Boston Consulting Group’s September 2025 white paper on China's manned eVTOL market presents a comprehensive assessment that moves beyond speculation into a rigorous analysis of what could become aviation’s most significant development since the advent of commercial jet travel. The numbers tell a compelling story: $41 billion by 2040, with 160,000 units sold annually. But the real insights emerge from BCG’s methodology, which treats eVTOLs not as flying cars but as an entirely new aircraft category with distinct market mechanics.

Four Technologies Converging Into Something New

The whitepaper correctly identifies the technological convergence driving eVTOL viability, but the analysis goes deeper than most industry reports. Electric propulsion, distributed propulsion architecture, next-generation aircraft configurations, and intelligent flight systems not only enable eVTOLs, but they also fundamentally redefine the aircraft design philosophy.

The breakthrough in distributed propulsion deserves particular attention. Traditional aircraft depend on one or two engines, creating single points of failure that have shaped aviation safety protocols since the Wright brothers. eVTOLs scatter multiple smaller propulsors across the airframe, creating what BCG describes as “true redundancy”, the ability to continue safe flight even with multiple propulsor failures. This isn’t just backup systems. It’s an aircraft that can lose significant propulsion and still complete missions safely.

Electric motors bring their own advantages beyond environmental benefits. Fewer moving parts mean lower maintenance costs and improved operational reliability compared to internal combustion engines. The structural simplicity significantly enhances the feasibility of low-altitude operations within urban environments, where noise and emissions are more critical concerns than in traditional aviation contexts.

Market Split That Challenges Conventional Wisdom

BCG’s division between personal and mobility eVTOLs reveals market dynamics that challenge industry assumptions. Personal aircraft with 1-2 seats and a 100-kilometer range are designed to meet the recreational and light transport needs. Mobility eVTOLs with 4-6 seats and a range of 70-500 kilometers aim for urban and intercity passenger service.

BCG’s projected market split surprises: personal eVTOLs are expected to capture 55% of the value by 2040, worth $23 billion, versus $18 billion for mobility applications. This inverts conventional wisdom that urban air mobility would dominate early eVTOL markets.

BCG’s methodology for reaching these conclusions relies on benchmarking against luxury vehicle sales patterns, particularly sports cars and off-road SUVs that cater to similar motivations related to exploration and personal identity. The analysis uses luxury car sales data for vehicles above RMB 1.5 million, applying conversion rates based on identical purchasing motivations. This yields a projected steady-state annual volume of around 20,000 units for mid-to-high-end eVTOLs, representing approximately 1.3-1.4% penetration among target households.

China’s 7.4 million high-net-worth and affluent households, which are growing at a rate of 3% annually, provide a natural base for early adoption. These households have already demonstrated an appetite for luxury technology, driving luxury vehicle sales above RMB 0.6 million from under 100,000 units to over 400,000 units in the past decade.

Regulatory Evolution: From Exception to Institution

The whitepaper documents China’s decisive shift from exceptional approvals to institutionalized regulatory pathways. The Civil Aviation Administration of China issued the first eVTOL type certificate in 2023, marking a fundamental change from experimental exemptions to formal certification processes.

The certification framework requires multiple approvals, including the Type Certificate (TC), Production Certificate (PC), Airworthiness Certificate (AC), and Operation Certificate (OC), where applicable. The Type Certificate remains the critical milestone, typically requiring 2-5 years to obtain. Multiple aircraft models currently progress through CAAC’s dedicated eVTOL certification pathway, with additional certifications expected in the second half of 2025.

China’s 2024 National Airspace Classification Guidelines formally defined non-controlled zones, including Class G (below 300 meters) and Class W (below 120 meters). These classifications provide eVTOLs with clearly defined operating areas, though mobility eVTOLs face stricter oversight for cross-regional operations.

Infrastructure: The Shenzhen Model

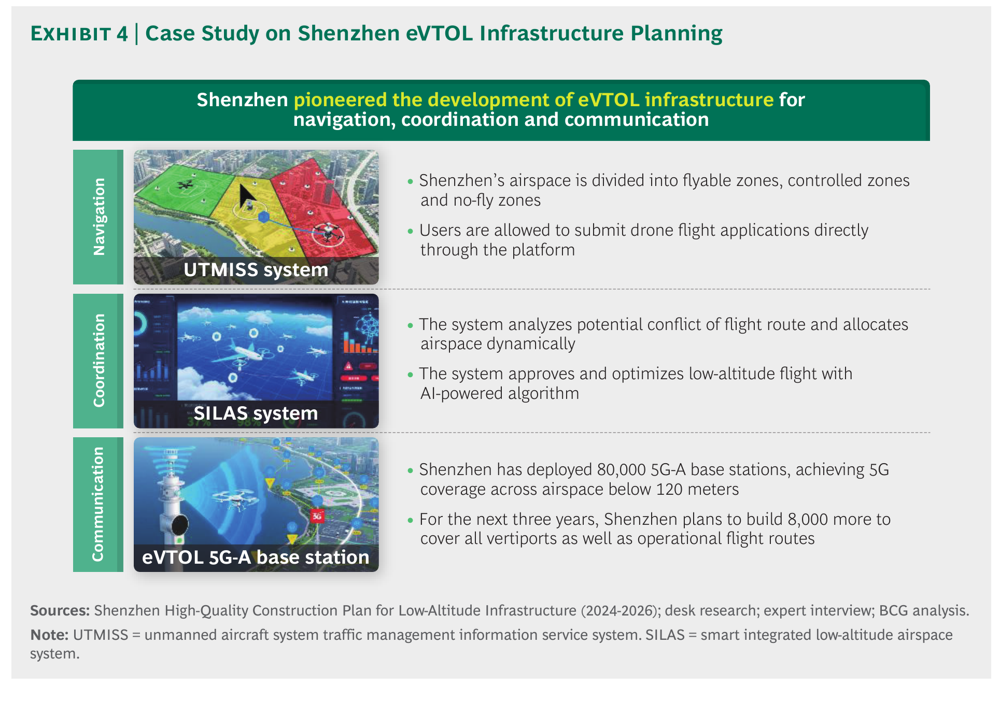

Shenzhen emerges as the leading example of comprehensive low-altitude infrastructure planning. The city’s “four-network system” integrates navigation, surveillance, communications, and flight services, supported by over 80,000 5G-A base stations, including several hundred specifically designed for low-altitude air-to-ground connectivity.

The Unmanned Aircraft System Traffic Management Information Service System (UTMISS) and Smart Integrated Low-Altitude Airspace System (SILAS) enable digital airspace segmentation, automated flight plan approvals, and AI-driven route optimization. Users can submit flight applications directly through the platform, which analyzes potential conflicts and dynamically allocates airspace.

This represents a complete departure from traditional aviation infrastructure models, demonstrating how cities can enable low-altitude operations without bankruptcy-inducing capital investments. The infrastructure requirements diverge dramatically between personal and mobility applications. Personal eVTOLs operating in isolated, pre-approved suburban areas require minimal technical support. Mobility eVTOLs demand certified takeoff and landing points, redundant communication systems, integrated flight surveillance, and advanced weather monitoring.

Supply Chain Convergence: Automotive Meets Aviation

The whitepaper identifies specific suppliers driving China’s eVTOL supply chain maturation. Core subsystems, including electric propulsion, composite fuselage structures, flight control modules, and navigation systems, are increasingly sourced from leading players across China’s aviation and automotive industries.

Key suppliers include CATL and Gotion, which bring proven experience in high energy density and discharge rates. Wolong Electric provides precision axial-coaxial permanent magnet motors for stable propulsion. GLAVI Aviation and Hengshen supply lightweight composite frames with aerodynamic efficiency. AVIC contributes avionics and real-time flight computing systems with fault-tolerant control capabilities.

The convergence of the automotive and aerospace industries offers significant advantages in terms of cost reduction and manufacturing scale. The new energy vehicle industry’s technological and industrial leadership directly benefits eVTOL development, with automotive production volumes and cost pressures driving innovations in electric motors, power electronics, and battery systems.

Personal Aircraft Leading Commercial Deployment

The assessment that personal eVTOLs will achieve scaled commercialization within one to two years, while mobility eVTOLs require three to five years, reflects a realistic understanding of the complexities associated with regulatory and infrastructure requirements. Personal eVTOLs benefit from clearer certification pathways, lower infrastructure demands, and operating environments that pose fewer integration challenges.

XPeng AeroHT exemplifies this approach with its X3 Land Aircraft Carrier, creating consumer-grade dual-mode products through an integrated aircraft-ground vehicle platform. The flying module can be transported and parked within the ground vehicle, deploying seamlessly through automated separation mechanisms. The ground unit recharges the flying module while in motion or parked, with simple controls supported by intelligent assisted-driving functions.

EHang’s EH216-S represents another model, offering eVTOL services through regulated operators in partnership with scenic destinations and tourism groups. The OEM provides the aircraft while licensed third parties manage operations.

Market Expansion Strategy: Tourism and Training

BCG projects the low-altitude tourism segment will generate annual sales of around 4,000 units by 2040, with a market potential of about $800 million. The analysis benchmarks against current helicopter usage across China’s 5A-rated scenic spots, projecting that eVTOLs could achieve 4-11% penetration across Class-A scenic zones by 2040.

Personal eVTOLs demonstrate unique advantages over conventional helicopters in tourism applications. Lower noise makes them suitable for flying over nature reserves or heritage sites without disturbing wildlife or visitor experiences. Greater operational flexibility enables closer flight paths over canyons, lakes, and other hard-to-reach areas. Lower operating costs support regular operations rather than premium, occasional flights.

The rental and training markets provide additional growth vectors. BCG expects personal eVTOLs to achieve a rental share of approximately 5% of personal sales, reaching around 7,000 units annually by 2040, with a market potential of roughly $1 billion. Aviation training demand is expected to grow in tandem with user interest in personal flying, projected to reach $150-190 million over the medium term.

Mobility Applications: Private Before Public

China’s mobility eVTOL market projections reach $18 billion by 2040, with annual sales exceeding 7,000 units. Private ownership accounts for approximately 73% of the total market potential, with airport and high-speed rail transfers contributing around 15%, and private charter flights representing about 12%.

The private ownership analysis benchmarks China’s potential against the US general aviation market, which operates 168,000 aircraft for personal and business charter under Part 135 regulations, representing a 2.4% penetration among individuals with over $1 million in assets. BCG projects that as airspace management liberalizes and regulatory frameworks evolve, China’s mobility eVTOL market will reach a scale comparable to today’s US market by 2040.

For city air link applications, eVTOLs offer compelling advantages in bypassing road congestion. Travel from Beijing’s central business district to major airports takes only 15-20 minutes by eVTOL compared with 1.5-2 hours by car or subway. Cost projections reach RMB 10 per passenger per kilometer, significantly lower than helicopter transfers at RMB 50 per passenger per kilometer and comparable to premium ride-hailing fares.

Global Expansion: Opportunity and Obstacles

BCG projects the international eVTOL market will reach $184 billion by 2040, representing the most significant growth opportunity for Chinese manufacturers over the next 10-15 years. The global personal eVTOL market is projected to reach $93 billion by 2040, with North America, China, and Europe forming the three primary growth poles.

North America leads with a mature, affluent consumer base, accounting for 33% of global luxury vehicle sales and 43% of global high-net-worth households. Open airspace—85% classified as non-controlled Class G—supports flexible low-altitude operations. Europe faces a slower commercial rollout due to stringent certification requirements, but shows rising consumer interest in sustainable travel.

Chinese eVTOL manufacturers face four core challenges expanding internationally: certification complexity, localized operations requirements, infrastructure bottlenecks, and export complications. Global certification standards remain fragmented, requiring case-by-case evaluation. Even under bilateral airworthiness agreements, the FAA and EASA impose strict scrutiny on Chinese products, with certification cycles potentially exceeding three years.

Strategic Imperatives: Cash Flow and Ecosystems

BCG identifies four key capabilities for market leadership: prioritizing stable cash flow over long-cycle innovation, building forward-looking R&D capabilities, establishing agile supply chains, and cultivating comprehensive eVTOL ecosystems.

The cash flow emphasis acknowledges that eVTOL development requires sustained investment over extended periods. Joby Aviation’s example of raising over $3 billion while only approaching commercial viability illustrates the capital intensity. Chinese manufacturers operating in more constrained financing environments must balance innovation with commercialization.

Ecosystem development recognizes that eVTOL success depends on more than aircraft manufacturing. Sales, delivery, maintenance, financing, and insurance systems all require development, with limited reference cases and technical standards currently available. China hosts over 100 general aviation camps and is increasing its provincial low-altitude infrastructure initiatives, laying the foundations for industry growth.

Assessment: Positioned for Liftoff

The whitepaper concludes that China’s eVTOL industry “is no longer taxiing. It is ready for liftoff”. This assessment appears accurate for personal applications, where near-term commercialization seems achievable based on current regulatory progress, infrastructure development, and supply chain readiness.

The convergence of policy support, regulatory institutionalization, infrastructure deployment, and supply chain maturation creates conditions for scaled commercialization that didn’t exist even two years ago. China’s approach of allowing personal eVTOLs to mature the ecosystem before tackling more complex mobility applications represents a pragmatic path that could establish global leadership in this emerging industry.

The following two years will determine whether China’s eVTOL ambitions translate into sustainable commercial operations. Success requires not just technological achievement, but also the development of operational expertise, a safety culture, and market acceptance that define successful aviation enterprises. The foundations appear solid. The real test lies in execution.

Download PDF Whitepaper: