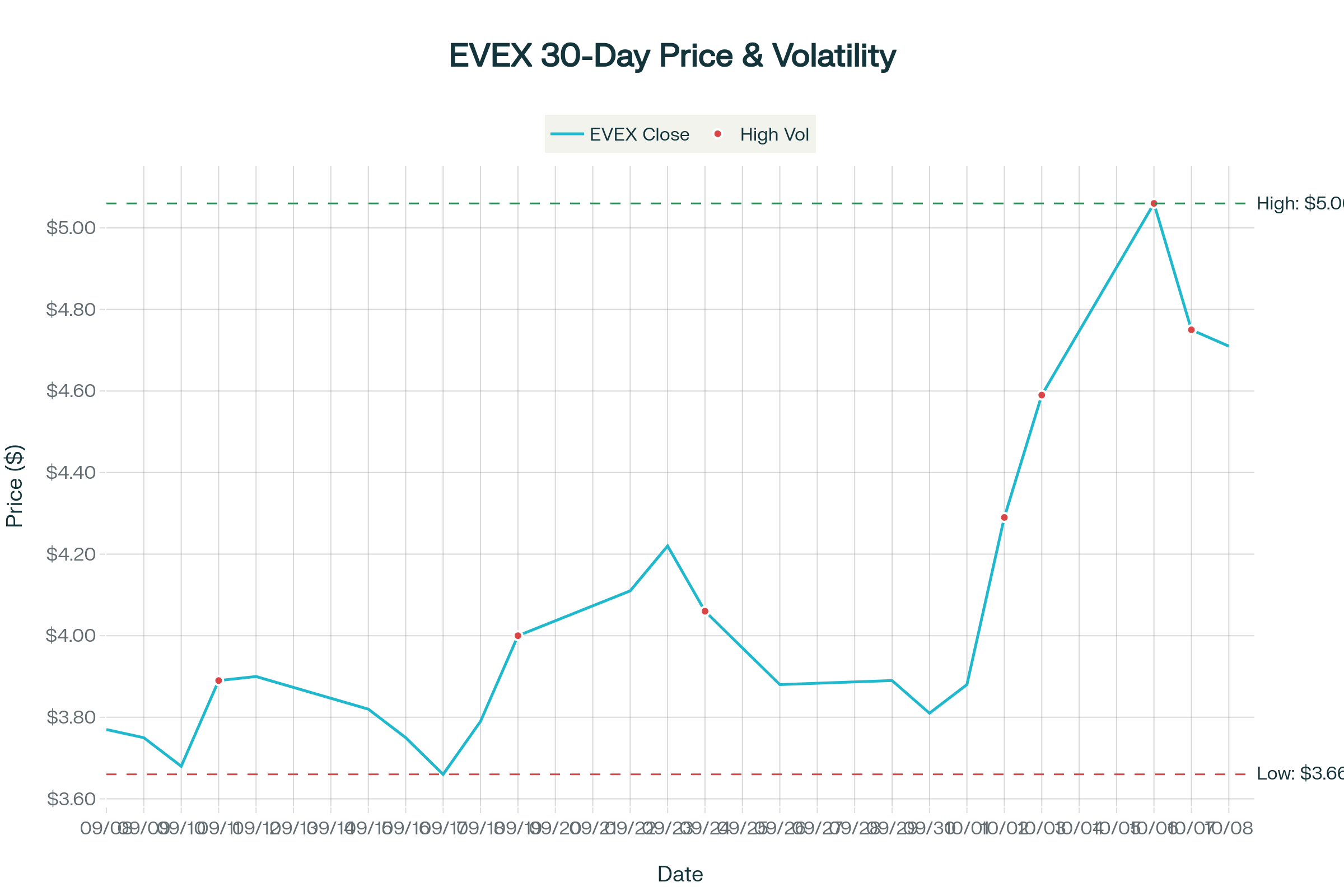

Eve Holdings (EVEX) 30-Day Stock Performance: September 8 - October 8, 2025

Eve Holdings (EVEX) 30-Day Stock Performance: September 8 - October 8, 2025

Eve Holdings’ specifications remain preliminary, targeting a 60-mile range with four-passenger capacity. The company’s partnership with Embraer provides manufacturing credibility, but it hasn’t translated into meaningful flight test progress.

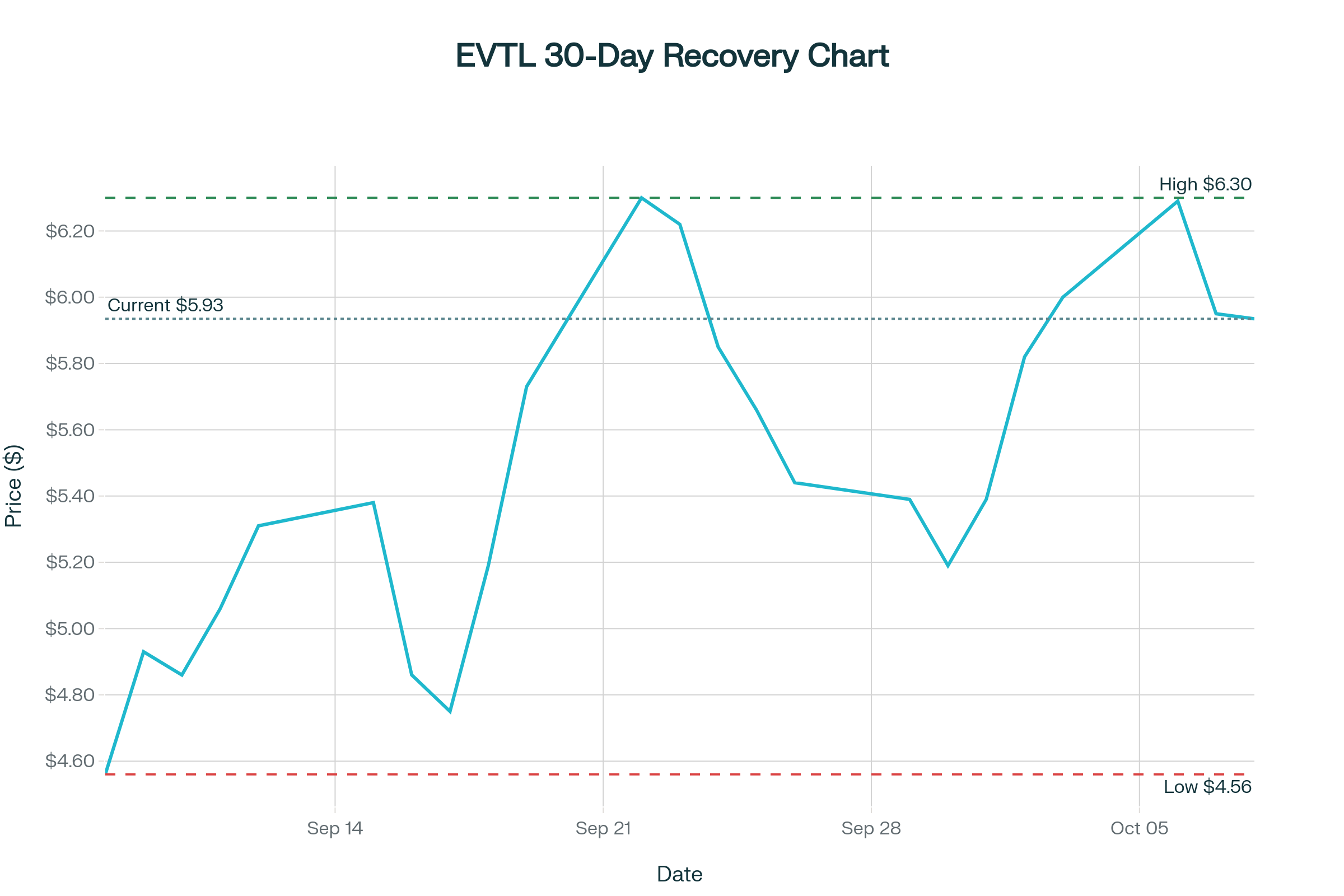

Vertical Aerospace (EVTL) 30-Day Stock Performance: September 8 - October 8, 2025

Vertical Aerospace (EVTL) 30-Day Stock Performance: September 8 - October 8, 2025

Vertical Aerospace’s VX4 aims for a 100-mile range, matching competitors, but supply chain delays and funding constraints have limited development progress. The company’s reverse stock split and delisting warnings reflect operational challenges that technical specifications cannot address.

Market Valuation Disconnect

The relationship between certification progress and market valuation exposes irrational pricing mechanisms. Joby Aviation commands a $16.19 billion market capitalization despite being 80 percent through certification, while EHang Holdings trades at $1.40 billion with full regulatory approval and active commercial operations. This premium reflects investor preference for U.S. market access over operational readiness.

Archer Aviation’s $4.2 billion valuation at 60 percent certification completion exceeds Eve Holdings’ $1.41 billion despite Eve’s substantial order book and Embraer partnership. The disparity suggests that the market focuses on near-term commercialization prospects rather than long-term production capabilities.

Vertical Aerospace’s $80 million market capitalization reflects fundamental concerns about survival rather than technological merit. The company’s financial distress overshadows aircraft development progress, creating existential risks that technical capabilities cannot resolve.

Operational Readiness Comparison

Flight test hours provide the most reliable indicator of development maturity. EHang Holdings leads with over 40,000 hours of flight time across more than 50 aircraft, demonstrating an operational scale that validates commercial readiness. The company’s autonomous operation model reduces certification complexity while enabling cluster management for tourism applications.

Joby Aviation’s 30,000 flight test hours across eight aircraft represent substantial validation for piloted operations. The company’s partnership with Toyota for manufacturing scale and Delta Air Lines for commercial deployment provides credible commercialization pathways beyond regulatory approval.

Archer Aviation’s 5,000 flight test hours across six aircraft demonstrate meaningful progress, but limited operational validation compared to industry leaders. The Stellantis manufacturing partnership provides automotive production expertise, though aerospace certification requirements differ significantly from automotive standards.

Eve Holdings and Vertical Aerospace show minimal flight test accumulation, with 500 and 1,200 hours, respectively. These limited validation programs reflect early development stages that contradict market expectations for near-term commercialization.

Speculation Runway: Why Money Moves Faster Than Aircraft

The October volatility episode reveals how eVTOL stocks have become detached from the realities of aerospace developments. A social media post about Tesla’s robotaxi event triggered industry-wide speculation that overlooked the fundamental differences between ground-based autonomous vehicles and aircraft, which require extensive flight testing and regulatory approval.

This behavior pattern alarms institutional investors who are familiar with the timelines of aerospace development. The five-year certification process for new aircraft types requires patient capital willing to support extended development phases without expecting quarterly operational progress. Current volatility levels signal retail speculation rather than institutional confidence in long-term industry prospects.

The industry’s credibility suffers when stocks respond more to social media speculation than operational milestones. EHang’s achievement of world-first commercial eVTOL certification should command more market attention than Tesla rumors, yet it generated minimal investor response compared to unfounded acquisition speculation.

Beyond Logos and Press Releases: Who’s Actually Building?

Beyond certification progress, manufacturing partnerships reveal the level of preparation for commercial-scale production. Joby’s Toyota alliance provides access to automotive production expertise and quality systems essential for aircraft manufacturing at a transportation scale. The partnership extends beyond capital investment to operational knowledge transfer.

Archer’s Stellantis relationship offers similar manufacturing capabilities, though automotive partners must adapt to aerospace certification requirements that mandate different quality standards and traceability systems. The learning curve for automotive companies entering aerospace creates execution risks not reflected in current valuations.

EHang’s self-manufacturing approach provides operational control but limited scale potential. The company’s Chinese production base enables cost advantages while serving domestic market demand, though international expansion faces regulatory complexity.

Eve Holdings benefits from Embraer’s established aerospace manufacturing capabilities, providing immediate access to certified production systems. This advantage could prove decisive for commercial launch timing, assuming the company progresses through certification phases.

Vertical Aerospace’s partnerships with Rolls-Royce and Honeywell provide component expertise, but they have not yet translated to manufacturing readiness. The company’s financial constraints limit the effectiveness of its partnerships when cash flow cannot support continued development.

High Hopes, Hard Landings: Picking Winners Amid the Noise

The current volatile environment poses significant risks to long-term industry development. Day trader activity and social media speculation undermine the formation of patient capital, which is necessary for aerospace ventures that require multi-year development cycles. Institutional investors, who are essential for later-stage funding, tend to avoid industries characterized by excessive retail speculation and momentum trading.

This disconnect between technical progress and market pricing suggests potential opportunities for investors who can evaluate operational fundamentals rather than relying solely on price momentum. EHang’s commercial operations, valued at a fraction of those of its competitors, present compelling value if concerns over Chinese market access can be resolved.

Conversely, companies trading at substantial premiums to certification progress face execution risks if development timelines extend beyond market expectations. The aerospace industry’s history includes numerous certification delays and cost overruns that current valuations appear to ignore.

The industry requires market maturation that values operational milestones over speculation. Until volatility patterns align more closely with development progress, these stocks will remain unsuitable for risk-averse investors despite representing potentially transformative transportation technology.

The last five trading days have demonstrated that eVTOL stocks operate in a speculative environment disconnected from the realities of aerospace development. While the underlying technology shows promise and several companies approach commercial readiness, market behavior suggests treating these investments as high-risk speculation rather than traditional aerospace ventures. The industry’s long-term success depends on transitioning from social media-driven volatility to fundamental-based valuations that support the patient capital formation essential for aviation innovation.